Evolution of the Market

June 6, 2011

BY Robert Wisner

The explosive expansion in the U.S. corn starch ethanol industry the past few years has generated significant changes in livestock rations as the U.S. animal and poultry feeding sector sought feed cost savings by substituting DDGS for corn. A review of pricing relationships reveals how the DDGS market has evolved.

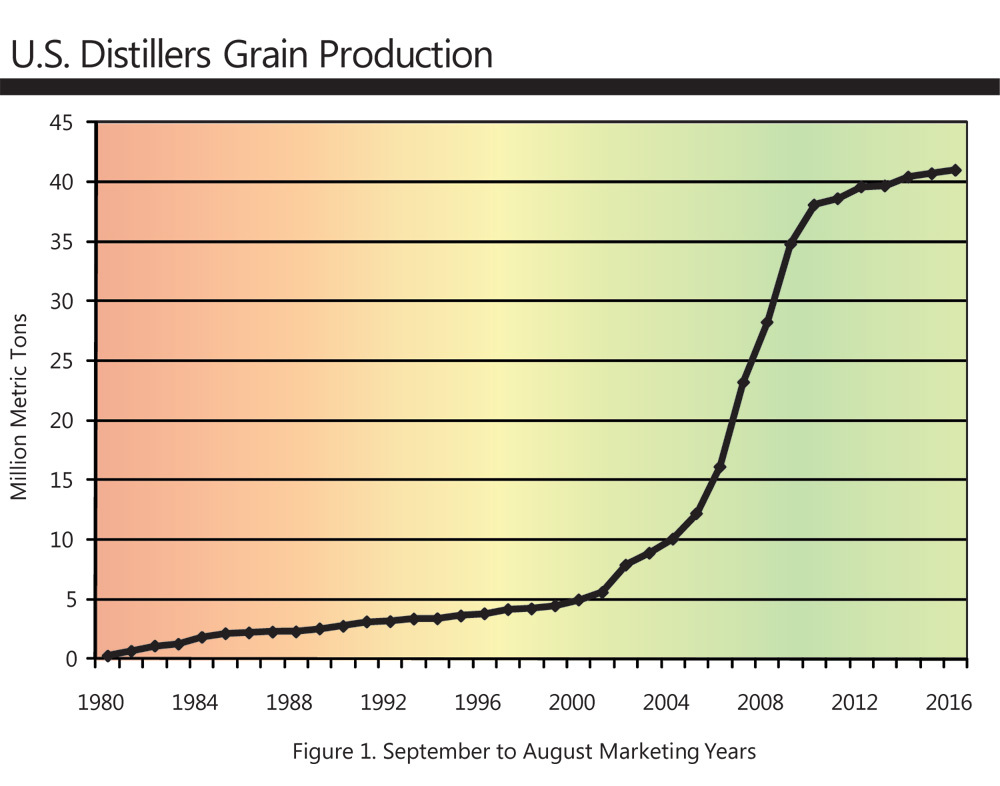

As ethanol production, and its coproduct distillers grains expanded, there was a time lag while the U.S. livestock and poultry industry developed systems for efficiently transporting, handling, and feeding the coproduct. Feeding of DGs is now widespread in the U.S., especially in the beef cattle and dairy industries. Although the rate of expansion in ethanol production has slowed substantially from the rapid growth of the last six years, further growth is expected in the next few years and continued growth in the markets for DGs will be important for profitable ethanol production. Early projections show an 8 to 9 percent increase for the current marketing year. (See Figure 1)

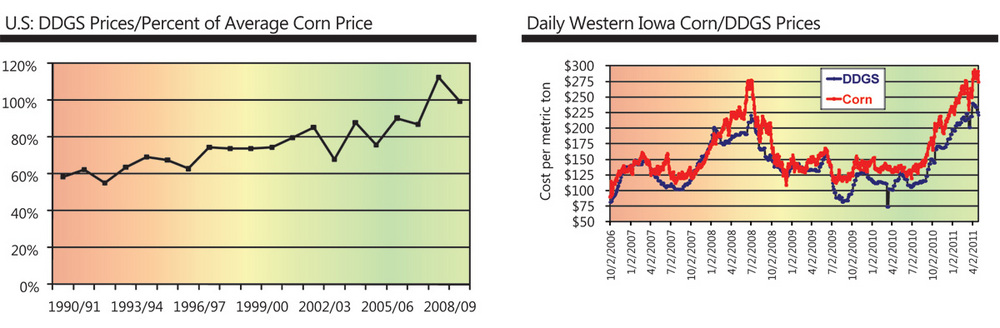

Tightening corn supplies have accompanied the rapid increase in corn processing for ethanol. That, in turn, has been accompanied by rising and increasingly volatile corn and soybean meal prices. Livestock and poultry producers have been on the alert for any alternative ingredients that may lower their costs. In the early stages of the explosive growth in ethanol production, DDGS prices were quite low and began to attract the attention of the livestock industry, especially large milk producing operations. In the past three to five years, DDGS feeding has rapidly expanded in the rest of the U.S. livestock sector. Future trends in its use will be important to the entire livestock, ethanol, grain and feed sectors.

Feed Value

Advertisement

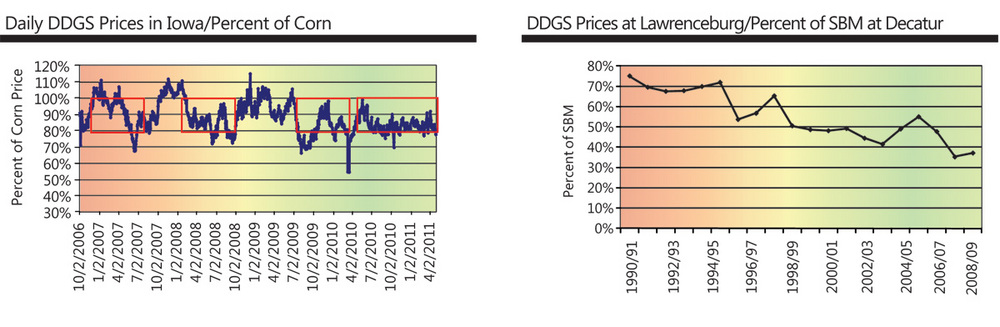

Distillers grains works best in ruminant diets. For beef feeding, it substitutes primarily for corn, while in dairy rations as well as in swine and poultry feeding, it substitutes for both corn and soybean meal. The increasing DDGS price as a percentage of corn prices and decreasing percentage of soybean meal prices suggests that the strongest source of demand for DDGS is as a corn replacement.

At least three different types of distillers grains are marketed in the U.S. Where ethanol plants are located close to feedlots, a portion of the distillers grains with solubles typically is sold as wet distillers grains with solubles (WDGS) or partially dried DGs labeled as modified (MDGS). Wet and modified distillers grains are moved directly to cattle feedlots, since they have limited storage life due to moisture content of 70-75 percent and 50-55 percent, respectively. Marketing of wet or modified DGs reduces ethanol production costs and energy used in the biorefinery. For beef cattle feeding, they also have feed conversion advantages over DDGS. Users located long distances from the plants, in other regions or countries, purchase DDGS because of the limited storability of the wet and modified versions.

DDGS is a medium-protein feed ingredient that replaces corn, soybean meal and other sources of phosphorus and calcium. Its percentages of fiber, protein, oil and other nutrients are concentrated to almost three times the percentages found in corn as the nearly 70 percent starch content of corn is converted to ethanol. High quality corn is important for the ethanol process since mycotoxins or other low-quality foreign substances also are concentrated nearly three-fold by weight when compared to unprocessed corn. The quality of DDGS can vary some from one ethanol plant to another, depending on drying temperature and other management factors.

DDGS is best suited for feeding to ruminant animals (cattle, sheep, goats, etc.) The digestive system of these animals allows them to convert DGs fiber into energy, while at the same time using the protein and other nutrients. Use of DDGS in hog and poultry rations is somewhat more limited, in part because of its fiber content. When DDGS is fed to these species, supplementation of some amino acids also is needed. Pork producers report that feeding high levels of DDGS during the feeding period can cause soft bellies that in turn cause problems in bacon production. DDGS from ethanol plants that remove corn oil has a higher protein and lower oil content than the typical DDGS, thus altering its nutritional content somewhat and making it more suitable for swine.

Advertisement

Replacement ratios in substituting DDGS for corn and soybean meal vary with the species of animal being fed. Estimated replacement ratios also vary slightly among recent feeding research trials. For typical beef cattle feeding operations in the U.S., 1 pound of DDGS (dry matter basis) is estimated to replace about 1.1 pounds of corn. Very little soybean meal is used in typical U.S. beef cattle feeding programs, so for this species, DDGS is mainly a substitute for corn. For dairy cattle, recent research indicates 1 pound of DDGS replaces about 0.6 pounds each of corn and soybean meal. For hogs, 1 pound of DDGS replaces about 0.8 pounds of corn and 0.2 pounds of soybean meal. When DDGS is fed to poultry, the replacement ratios are about 0.6 for both corn and soybean meal. In addition, recommended maximum DDGS percentages of the ration for swine and poultry are considerably lower than for cattle because of differences in their digestive systems. Recent research indicates DGs can be fed successfully to beef cattle at very high levels, of over 50 percent of the ration.

Because of the substitution ratios that vary by species, aggregate replacement of corn and soybean meal by DDGS depends on the market share being fed to the various species. Aggregate current national data on shares by species in the U.S. are not available from government sources, but indications from the ethanol industry are that beef cattle are the largest market for DGs by a considerable margin, followed by its use for dairy cows, hogs and poultry, in that order.

For DDGS that is exported, even less information is available on percentage shares of use by species, but on average, significantly less is used for beef than in the U.S. and a relatively higher percentage is believed to be used for poultry and hogs. Thus, DDGS exports are believed to replace relatively more soybean meal and relatively less corn on a percentage basis than in the U.S.

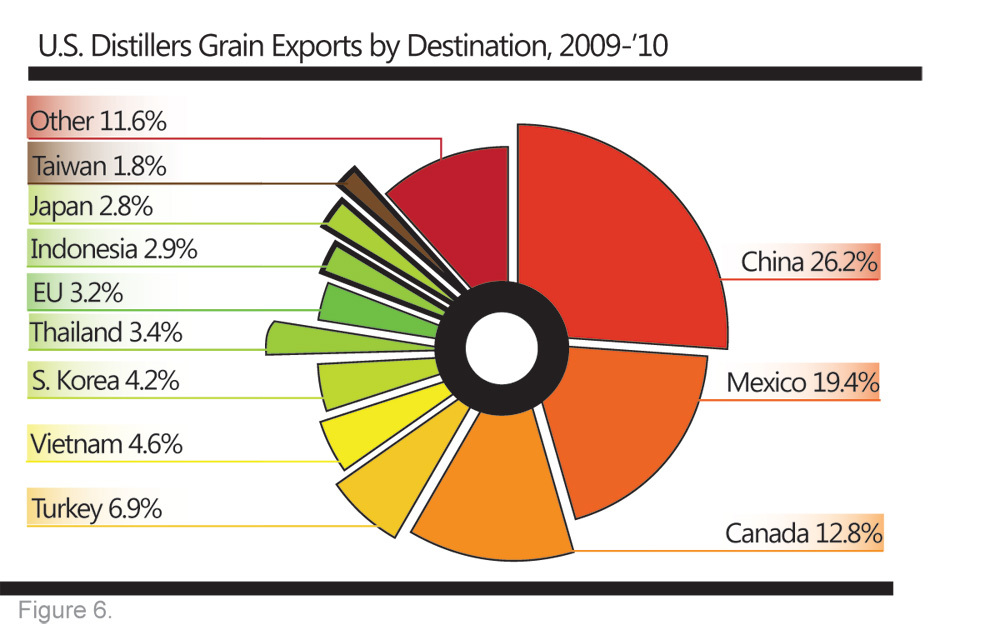

Exports by Destination

In the past few years, DDGS exports have grown rapidly as foreign livestock and poultry producers became familiar with its potential cost savings and ways of effectively using it as a replacement for corn and soybean meal. Currently, it appears that about three-quarters of the U.S. DGs supply is used domestically, with the remainder exported. Initially, the largest export markets for DDGS were the nearest ones, namely Mexico and Canada. However, other significant DDGS export markets have begun to emerge as seen in Figure 6, showing U.S. Census of Manufacturing export data. The census data also includes a small amount of other byproduct feeds from the brewing industry. The most significant of these emerging markets is China, which during the past two years has become the largest foreign buyer of U.S. DDGS. China’s consumer demand for more animal, poultry and aquaculture products is growing rapidly. China recently accused the U.S. of dumping DDGS into export markets and its claim is being examined by the World Trade Organization. Trade sources offer a number of reasons for China’s action, including a possible temporary over-supply in its markets as end users and handlers learn how best to use the product. Other possible explanations include retaliation for U.S. trade policies on some Chinese products. The outcome is a bit uncertain but many analysts expected that China’s imports will increase in the years ahead, thus becoming a growing influence on DDGS prices and availability for other users.

For profitable ethanol production, strong and expanding markets for DGs are important. Profitable ethanol production also is important for grain farmers as well as crop input and marketing firms. Availability and cost of DGs is of major importance to both domestic and foreign livestock and poultry sectors. Expanded exports, plus the development of new coproducts and enhanced DGs, will continue to impact the market as it evolves.

Author: Bob Wisner

Agricultural Economist, AgMarketing Resource Center

Iowa State University

rwwisner@iastate.edu

Upcoming Events