Ethanol exports reach 25-month high in January, Brazil top draw

Renewable Fuels Association

March 11, 2014

BY Holly Jessen

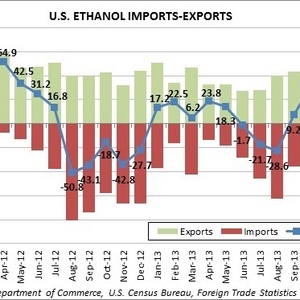

In January, U.S. ethanol exports reached 86.2 million gallons, the highest monthly export total since December 2011, according to government data released last week.

“Exports were up a third from December 2013, while imports remained sparse, meaning the United States was a net ethanol exporter by the widest margin in over two years,” said Ann Lewis, research analyst for the Renewable Fuels Association.

In the first month of the year, Brazil was the top customer for U.S. ethanol, bringing in 23.9 million gallons. That’s the largest amount exported to Brazil since January 2012. Canada dropped down from the top slot, bringing in only 18.8 million gallons of U.S. ethanol, a 36 percent decrease from the month before. Other top destinations in January include 12.4 million gallons to the United Arab Emirates, 10.7 million gallons to India, 5.5 million gallons to the Philippines and 3.3 million gallons to Mexico.

Advertisement

Advertisement

The U.S. only imported 4.7 million gallons, 4 percent more than was imported in December. About half of the imported ethanol came from Brazil. Another 47 percent came from Spain and 1 percent from the Netherlands.

On the other hand, the U.S. is exporting less distillers grains. In January, exports were down 9 percent to 903,827 metric tons. China was again in the No. 1 slot, receiving 344,147 metric tons. “However, China’s market share scaled back to 38 percent, in contrast with its majority stake, 56 percent, of U.S. (distillers grains) exports averaged over the second half of 2013,” she said.

Advertisement

Advertisement

The totals for exports in 2013 were reported in early February. Geoff Cooper, senior vice president of research and analysis for RFA, wrote in a blog post that the 621.5 million gallons exported last year was down 16 percent from 2012 but still the third-highest annual total on record.

Canada was at the top of the list, importing 52 percent of the U.S. ethanol that was exported for the year. “Meanwhile, U.S. ethanol imports tallied 395.2 million gallons for the year, down 27 percent from 2012 and well below the levels envisioned by the U.S. EPA (600-800 million gallons) for the purposes of meeting the renewable fuel standard’s advanced biofuel requirements,” Cooper said. “Instead, those requirements were largely satisfied with domestically-produced biodiesel.”

In contrast, U.S. distillers grains exports hit a new record of 9.7 million metric tons in 2013. That’s up 31 percent from the previous year and well above the previous record of 9 million metric tons in 2010. China, the top destination for distillers grains, brought in 46 percent of the total exported

Related Stories

Broco Energy on July 17 announced a new partnership with the Massachusetts Port Authority (Massport) to deliver and transition Massport's fuel tanks to renewable diesel across its various facilities.

Shell Aviation, Accenture, and Amex GBT on July 10 announced Avelia is in the process of evolving to an industry solution with independent data hosting and a multi-supplier model helping users access the GHG benefits of SAF.

The U.S EPA on July 17 released data showing more than 1.9 billion RINs were generated under the RFS during June, down 11% when compared to the same month of last year. Total RIN generation for the first half of 2025 reached 11.17 billion.

The U.S. EPA on July 17 published updated small refinery exemption (SRE) data, reporting that six new SRE petitions have been filed under the RFS during the past month. A total of 195 SRE petitions are now pending.

European biodiesel producer Greenergy on July 10 confirmed plans to shut down its biodiesel plant in Immingham, Lincolnshire, U.K. The company temporarily suspended operations at the facility earlier this year.

Upcoming Events