DECC publishes new reports evaluating RHI renewable heat programs

Department of Energy and Climate Change

February 16, 2016

BY Katie Fletcher

Recently published reports by the U.K. Department of Energy and Climate Change demonstrate over 80 percent of applicants to the renewable heat incentive (RHI) are satisfied with their new systems. These government financial incentives promote the use of renewable heat through technologies, such as biomass boilers, both for domestic and non-domestic uses. The government-collected data shows the RHI has had a positive influence in the renewable heat technology market, helping the U.K. decarbonize heat, while reducing costs. The evaluation reports follow the government’s commitment to increase funding for the RHI to £1.5 billion ($2.1 billion) in 2021 to ensure the U.K. continues progressing towards its climate goals while reforming the scheme to improve value for money, delivering savings of almost £700 million by 2020-21.

“Reforming how we use energy for heating is critical to achieving secure, affordable and clean energy for families and businesses across the country,” said Energy Minister Lord Bourne. “That is why the government will be pushing a more cost effective, targeted renewable heat incentive scheme for the next five years.”

The collection of research evaluation reports includes data presented for applicants who participated in the domestic and non-domestic RHI separately, as well as reports relevant to both RHI programs.

Under those associated with the domestic scheme, was a report from waves 1 to 12 of the domestic RHI census of accredited applicants, in addition to qualitative research from domestic RHI owner occupier applicants. Between May 2014 and April 2015, 25,568 successful applications were received by the domestic RHI scheme from owner-occupiers, 33 percent of those were new applications. Applicants were asked what triggered their decision to install a new heating system and the most common reason was the availability of a grant or other funding—52 percent of applicants who installed biomass systems indicated this was important. After explaining why they invested in a new heating system, applicants were asked why they chose a specific renewable heat technology, 45 percent were financial related and 10 percent reflected environmental concerns. The RHI was one of a number of other factors that prompted participants to install renewable heat technology. One installer of biomass heat technology shared in the qualitative report that “It would have been cheaper to put in [a new gas boiler], the initial cost, obviously, than putting in a biomass boiler, but once it was explained to us that we could get the RHI, we decided that the green option was better, a nice thing to do…I Think it was an important trigger… if it hadn’t been for the RHI, we probably would have put a gas boiler in.”

Advertisement

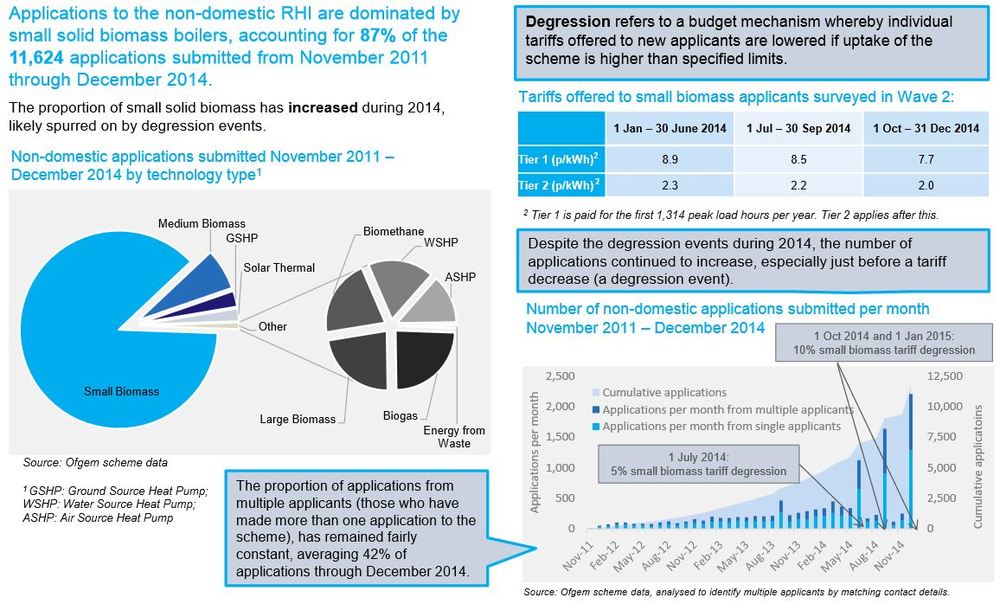

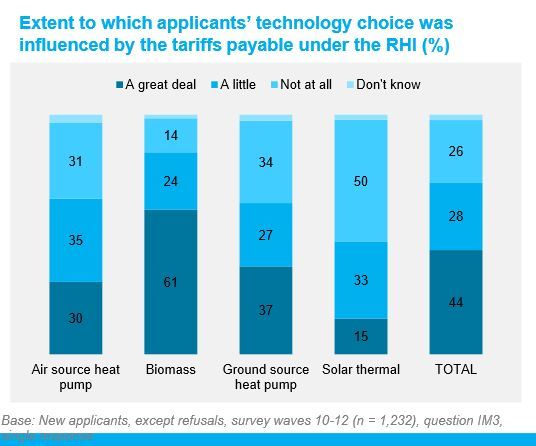

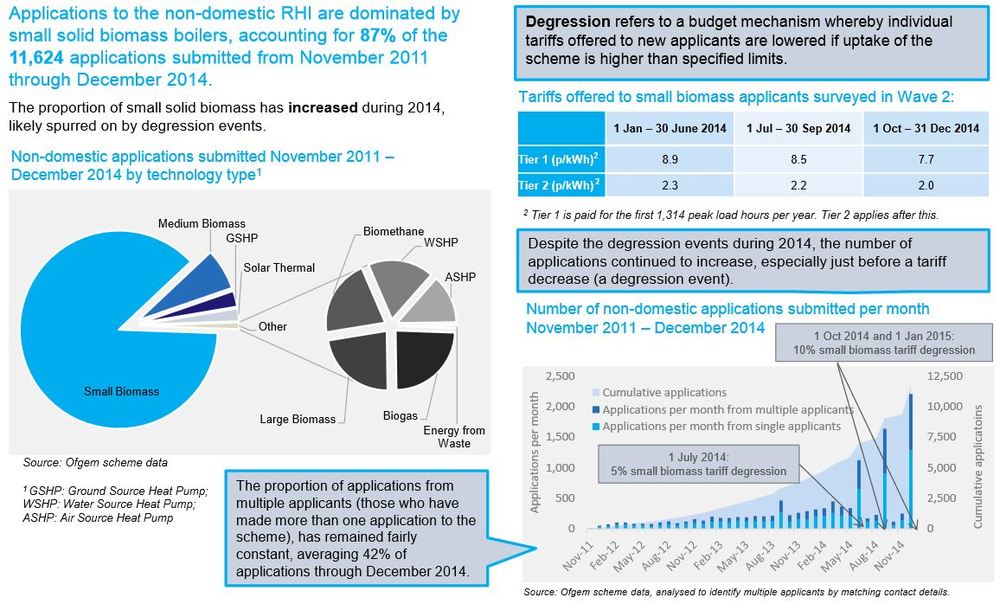

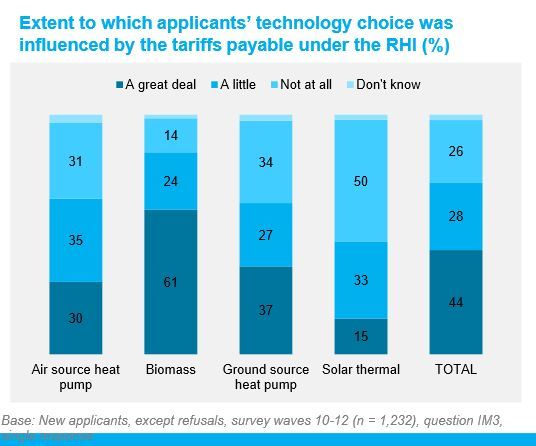

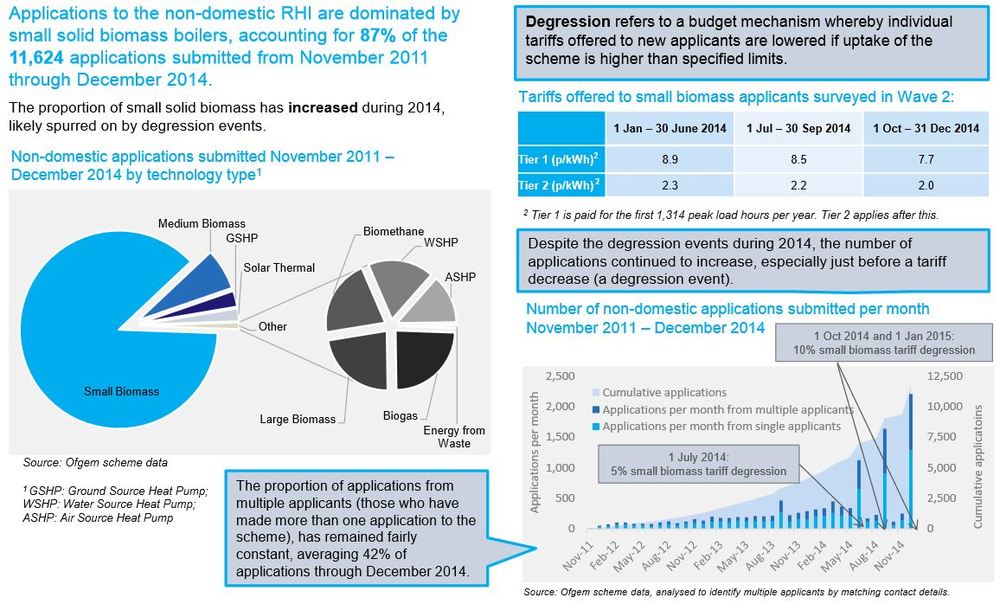

The recently published non-domestic RHI evaluation survey report is wave 2, following wave 1 which was conducted in early 2014. Many of the survey questions yielded common responses as domestic RHI applicants. For example, financial factors play a key role in the decision-making process of non-domestic applicants. In fact, 63 percent of applicants would not have installed a renewable heat technology if not for the RHI. The non-domestic scheme is dominated by small, solid biomass boilers, accounting for 87 percent of the 11,624 applications submitted from November 2011 through December 2014.

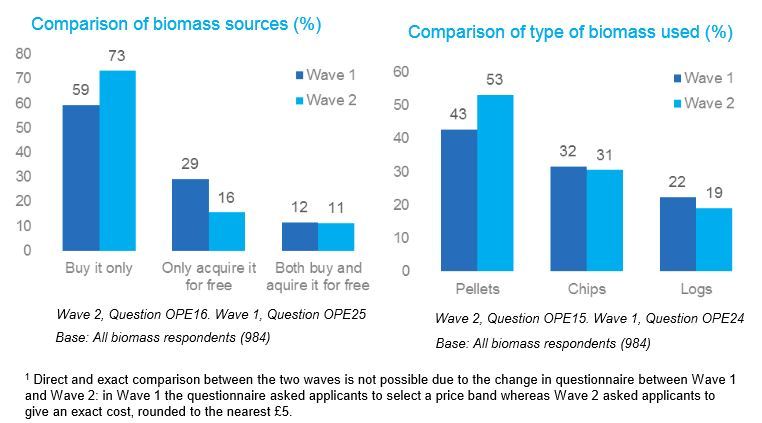

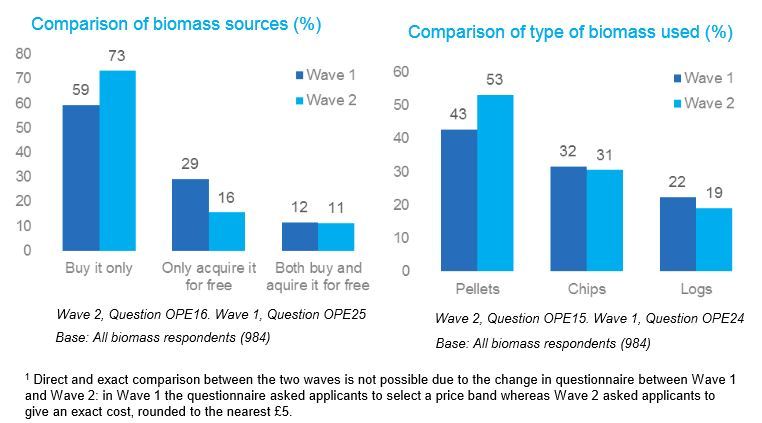

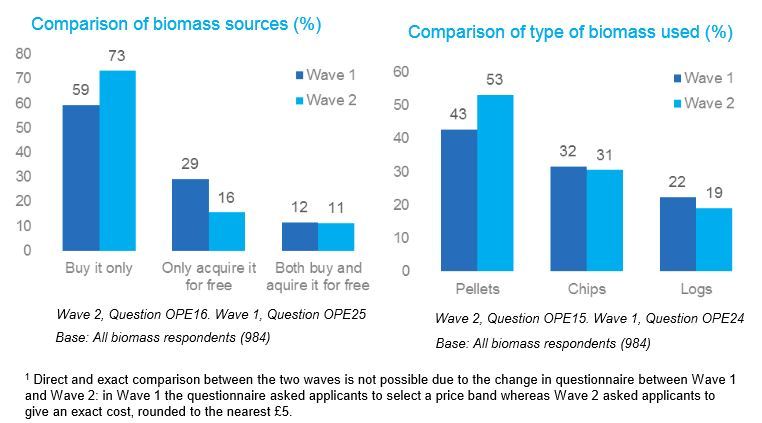

The survey showed that 87 percent of applicants were satisfied with the operation of their installation. The biomass fuels used and costs were also surveyed. A majority of applicants (73 percent) report buying their biomass fuel of which the most common form is pellets (53 percent). More applicants reported buying some or all of their biomass fuel and using pellets in the wave 2 survey compared to wave 1. Wave 2 applicants reported the median price of biomass fuel to be £208 per metric ton up from £150 to £199 per metric ton for wave 1 applicants. This is attributed to pellets being the most expensive form of fuel on a per ton basis, according to the report.

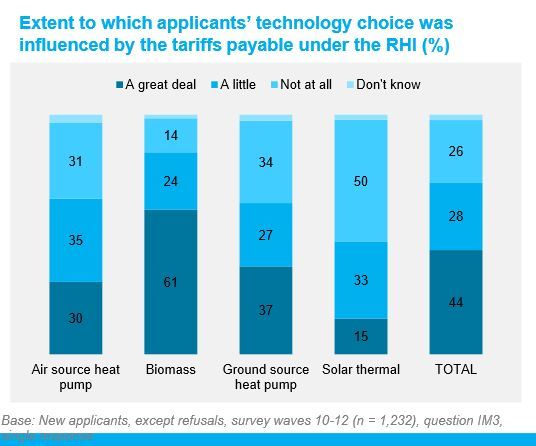

The DECC report concludes that the significant growth in the biomass market since 2009 is attributed to three key factors: the RHI, increased consumer and lender confidence and the historic increases in oil prices. The report states, “the dominance of biomass in the renewable heat industry was confirmed by participates and attributed to the fact that biomass was perceived to be the easiest retrofit solution as well as seen as better suited to old, inefficient properties than other technologies.” Participants also believe that the RHI tariff for biomass was more generous when compared to the tariff for other renewable heat technologies.

Amongst the reports relevant to both schemes, was an evaluation of the microgeneration certification scheme (MCS). Nearly three in five installers (58 percent) felt that the RHI had been wholly positive in its influence on the renewable energy market, with 34 percent believing that the influence of the RHI was both positive and negative and 8 percent reporting that the scheme had been wholly negative of MCS installers.

DECC sees potential for the market growing to a point where over 800 MW of additional capacity are added each year, and could see a real terms reduction in installation costs of between 9 and 11 percent resulting from the development of mass market. Overall costs (including the lifetime fuel costs) are forecast to fall by a third in mass-market conditions looking at the U.K. market as a whole.

Advertisement

The U.K. Renewable Energy Association issued support of the RHI evaluation. “The reports show that consumers and businesses are in general very satisfied with their renewable heat installations, and 88 percent would recommend their renewable heat technology to others,” said Frank Aaskov, policy analyst at the REA. “There is always room for improvement, both in the RHI and within the sector, but it is clear that biomass and wood heating is a modern and mature technology that has huge potential for growth. We hope this is reflected in the government’s reform of the RHI, when this consultation is launched later this quarter.”

The collection of research reports evaluating the domestic and non-domestic RHI can be accessed here. Earlier this year, DECC released monthly deployment data for the RHI program through December 2015, which can be downloaded here.

Announced just before the evaluation reports were published by the DECC, Enterprise, Trade and Investment minister, Jonathan Bell, stated his proposal to close Northern Ireland’s domestic and non-domestic RHI schemes. “‘It is with great reluctance that I have had to announce my intention to close both RHI schemes,” Bell commented on his decision. “Both schemes have been very successful with the non-domestic scheme in particular seeing significant uptake during the last 12 months and more so in the run up to the recent scheme changes introduced in November 2015. It is estimated that around 6 percent of NI’s heating needs are now provided through renewable technologies. The executive’s target to achieve 4 percent renewable heat has been exceeded.”

He added that the increased demand means the available budget for new applications has been exhausted and that in order to meet RHI commitments for existing installations, significant levels of additional funding will have to be found from within the NI executive’s budget for the next five years to address the current deficit. “To prevent further overspend I must bring forward legislation to the assembly to close both schemes to new applications,” Bell said. “My department will also be carrying out a comprehensive review and audit, to ensure that the operation of the schemes is strictly in compliance with the scheme requirements and the underpinning legislation.”

Upcoming Events