Crushing Questions

July 1, 2006

BY Dave Nilles

When Archer Daniels Midland Co. (ADM) announced in October 2005 that it was planning to build a 50 MMgy canola oil-based biodiesel plant in Velva, N.D., the industry took notice. After all, it was the largest proposed biodiesel plant in the United States at the time. So when the agri-giant later upped the size of the future facility to 85 MMgy, it was like a shot across the bow for other existing and would-be producers-a sign that a major oilseed player was getting in the game.

Granted, Ag Processing Inc. started producing biodiesel in Sergeant Bluff, Iowa, years before most politicians knew what it was, but ADM's entrance seemed to signify a few important things: It was more proof that biodiesel had definitely arrived, and, finally, the industry was going to see a major biodiesel plant built alongside a large crush facility.

While Biodiesel Magazine intended to discuss the feasibility and economics of building a biodiesel plant collocated with an existing crush facility, industry experts made it clear that it isn't necessarily the location of such an enterprise that provides an advantage-if there really is an advantage at all. Rather, any competitive edge is gained in locking up feedstock supply.

Renewable Energy Group Project Engineer Mark Vermeer points out that collocating a biodiesel plant with an oilseed crusher provides little to no benefit if no feedstock contracts exist.

But building next to an oilseed crush facility does make sense. That's why existing oilseed companies are beginning to do just that (see sidebar, page 48-49). The benefits are significant if there are contracts in place because shipping costs are virtually nothing. However, for every biodiesel producer, the goal is obtaining a constant supply of feedstock.

What does the introduction of the big oilseed players mean to the industry? "It is very significant," Vermeer says. "They carry a big stick in a feedstock-limited industry."

A Tidal Wave of Capacity

The National Biodiesel Board holds that a goal of 1 billion gallons of U.S. biodiesel production by 2015 is a reasonable target on an aggressive but steady timeline that allows for managed, sustainable growth. It also allows for feedstock markets to adjust and develop alongside the industry. However, the opposite appears to be happening. With up to 50 projects claiming to be edging closer to production, a wall of biodiesel could possibly be coming on line within the next 18 months. "If it all comes on line, it's more capacity than we have economically viable feedstock sources for," says Marc-IV Consulting's Leland Tong.

Delta-T's Larry Sullivan agrees. "There is no way [the biodiesel industry] can continue to announce the plants it has announced and reach a national basis," he says. "There simply isn't that much oil to go around. The diesel market can handle that much biodiesel-there will be a market for the biodiesel out there-but logistics will be a profound problem in the future."

Several sources tell Biodiesel Magazine that railcar shortage is already becoming a problem in moving product and obtaining feedstock. It's an issue that has negatively affected many facets of the agriculture industry for years.

Biodiesel plants located adjacent to crush facilities do hold an advantage in railcar availability and access. However, even these projects aren't immune to the laws of supply and demand.

Located on the Union Pacific Railroad and along the Interstate 90 corridor, Minnesota Soybean Processors (MnSP) has been producing biodiesel since fall 2005. Initially using Volga, S.D.-based South Dakota Soybean Processor's refined soy oil as feedstock, MnSP now utilizes its own soy oil from its 100,000-bushels-per-day soy crush facility. The plant produces approximately 770,000 tons of soy meal and 200,000 tons of crude soybean oil annually, which is treated at MnSP's soy oil pretreatment facility.

Despite its vertical integration, things haven't gone easily regarding the biodiesel plant. Plant management attributes successive short soy crops in southwest Minnesota and biodiesel start-up costs to a weaker-than-expected financial position. Narrowing soybean margins are also affecting the plant's early success.

"Yet the primary business is meal," Sullivan says. "If I build a 3,000-ton-per-day crush facility with 30 [MMgy] to 50 MMgy of biodiesel, my primary business would be meal. The second business would be vegetable oil or biodiesel."

Soy Meal Dynamics Change

For biodiesel producers building next to an oilseed crushing facility, the economics of soybean meal still come into play. "No one builds that kind of crush plant without having a business plan to sell the meal primarily," Sullivan says.

Some are starting to see the market dynamics shift. Declining domestic meal demand and increasing soy oil demand for biodiesel may eventually result in the soybean crush being driven by oil demand rather than meal demand. Several industry insiders said as much at a recent biodiesel investment conference in St. Louis. If such a shift pushes soy meal prices lower, soybean prices may be supported by high soybean oil prices. As it stands, the soy crush will fall short of the USDA's 2006 projections.

Discussing soy meal brings to light the commodity nature of this industry, something that bridges into fuel ethanol. Tong provides an example: "An ethanol plant can be built in the middle of a corn field," he says. "The plant can draw that feedstock in from where it is located. With a biodiesel plant, the input is the byproduct of another industry. I could put a biodiesel plant in the middle of a soybean field, but I can't get the oil out of the soybeans."

Feedstock Neutrality Becomes Priority

With agri-giants like ADM and Cargill beginning to use their own soy oil in their own biodiesel facilities, the pressure is falling on stand-alone plants to survive in a more costly market.

"Feedstock neutrality is a must," says Jake Stewart, vice president of Biodiesel Industries. "If you build a high-volume facility around one feedstock with little flexibility, that to me … is a risky place to be. If there is a hedging mechanism, like an ADM or Cargill has, you can mitigate some of that risk. Feedstock neutrality, or being closer to feedstocks and closer to the end-market, allows nimbleness through the natural turbulence of the industry."

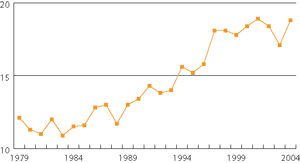

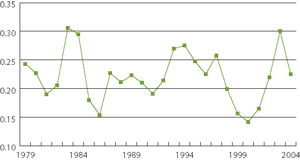

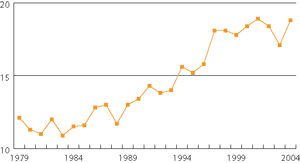

A quick look at U.S. soy oil prices would seem to support Stewart's view. Prices have thus far been on an incline in 2006. Overall, soy oil production has risen slowly but steadily in the last two decades to nearly 19 billion pounds per year. Soy oil prices have spiked occasionally but typically have stayed within the 20-to-22-cent range. The 20-year low was 14 cents in 2000 with a high of 30 cents in 1984. Soy oil spiked again as recently as 2003 when it again reached $0.30. In its latest report, the USDA predicted that record U.S. soybean carryover coupled with stable output may boost demand even more in 2006-'07.

Stewart says that may lead the industry to the beginning of a new model of production. "The model we're working out of now is a value-added model," he says. "The major agricultural companies can hedge by having a food commodity demand and biodiesel demand on the oil. That helps stabilize the price and raise the price of the oil. For biodiesel production, it doesn't have long-term viability for our industry. To the extent we can vertically integrate and focus on creating fuel, it will stabilize pricing and growth of the industry."

The landscape of the biodiesel industry continues to change. While no universal business model exists, feedstock prices in the near future may force the hand of some potential producers.

"At some point the economies of scale are going to come into play," Tong says. "It's going to boil down to the cost of production. There are niches for smaller plants in certain areas, but the primary cost is still your feedstock."

Dave Nilles is a Biodiesel Magazine staff writer. Reach him at dnilles@bbibiofuels

.com or (701) 373-0636.

Granted, Ag Processing Inc. started producing biodiesel in Sergeant Bluff, Iowa, years before most politicians knew what it was, but ADM's entrance seemed to signify a few important things: It was more proof that biodiesel had definitely arrived, and, finally, the industry was going to see a major biodiesel plant built alongside a large crush facility.

While Biodiesel Magazine intended to discuss the feasibility and economics of building a biodiesel plant collocated with an existing crush facility, industry experts made it clear that it isn't necessarily the location of such an enterprise that provides an advantage-if there really is an advantage at all. Rather, any competitive edge is gained in locking up feedstock supply.

Renewable Energy Group Project Engineer Mark Vermeer points out that collocating a biodiesel plant with an oilseed crusher provides little to no benefit if no feedstock contracts exist.

But building next to an oilseed crush facility does make sense. That's why existing oilseed companies are beginning to do just that (see sidebar, page 48-49). The benefits are significant if there are contracts in place because shipping costs are virtually nothing. However, for every biodiesel producer, the goal is obtaining a constant supply of feedstock.

What does the introduction of the big oilseed players mean to the industry? "It is very significant," Vermeer says. "They carry a big stick in a feedstock-limited industry."

A Tidal Wave of Capacity

The National Biodiesel Board holds that a goal of 1 billion gallons of U.S. biodiesel production by 2015 is a reasonable target on an aggressive but steady timeline that allows for managed, sustainable growth. It also allows for feedstock markets to adjust and develop alongside the industry. However, the opposite appears to be happening. With up to 50 projects claiming to be edging closer to production, a wall of biodiesel could possibly be coming on line within the next 18 months. "If it all comes on line, it's more capacity than we have economically viable feedstock sources for," says Marc-IV Consulting's Leland Tong.

Delta-T's Larry Sullivan agrees. "There is no way [the biodiesel industry] can continue to announce the plants it has announced and reach a national basis," he says. "There simply isn't that much oil to go around. The diesel market can handle that much biodiesel-there will be a market for the biodiesel out there-but logistics will be a profound problem in the future."

Several sources tell Biodiesel Magazine that railcar shortage is already becoming a problem in moving product and obtaining feedstock. It's an issue that has negatively affected many facets of the agriculture industry for years.

Biodiesel plants located adjacent to crush facilities do hold an advantage in railcar availability and access. However, even these projects aren't immune to the laws of supply and demand.

Located on the Union Pacific Railroad and along the Interstate 90 corridor, Minnesota Soybean Processors (MnSP) has been producing biodiesel since fall 2005. Initially using Volga, S.D.-based South Dakota Soybean Processor's refined soy oil as feedstock, MnSP now utilizes its own soy oil from its 100,000-bushels-per-day soy crush facility. The plant produces approximately 770,000 tons of soy meal and 200,000 tons of crude soybean oil annually, which is treated at MnSP's soy oil pretreatment facility.

Despite its vertical integration, things haven't gone easily regarding the biodiesel plant. Plant management attributes successive short soy crops in southwest Minnesota and biodiesel start-up costs to a weaker-than-expected financial position. Narrowing soybean margins are also affecting the plant's early success.

"Yet the primary business is meal," Sullivan says. "If I build a 3,000-ton-per-day crush facility with 30 [MMgy] to 50 MMgy of biodiesel, my primary business would be meal. The second business would be vegetable oil or biodiesel."

Soy Meal Dynamics Change

For biodiesel producers building next to an oilseed crushing facility, the economics of soybean meal still come into play. "No one builds that kind of crush plant without having a business plan to sell the meal primarily," Sullivan says.

Some are starting to see the market dynamics shift. Declining domestic meal demand and increasing soy oil demand for biodiesel may eventually result in the soybean crush being driven by oil demand rather than meal demand. Several industry insiders said as much at a recent biodiesel investment conference in St. Louis. If such a shift pushes soy meal prices lower, soybean prices may be supported by high soybean oil prices. As it stands, the soy crush will fall short of the USDA's 2006 projections.

Discussing soy meal brings to light the commodity nature of this industry, something that bridges into fuel ethanol. Tong provides an example: "An ethanol plant can be built in the middle of a corn field," he says. "The plant can draw that feedstock in from where it is located. With a biodiesel plant, the input is the byproduct of another industry. I could put a biodiesel plant in the middle of a soybean field, but I can't get the oil out of the soybeans."

Feedstock Neutrality Becomes Priority

With agri-giants like ADM and Cargill beginning to use their own soy oil in their own biodiesel facilities, the pressure is falling on stand-alone plants to survive in a more costly market.

"Feedstock neutrality is a must," says Jake Stewart, vice president of Biodiesel Industries. "If you build a high-volume facility around one feedstock with little flexibility, that to me … is a risky place to be. If there is a hedging mechanism, like an ADM or Cargill has, you can mitigate some of that risk. Feedstock neutrality, or being closer to feedstocks and closer to the end-market, allows nimbleness through the natural turbulence of the industry."

A quick look at U.S. soy oil prices would seem to support Stewart's view. Prices have thus far been on an incline in 2006. Overall, soy oil production has risen slowly but steadily in the last two decades to nearly 19 billion pounds per year. Soy oil prices have spiked occasionally but typically have stayed within the 20-to-22-cent range. The 20-year low was 14 cents in 2000 with a high of 30 cents in 1984. Soy oil spiked again as recently as 2003 when it again reached $0.30. In its latest report, the USDA predicted that record U.S. soybean carryover coupled with stable output may boost demand even more in 2006-'07.

Stewart says that may lead the industry to the beginning of a new model of production. "The model we're working out of now is a value-added model," he says. "The major agricultural companies can hedge by having a food commodity demand and biodiesel demand on the oil. That helps stabilize the price and raise the price of the oil. For biodiesel production, it doesn't have long-term viability for our industry. To the extent we can vertically integrate and focus on creating fuel, it will stabilize pricing and growth of the industry."

The landscape of the biodiesel industry continues to change. While no universal business model exists, feedstock prices in the near future may force the hand of some potential producers.

"At some point the economies of scale are going to come into play," Tong says. "It's going to boil down to the cost of production. There are niches for smaller plants in certain areas, but the primary cost is still your feedstock."

Dave Nilles is a Biodiesel Magazine staff writer. Reach him at dnilles@bbibiofuels

.com or (701) 373-0636.

Advertisement

Advertisement

Advertisement

Advertisement

Upcoming Events