European Biomass Association releases 2016 bioenergy outlook

European Biomass Association

October 24, 2016

BY Katie Fletcher

The European Biomass Association (AEBIOM) recently released its annual statistical report for 2016, providing an in-depth look at the bioenergy sector in the EU-28 Member States. Last year’s edition added analysis of the support schemes in place for biomass heating, electricity and transport. This year, the report is further enriched with the addition of market forecasts based on past trends and the existing reality to help envision how European bioenergy markets will evolve in the coming years.

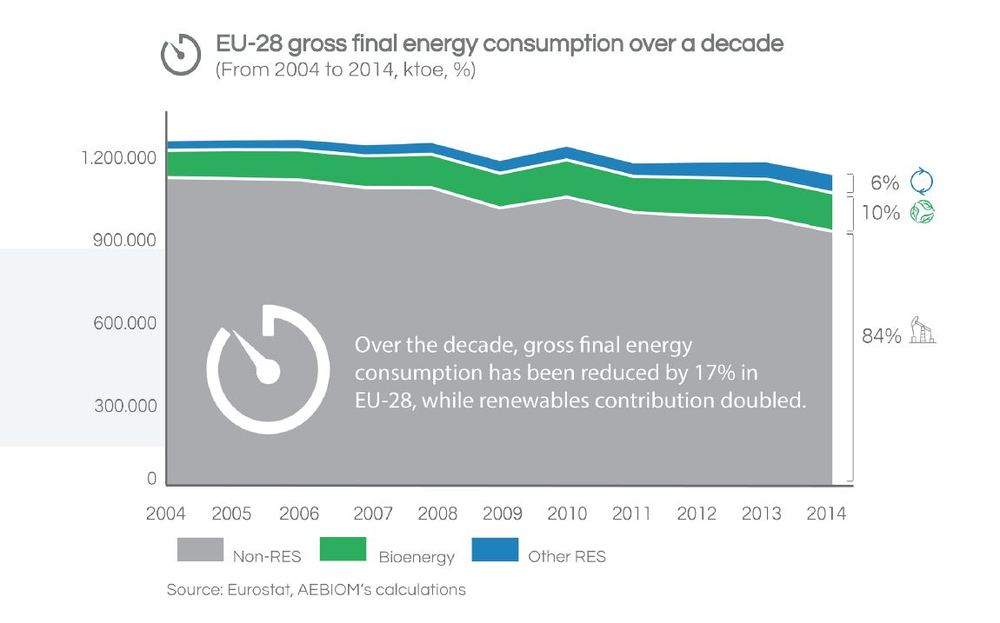

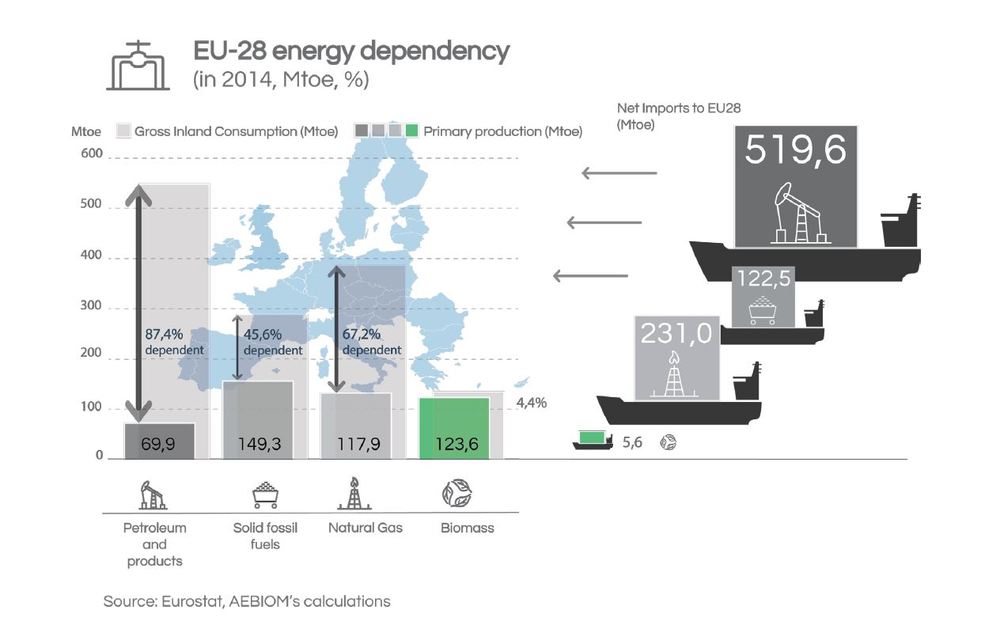

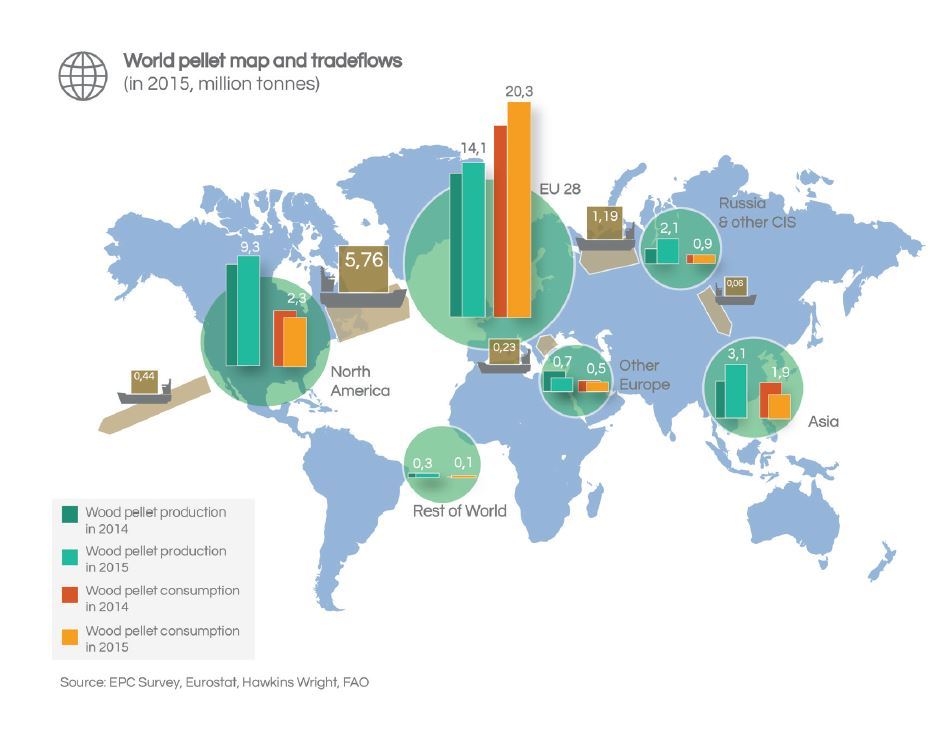

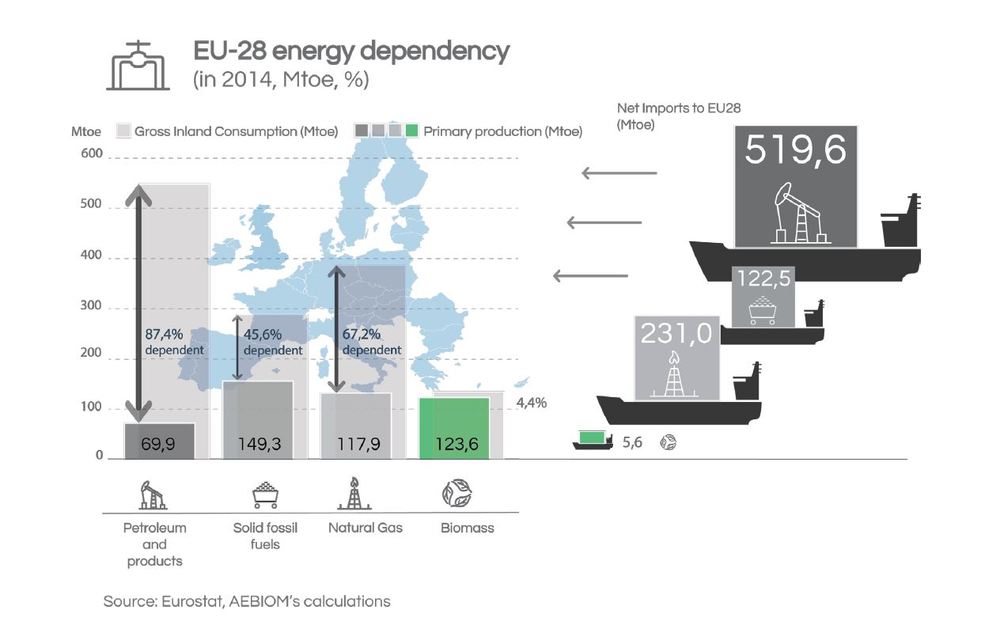

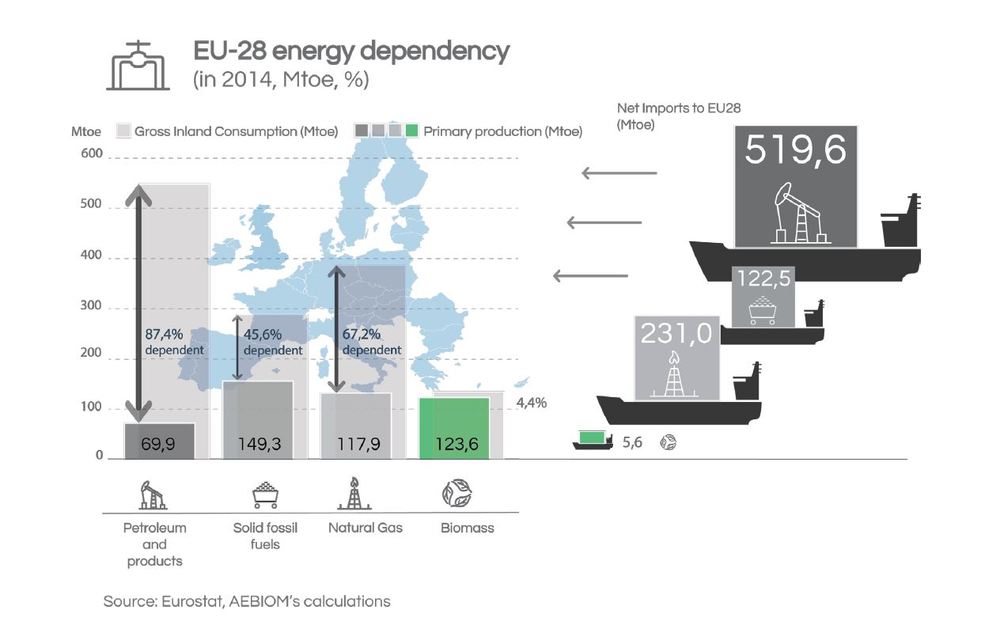

In the beginning of the report, AEBIOM noted that although 2015 was a year of great commitment to renewables worldwide with the agreement at the 21st Conference of the Parties in Paris, the EU still remains highly dependent on imported fossil fuels to meet energy demands. Average EU-28 energy dependency was 53.4 percent in 2014, with fossil fuels making up over 99 percent of net imports of energy. In comparison, the U.S. has an energy dependency of 14 percent. However, renewables have the ability to secure the EU’s future energy mix. For example, biomass imports currently represent only 4.4 percent of total European bioenergy consumption, and the remaining 95.6 percent contributes directly to the development of local economics, especially in rural areas where most biomass is harvested and processed, according to Eurostat and AEBIOM’s calculations.

The EU still lags behind countries like Brazil, India, Indonesia and Japan when it comes to renewables. “To become number one, the EU needs strong, clear and ambitious objectives and policy measures that support renewable energy development,” the report read. AEBIOM and other sectoral associations expressed opinions on how to reach this status in the renewable energy directive (REDII) for the period post-2020.

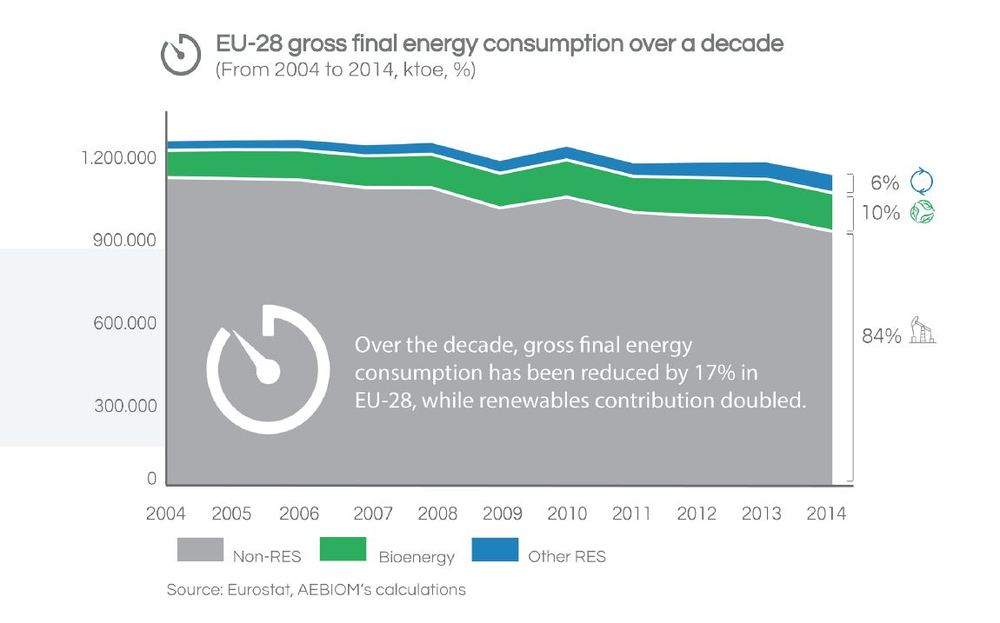

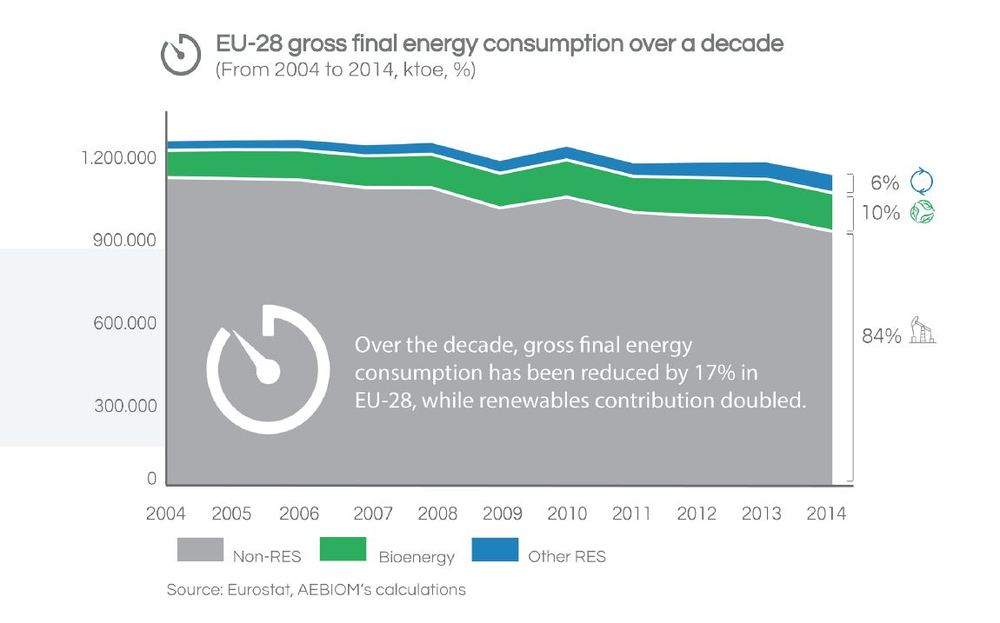

Jeffrey Skeer, senior program officer with the International Renewable Energy Agency, shared in the report that renewable share of energy use for electricity and heat has nearly doubled in just a decade, partly due to the robust expansion of bioenergy, which has been driven by using biomass in combined-heat-and-power (CHP) plants, urban district heating plants and modern home furnaces. Biomass accounts for nearly a fifth of renewable electricity production and nine-tenths of renewable heat.

Skeer continued by saying that renewable share of energy for transport has expanded nearly six-fold, partially due to the expanded use of biodiesel and bioethanol. “Advanced liquid biofuel technologies, which can make use of lignocellulosic feedstocks from rapidly growing trees and grass, should become an important part of the energy picture as they mature,” Skeer said.

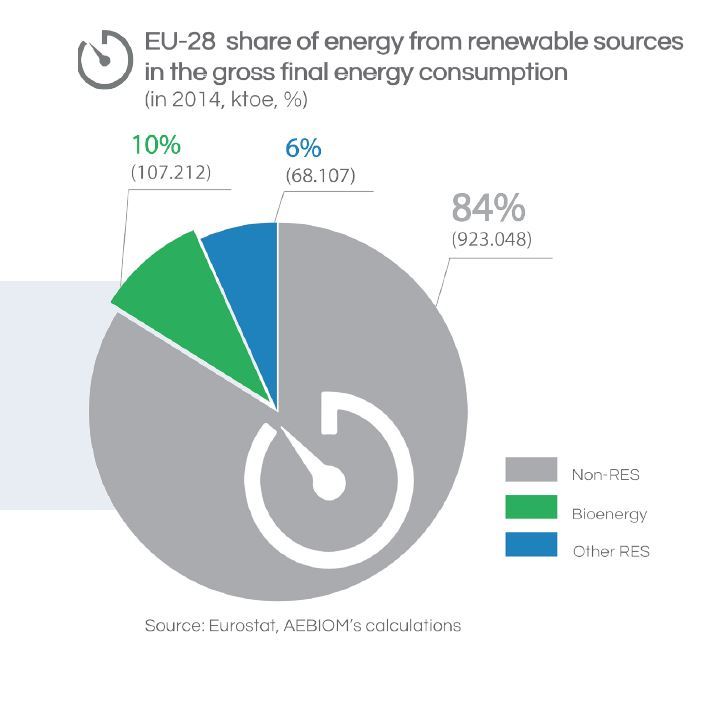

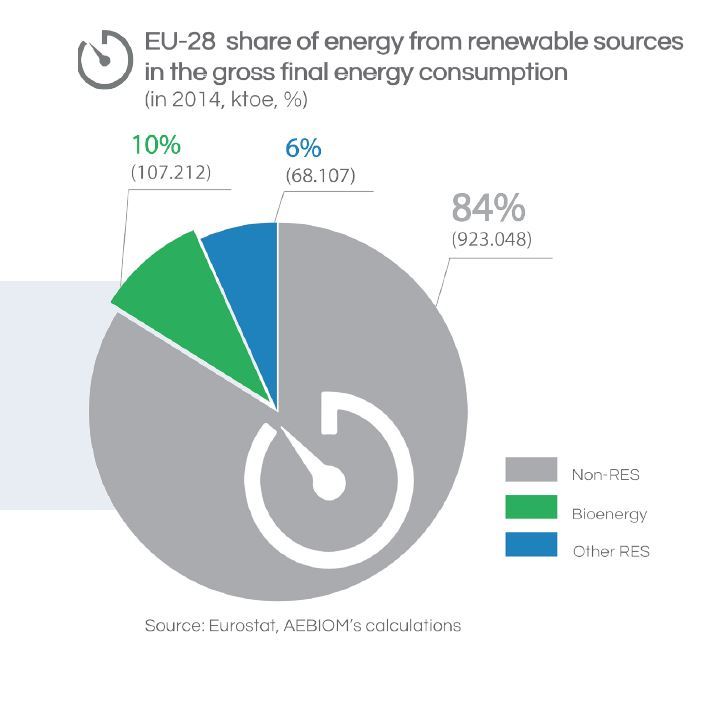

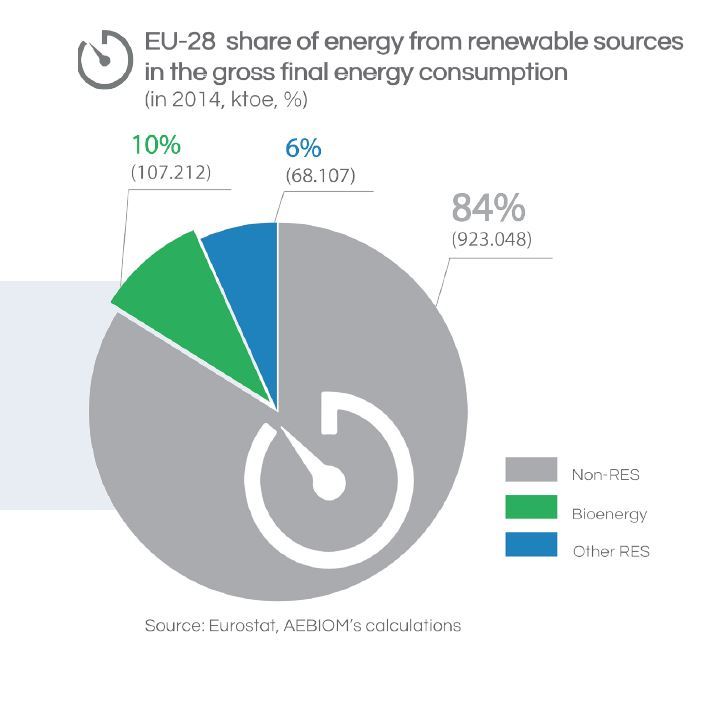

AEBIOM highlighted the crucial role bioenergy must play to meet EU’s 2020 objectives. By 2020, bioenergy is expected to contribute to half of the EU’s 20 percent REDII target. Bioenergy accounted for 61 percent of all renewable energy consumed, or 10 percent of the gross final consumption of energy in Europe in 2014. As bioenergy is the only renewable energy source able to provide green fuel for heating and cooling, power generation and transport applications, AEBIOM’s statistical report analyzed each sector individually.

Around half of total EU energy consumption comes from heating and cooling, of which 82 percent is powered by fossil fuels. However, bioenergy is currently the leading renewable in heating and cooling (88 percent), representing 10 percent of EU gross final consumption of energy. AEBIOM cited that it sees a great opportunity for improvement in this sector and bioenergy is gaining importance in EU policy, in buildings specifically.

The electricity market has traditionally been more closely addressed by European regulations, allowing 27 percent of the market share to be made up of renewables. Bioenergy represents 5 percent of the overall EU power generation.

Advertisement

In the transport sector, renewables represent 5 percent of EU total energy consumption, 90 percent of which is provided by biofuels. According to AEBIOM, the transport sector has always been the most challenging in terms of market penetration, and it’s challenging to foresee how biofuels—first-gen in particular—will continue to develop, as recent EU legislation, like the Indirect Land Use Change Directive from September 2015, has established a quota for these biofuels.

As Skeer pointed out, bioenergy consumption has more than doubled in 2014 since 2000. According to Member States’ projections made in 2010, by 2020, implied growth is expected to be around 32 percent when compared to 2014. Within each market segment, an increase by 2020 of 16.9 percent is expected for heat, 38 percent for electricity and 105 percent for transport. According to AEBIOM, projections for heat and electricity can be reached, but it’s not likely the case for transport.

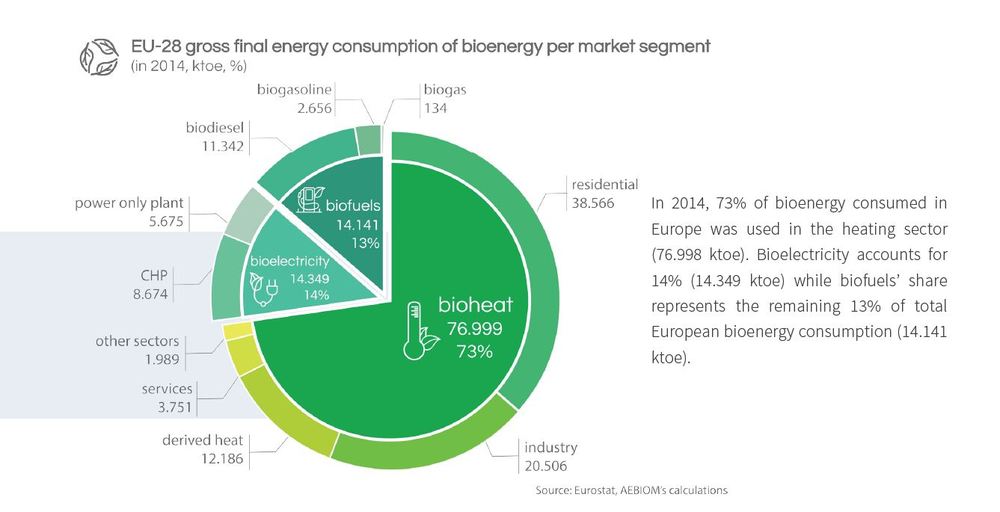

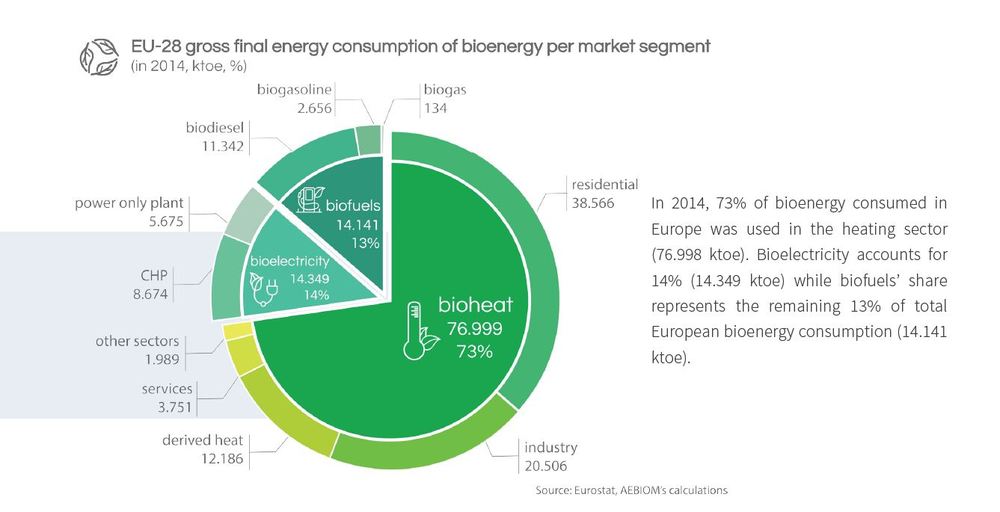

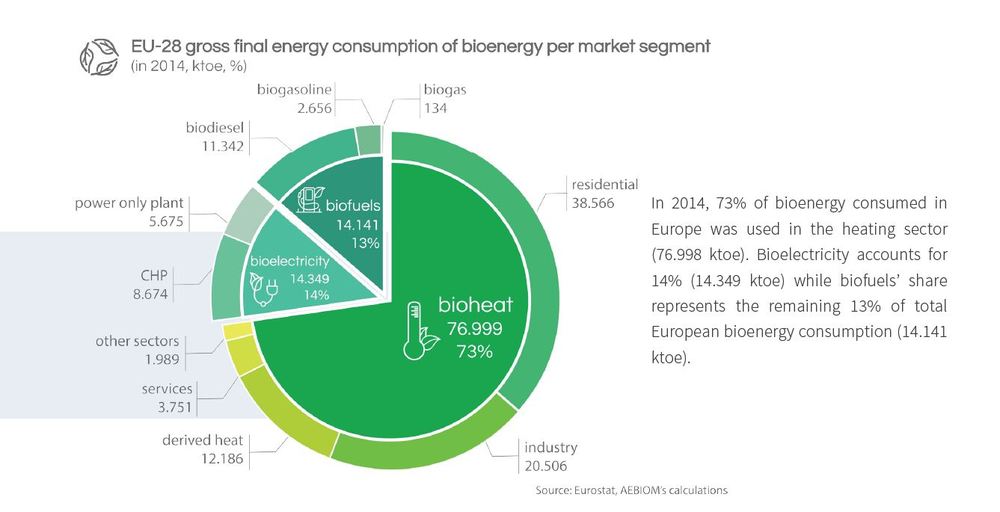

The heating sector is the largest market segment for bioenergy consumption (73 percent). Bioelectricity accounts for 14 percent and biofuels represent the remaining 13 percent of total European bioenergy consumption. Residential consumption remains the strongest driver of bioheat use, with half of total consumption. This heat comes from individual heating appliances such as stoves and boilers using wood logs, woodchips or pellets. AEBIOM stated in the report that this sector may decrease in volume of biomass consumption in the future due to energy efficiency measures.

District heating networks carrying derived heat to individuals and businesses is also an important part of EU bioheat consumption—even essential in places like Nordic and Baltic countries. Five countries currently account for more than 50 percent of bioheat consumption. Germany is the largest with 14 percent or 11.1 metric tons of oil equivalent (Mtoe), Sweden follows with 8.8 Mtoe and France with 7 Mtoe.

In regards to renewable power, bioenergy only represents 18 percent of renewable electricity production, but as intermittency remains an issue, biomass will play a growing role as a backup, dispatchable energy source, according to AEBIOM. A majority of this biopower (60.4 percent) comes from CHP plants. On the other hand, CHP plants represent the smallest use for traditional power generation at only 11.7 percent, whereas power-only plants amount to 88.3 percent. “The use of biomass in CHP increases the overall efficiency and lower emission and fuel consumption when producing green power,” said Aners Nordstrom with DONG Energy. “This provides an opportunity to further improve the environmental performance of CHP.”

Same as bioheat, the EU’s top five countries generating bioelectricity represent more than half of the total (66.8 percent). Germany is again the largest with 4.2 Mtoe (30 percent), followed by the U.K. with 1.9 Mtoe (14 percent) and Italy with 1.6 Mtoe (11 percent).

Bioenergy covers a wide range of raw materials and conversion technologies. Solid biomass represents more than two-thirds of biomass consumed (69 percent), biogas and biofuels represent 12 percent and 13 percent of gross inland energy consumption of biomass and biowaste, and renewable municipal waste used for energy purposes reached 7 percent. According to AEBIOM, solid biomass is therefore the market driver for bioenergy, essentially comprising woody biomass.

Advertisement

Last year, AEBIOM offered comprehensive insight on how woody biomass is consumed at the EU level. They found the residential sector still makes up the main share of wood energy consumption (27 percent). This is followed by the industrial use of wood chips in installations above 1 MW (22 percent) and small-scale use of wood chips (14 percent). Pellet consumption has grown in recent decades, but represents 6 percent of total EU wood energy consumption.

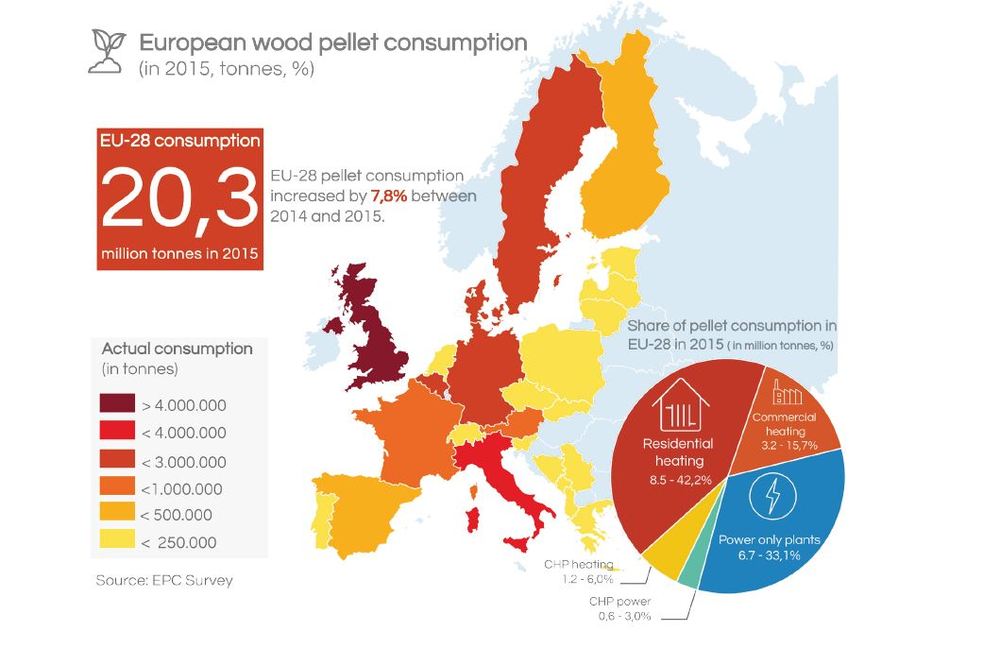

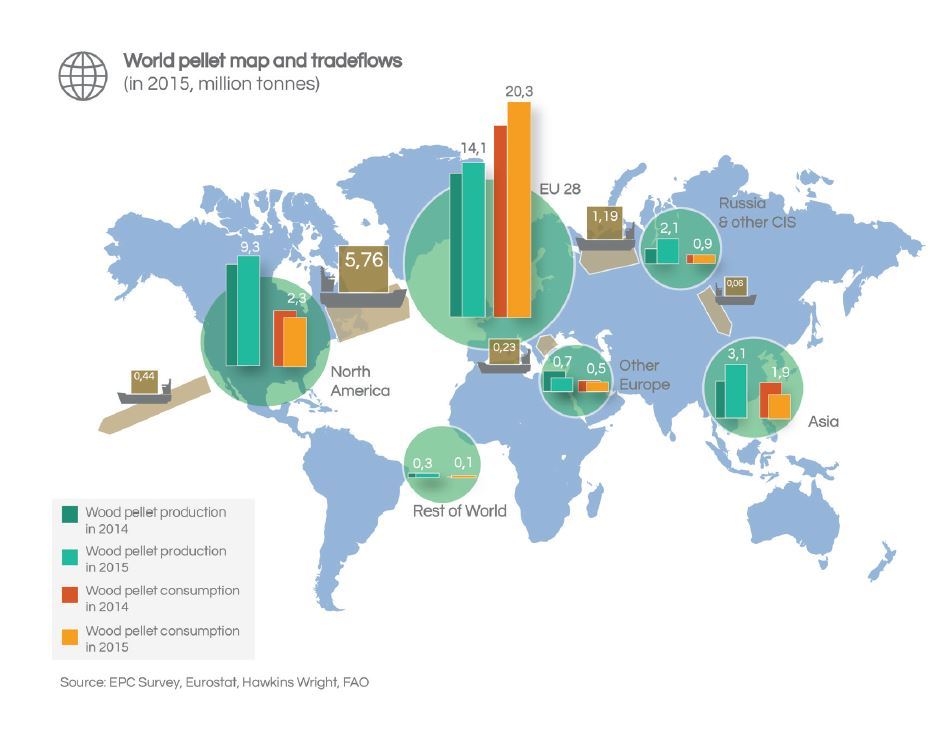

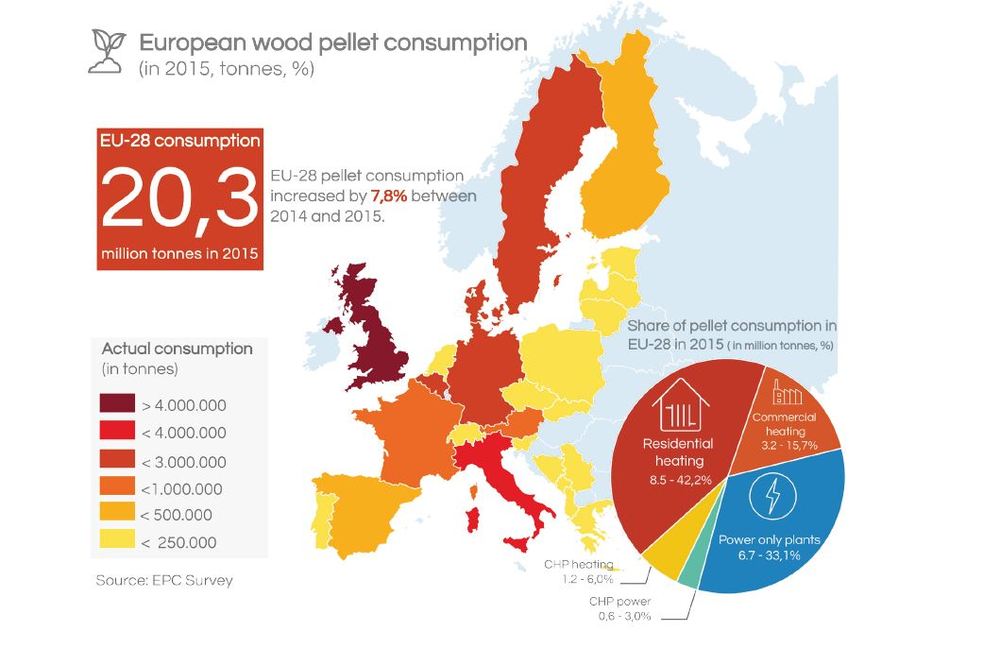

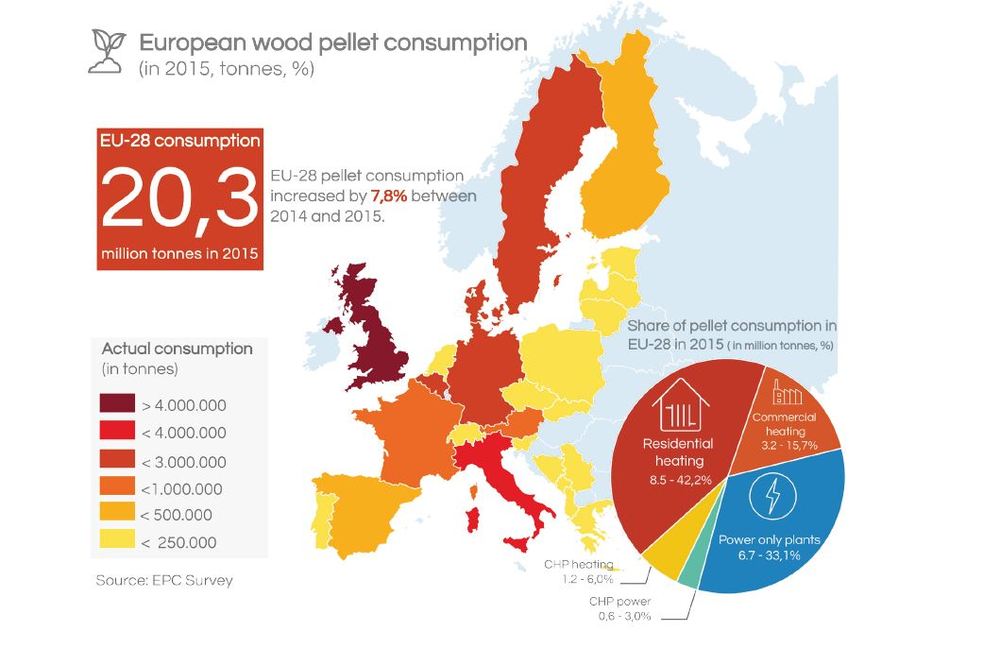

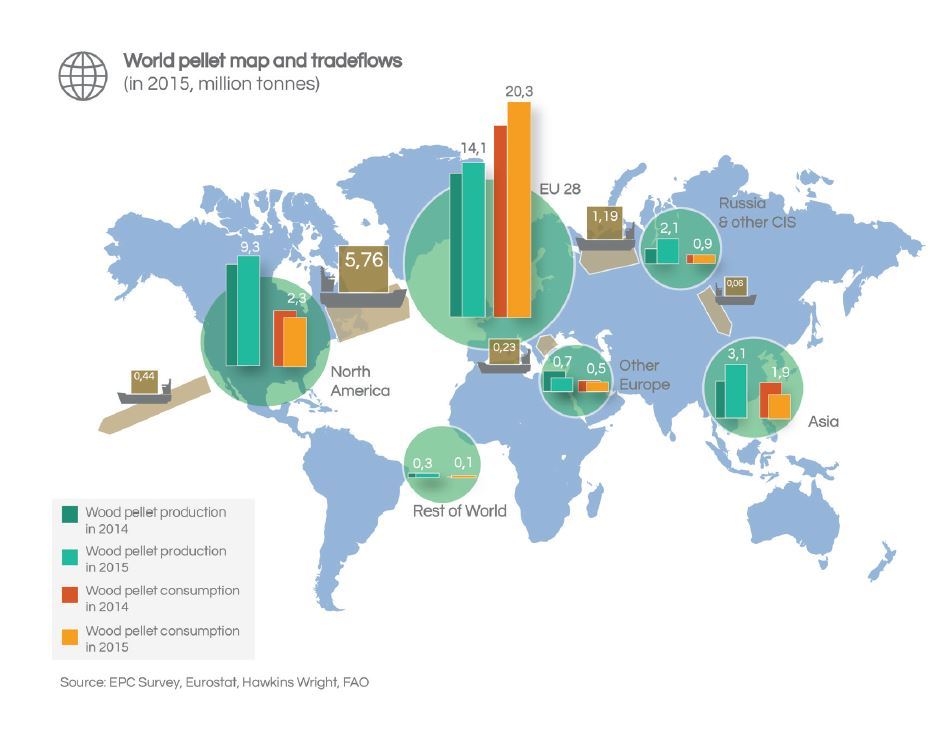

AEBIOM’s 2016 statistical report included a special focus on the pellet market. In 2015, wood pellet consumption in the EU-28 reached 20.3 million metric tons, 6 percent of total solid biomass used in Europe. Between 2014 and 2015 consumption increased 7.8 percent. A majority of consumption was for heat production at 12.9 million metric tons in 2015 (63.9 percent) and the remaining 36.1 percent of pellets (7.32 million metric tons in 2015) were used for power production. Pellets for power production is rising in the EU, with an increase of 14.9 percent between 2014 and 2015.

Italy is the largest consumer of heat at 3.1 million metric tons of the total 12.9 million metric tons of pellets consumed for heat. Pellet consumption of power is concentrated within a couple of Member States, with the U.K. as the largest consumer at 5.7 million metric tons, increasing between 2014 and 2015 by 21.4 percent.

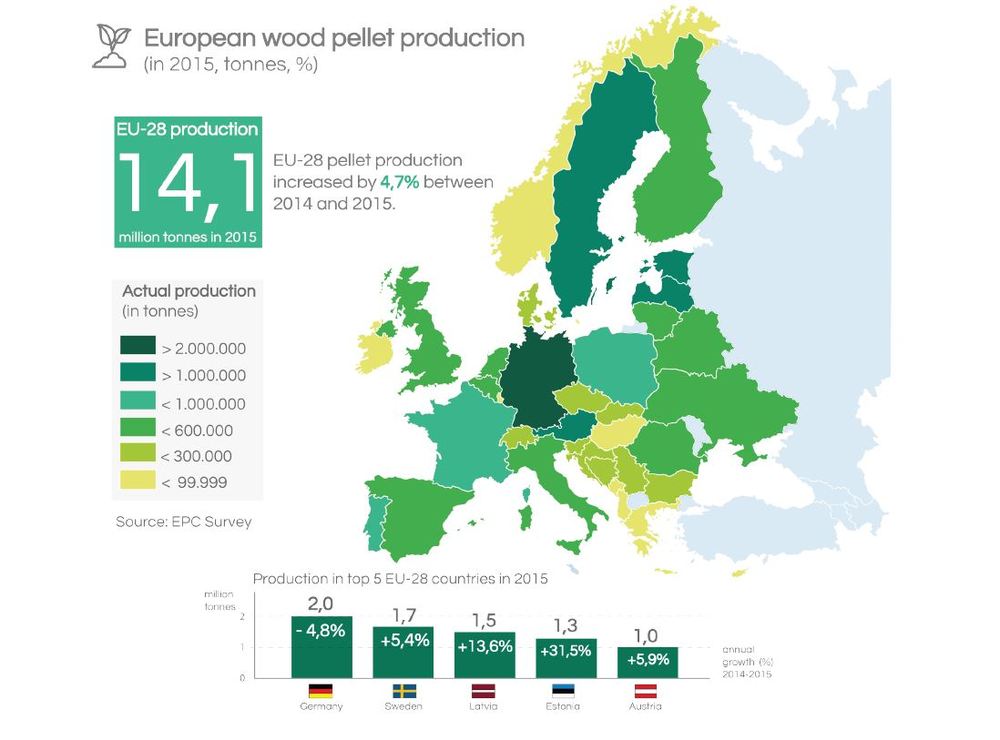

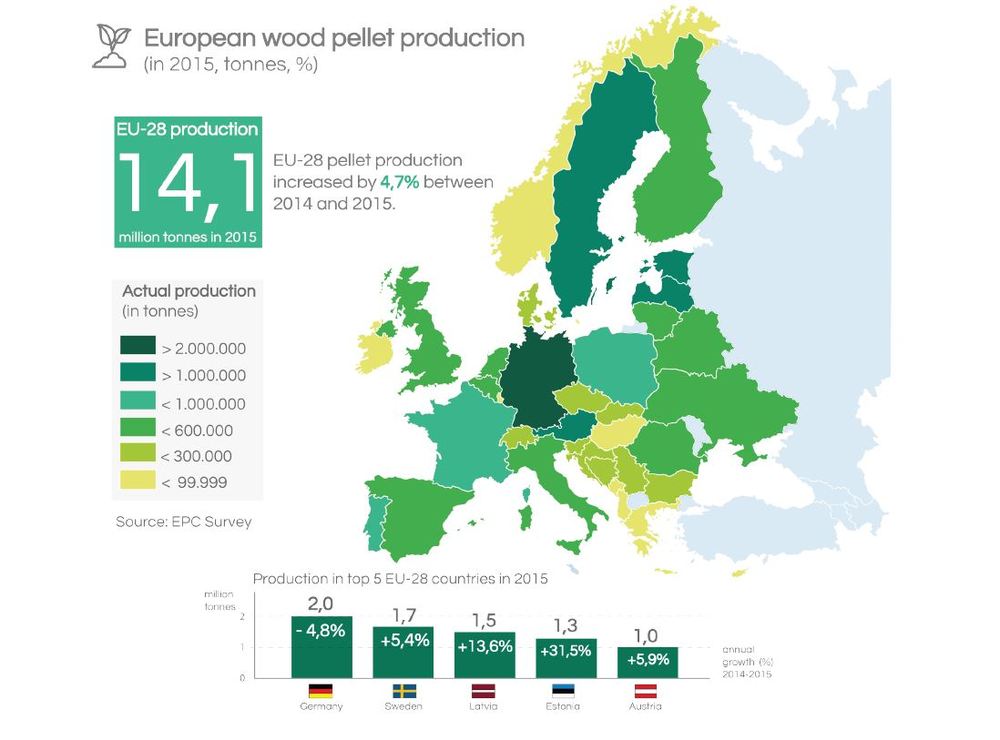

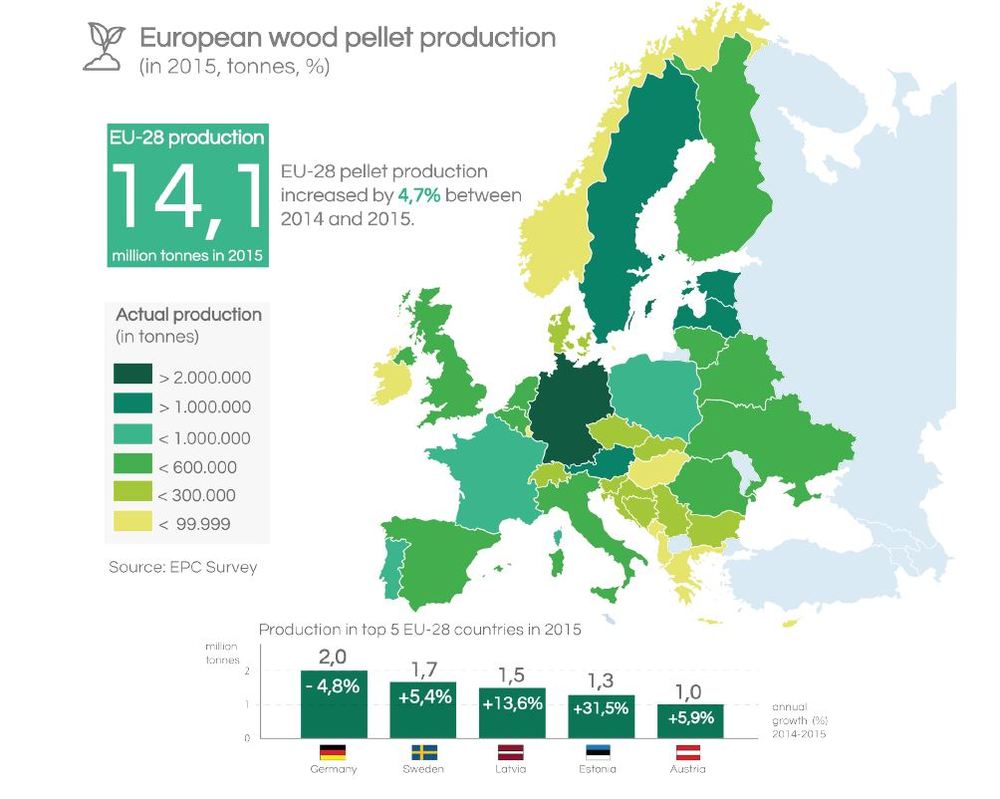

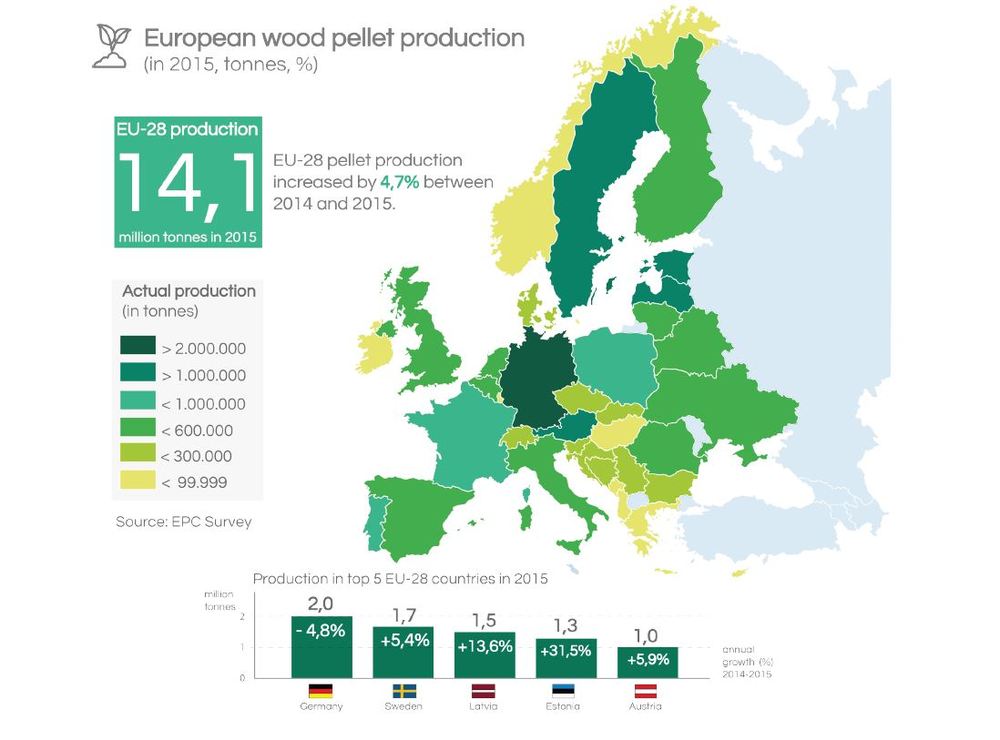

The region produced 14.1 million metric tons of pellets, serving 70 percent of its demand. Production increased between 2014 and 2015 by 4.7 percent. Germany is the largest producer of wood pellets at around 2 million metric tons per year, followed by Sweden, Latvia, Estonia and Austria.

The 300-page report’s table of contents can be accessed here. Besides a number of chapters discussing biomass and bioenergy in general, the report included special chapters on pellets and bioenergy support schemes.

A free summary version of the full report can be downloaded here.

The full report can be ordered here.

A summary of the 2015 AEBIOM report can be read here.

Upcoming Events