Does Your Alternative Energy Project Qualify for the New Market Tax Credit?

January 5, 2012

BY Tom Ritchie and Jim Schmidt

What is the New Market Tax Credit? The NMTC program was established by Congress as part of the Community Renewal Tax Relief of 2000 to provide private investment capital to businesses and nonprofits located in qualifying low-income communities. The goal of the program is to spur revitalization efforts of low-income and impoverished communities across the United States and its territories.

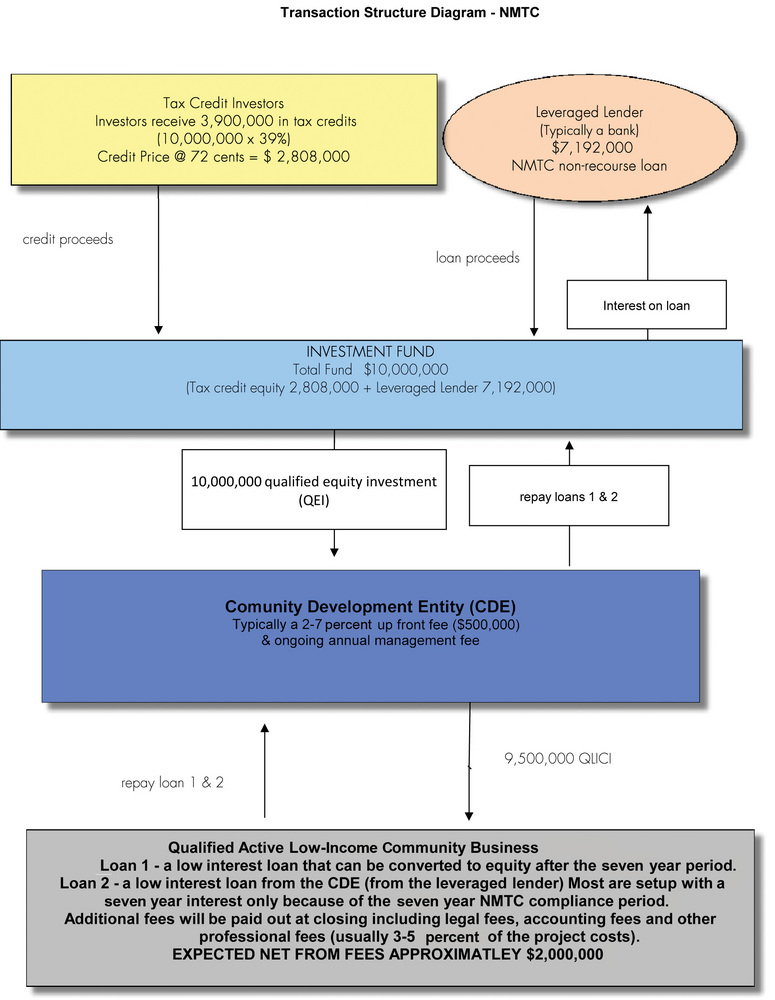

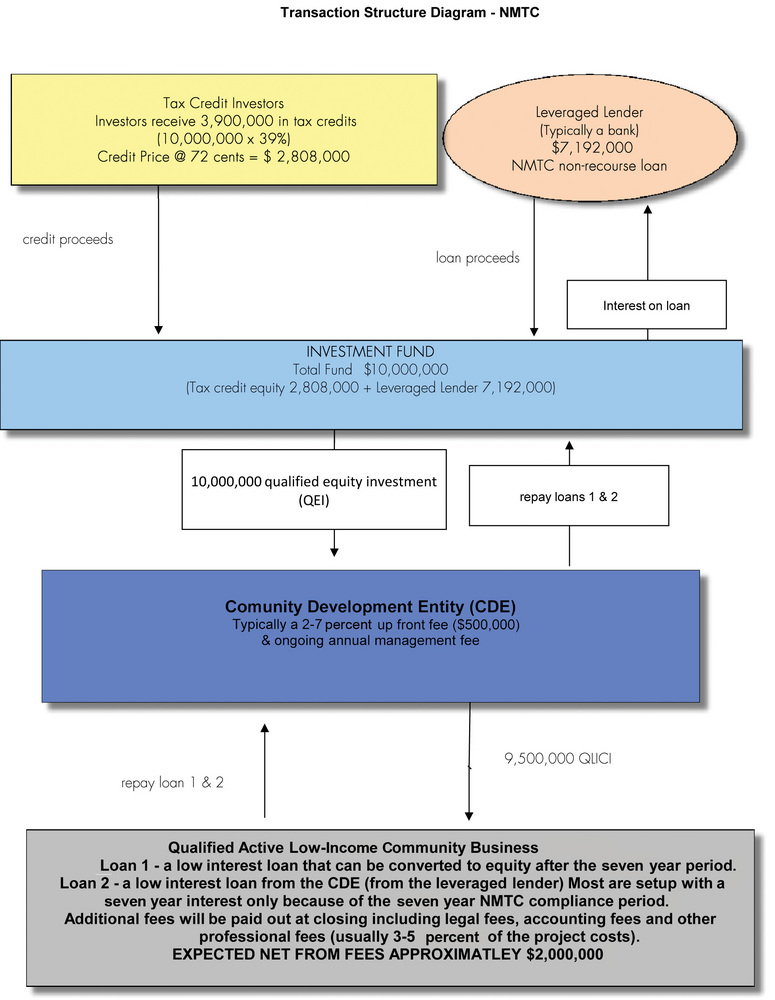

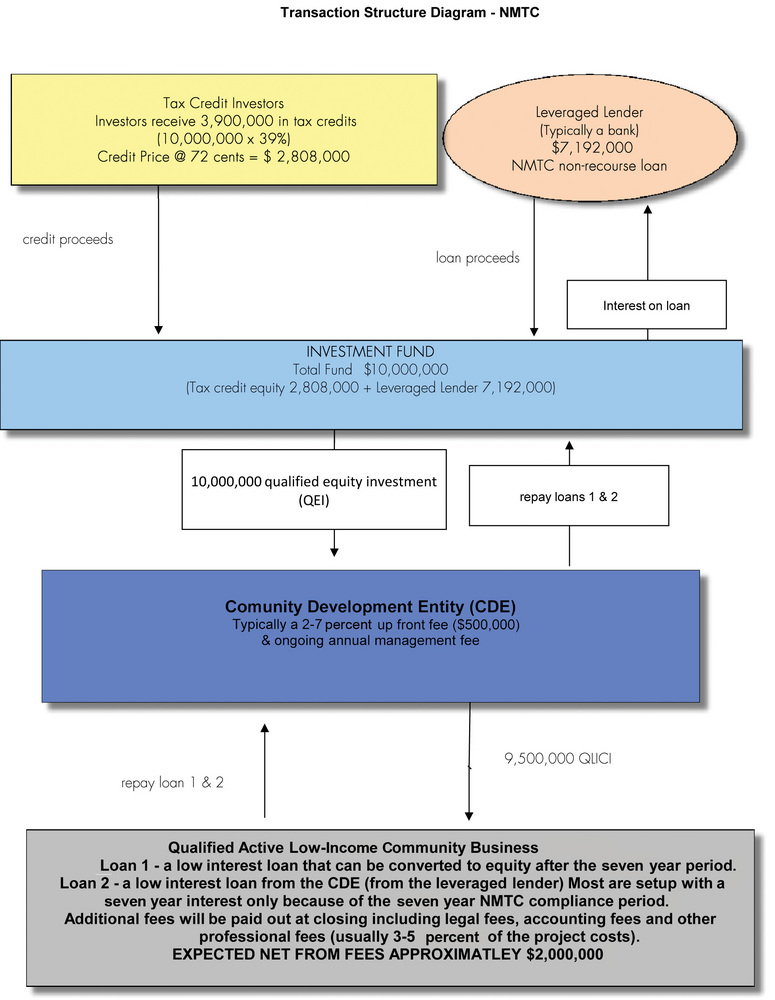

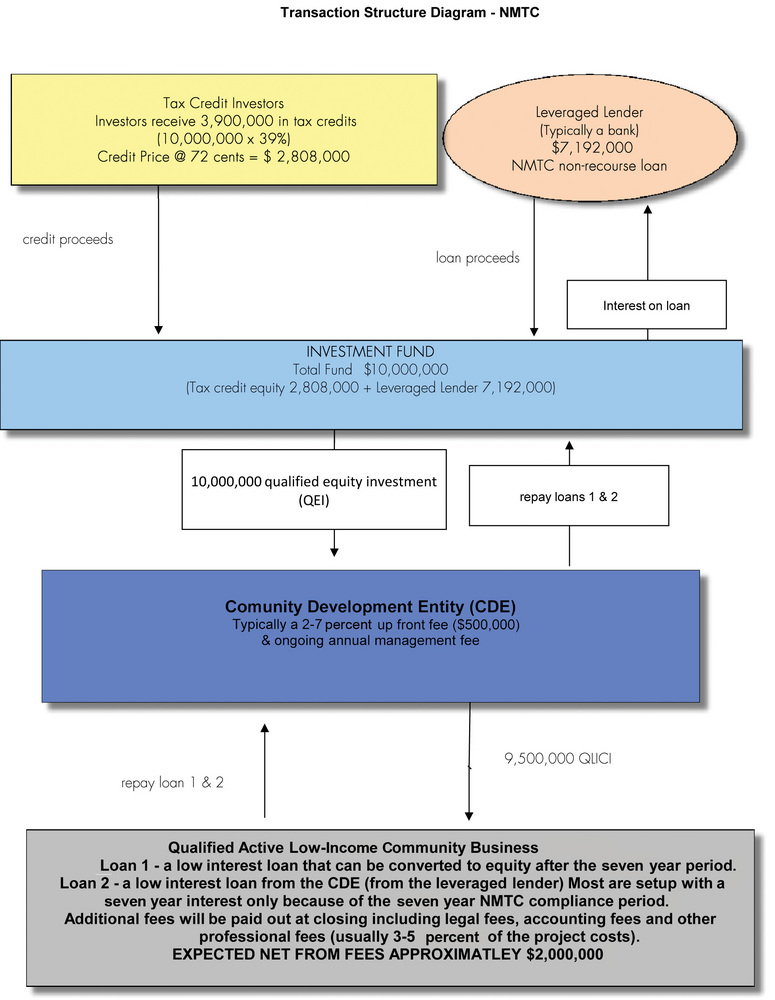

The simplest explanation of the program is that it provides tax credit incentives to investors for equity investments. But nothing about the program is simple. The credit is equal to 39 percent of the total investment. Five percent of the credit is available in each of the first three years and 6 percent in the final four years. The NMTC program is facilitated by the Community Development Financial Institutions Fund through the U.S. Treasury. The CDFI Fund allocates the credits to qualified Community Development Entities and the CDEs must invest in the Qualified Active Low-Income Community Business. The investment made to QALICB is called a Qualified Low-Income Community Investment. The credits are monetized generally in conjunction with permanent financing.

The NMTC is a complicated program whose bottom line can be cash injections up to 20 percent of the project’s total investment or capital need, or a lower interest rate on the project’s leveraged loan. In both cases, the cash or savings has a significant impact on the low-income community business.

Biomass projects—as well as all other businesses—need to undertake several steps in order to qualify for the NMTC.

1. “But for” test: A key question in evaluating the NMTC program is whether the investment is likely to have taken place “but for” the NMTC subsidy. Making this assessment is difficult because it requires estimating the decisions investors and developers would have made absent the tax credits. The CDEs have developed several methods to address some of the difficulties in evaluating this test; however, the need for capital will usually be enough to make an application to the CDE.

2. Check the Business Code: It is important to note that most projects in the biomass and alternative energy industry qualify for the NMTC. Furthermore, there are other credits and incentives that are available to the alternative energy industry that can be used in combination with NMTC. There are some restrictions in the farming industry and certain restrictions regarding holdings of intangibles, so biomass project leaders should confirm that their projects qualify for the credit. A qualifying project is referred to as a QALICB.

Advertisement

Advertisement

3. Check the Map: After establishing that your QALICB business code qualifies for the NMTC, the location of the project should be checked to the New Market Map. The business should be located in a qualifying urban or rural low-income community, which is liberally defined to include roughly 40 percent of the country. If your biomass project is not “on the map,” another method may be used to qualify your project. This alternative method is referred to as a targeted population, and it adds additional complexity to an NMTC project. Your NMTC attorney and CDE will determine if an alternative method is viable.

4. Identify a CDE: The NMTC program is facilitated by a CDE, which is responsible for allocating a portion of its credits in the form of a qualified equity investment (QEI), which allocates its portion of the tax credits to the individual QALICB. The CDE receives its credit from the CDFI Fund. Biomass companies must choose a CDE that is either local or national and that has credits available for your project. Many factors will be reviewed by the CDE to determine if it will allocate its allotment of credits to your project.

5. Choose an NMTC Attorney: The attorney is one of the keys to any successful NMTC transaction. The program is complicated and will require an attorney specializing in NMTC to navigate the business through the NMTC process. Typically the CDE can help with names of attorneys it has worked with in past NMTC projects. Attorney fees range between 1 and 1.5 percent of the total project costs.

6. Obtain Financing: Most NMTC projects are completed in conjunction with leveraged financing.

Advertisement

Advertisement

Because NMTCs create many issues for banks and require flexibility from the lending institution, it is important to work with a bank that is familiar with NMTCs and their unique requirements. A typical NMTC loan is interest-only for seven years due to the compliance period associated with an NMTC transaction. The leveraged lender does not have recourse to the assets of the QALICB if it were to default on its loan repayments. It can have recourse to the assets of the limited liability company formed to make the QEI. The QALICB generally has a put option for a nominal fee to purchase the tax credit equity from the tax credit investors.

7. Obtain Credit Investors: Many times this will be the bank or other financial institution involved in the NMTC financing, but it may also be large corporations or wealthy individuals. The credits are monetized for between 60 and 75 cents per credit. As noted earlier, the NMTC is a 39 percent credit where the credit investor receives 5 percent of the credits the first three years and 6 percent the next four. Eide Bailly specializes in matching NMTC projects with credit investors.

8. Close: Closing the NMTC program usually transpires concurrently with the financing or loan closing. The cash from the NMTC investors matches with the equity from the owners, along with the loan. Proceeds come together to create the total qualified investment that receives the 39 percent NMTC. The cash moves through the bank accounts of the different entities shown in the illustration on page 31.

The illustration provides a picture of the complexities of a leveraged NMTC transaction assuming a $10 million project.

In conclusion, there are virtually hundreds of issues that could arise in an NMTC transaction. Various fees can eat away at the NMTC proceeds, but for the right project, in the right area, the benefits are an injection of much-needed capital to expanding businesses. The typical NMTC project has a minimum of $5 million in total project costs. One reason for such a seemingly large entry amount is the legal fees, the CDE fees and other professional fees require a large investment to make the process worthwhile for the project developers and owners.

Authors: Tom Ritchie

CPA and partner, Eide Bailly

(918) 728-2100

tritchie@eidebailly.com

Jim Schmidt

CPA and partner Eide Bailly

(612) 253-6599.

jschmidt@eidebailly.com

Upcoming Events