Glorified, Torrefied & Cofired

August 23, 2011

BY Anna Austin

Over the past few years, many small torrefaction technology companies have popped up across the U.S. While some have made progress, others have disappeared as quickly as they started.

While the science behind torrefaction is not in question, it seems there are two major roadblocks for most companies trying to economically produce a product that will serve as a cofired or stand-alone fuel—overcoming the confusion surrounding the economics of torrefaction, and coming up with the cash to prove their process on a meaningful scale.

In Europe, where coal/biomass cofiring is common and carbon reduction incentives are enticing, large-scale torrefaction plants are being built. That’s a different scenario than in the U.S., where small start-up companies are mostly working on pilot- and demonstration-scale units.

Dutch clean tech company Topell Energy recently completed what it believes is the largest torrefaction plant in the world, a 60,000-ton facility now operating in the Netherlands. While Topell has plenty of European customers, the company believes there is great potential outside of the country, particularly in North America. But, as Robin Post van der Burg, director of business development at Topell, points out, considerable confusion still surrounds the mass and energy balance of torrefaction.

“People looking at torrefaction will find that there isn’t a lot of credible information out there,” he says. When evaluating mass and energy balances, there are three things that need to be looked at, according to van der Burg. The first is the thermal balance, or how much thermal energy comes out of a forest versus what comes out of the torrefaction process. “There’s a general understanding that you lose 20 percent of the bone-dry biomass, and that you also lose 20 percent of the thermal value, but that isn’t the case,” he says. “You have a 95 percent-plus thermal efficiency, and this is due to the nonlinear relationship between the moisture value and the heating value when you dry off the water. Beginning with 50 percent moisture, 5,000 Btu per pound, you would expect that it would go to 9,000 Btu at 0 percent moisture, but you actually get 10,000 Btu. There’s a bonus from driving off moisture, and that’s why the thermal efficiency of this process is so high.”

Hiroshi Morihara, CEO of Oregon-based torrefaction technology developer HM3 Energy Inc., says what makes up for lost energy, depends on how one looks at it—whether the energy content is reduced or increased. “When you torrefy, 10 percent of the wood energy will vaporize,” he explains. That 10 percent of energy has 30 percent of the mass of the wood, but the heat is used to dry the incoming feedstock that is normally 40 to 50 percent moisture, so that helps with the cost of the process. Though you lose 30 percent of the mass and 10 percent of the energy, the product we produce is about 20 percent more energy intense than regular wood pellets, and compared to Western coal, the heating value is very similar, about 10,000 Btu per pound.”

He adds that coal typically has about 25 percent moisture, which must be vaporized and requires energy. “That’s not the case with our product, so we have 20 percent more net energy on a per pound basis.”

The second thing to consider in torrefaction economics is the power balance, or how much energy is needed to convert biomass into biocoal. “This is a function of your reactor technology,” van der Burg explains. “In our case, it’s only 2 to 2.5 percent of the total energy output. In other words, if 1 ton of product has 6 megawatts (MW) of thermal output capacity, we use only about 150 kilowatts to produce that, or even less. Only 2 to 2.5 percent is lost in power needed for the process.”

Advertisement

The third important factor is the life-cycle analysis, or the total amount of CO2 emitted in the whole production process, including the diesel used in the chipping process, trucks that bring the biomass to the plant, power consumed in the plant and fuel when shipped. “If you take that into account, it’s in the same league as wind and solar,” van der Burg says. “We meet the same sustainability standards, but it’s a way cheaper solution and it’s baseload. That’s why in the EU, more and more companies are starting to understand that in the next decade biomass will be the major contributor in building up sustainable energy, and not so much wind and solar.”

Outside of the mass and energy balances, power producers that utilize coal look at torrefied biomass for its attractive physical properties. These include power utilities, but also smaller institutions such as universities.

Coal’s Match … MIA?

The University of North Carolina has a goal of phasing out coal by 2020 and for the past couple of years has been searching for the cleanest, most cost-effective replacement. While wood pellet test burns have been conducted—results of which are still pending—UNC has also considered torrefied pellets. “The attractions are a high heat density—similar to that of coal—and the physical property of being hydrophobic so it can be shipped in open containers and stored outside,” says Ray DuBose, UNC director of energy services. “We’re looking for something that will flow through our existing systems.”

The energy plant at UNC was built in 1991, so it’s relatively young for a coal-fired plant. “There’s a lot of life left in the existing equipment, and torrefied biomass would allow us to avoid retrofit costs,” DuBose says.

The initial problem associated with torrefied biomass experimentation has been securing a supply. “We’ve bid it twice now, and we’re still reviewing bids from the second round, but it doesn’t appear that anyone [in the U.S.] is producing torrefied wood on a regular basis,” DuBose says. “We’ve been contacted by a number of companies, but we can’t find anyone who has a regular supply.”

The Tennessee Valley Authority—a government-owned power utility—has been conducting biomass/coal cofiring tests for the past several decades, and also has an interest in torrefied pellets. Unfortunately, it has run into the same problem as UNC. “There doesn’t seem to be enough material, or supply,” says Daryl Williams, head of renewable energy at TVA. “We needed a couple thousand tons for test burns at our plant in north Alabama, and we had a few vendors promising that, but when it came down to it they couldn’t provide it.”

While TVA has put biomass testing on hold until regulatory uncertainties become clear, Williams says he expects that torrefied wood pellets would require no real changes to existing materials handling and storage when comilled with coal. “We have received samples of a number of different products, done some lab-scale analysis and compared it to green biomass, and it does have advantages,” he says. “It looks and feels like coal as far as the pulverizer is concerned, and it’s hydrophobic, so we’ll have no problems with insects or rot when it’s stored. One concern we have is cost, but like any new technology, the more advanced it becomes the lower the cost. We’re really curious to see how it will handle and combust at a cofired plant.”

Morihara says the reason for the lack of production in the U.S. is that the technology only found its way to the country a few years ago. “It’s a very new concept here, and those working here in the U.S. are small companies. As a result, they’re having a difficult time getting enough money to build commercial plants, whereas in Europe, there are companies that are fairly large and have money to build commercial plants, so they’re already doing it.”

Advertisement

HM3 appears to be farther along in development than other U.S. torrefaction companies. It is building a demonstration facility in Troutdale, Ore., has plans for a commercial-scale plant in Prineville, Ore., and has obtained multiple federal grants to help.

Moving beyond coal, Morihara points out that torrefied biomass is capable of things that traditional wood pellets aren’t—including being pulverized and blown into the furnaces of coal-fired power plants.

Why Not Wood?

“If you have a 500-MW plant, to retrofit it to also use wood pellets would cost about $300 million,” Morihara says. “If you use torrefied biomass, there is no retrofitting cost. For its Btu content, torrefied biomass may cost 20 percent more, but it has 20 percent more energy so the cost is actually very similar.”

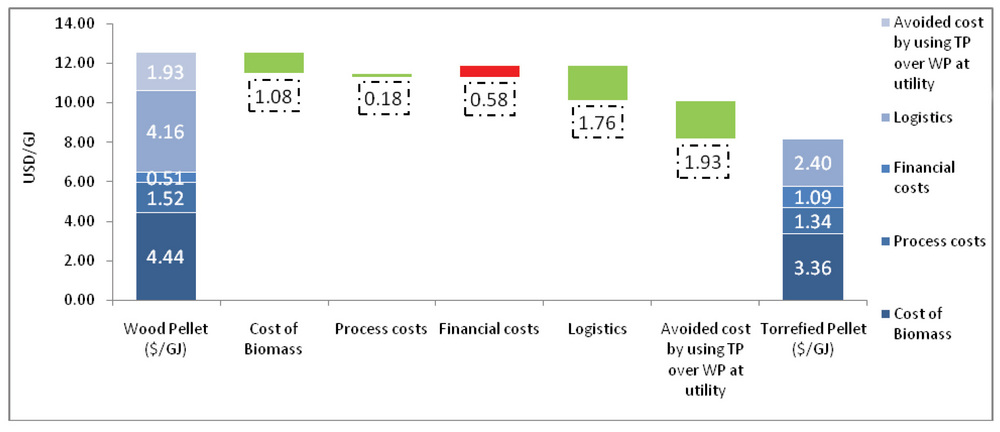

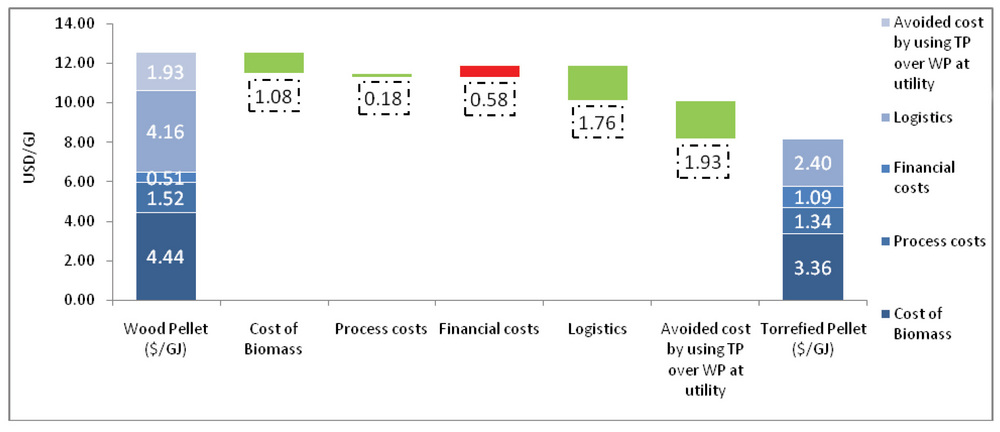

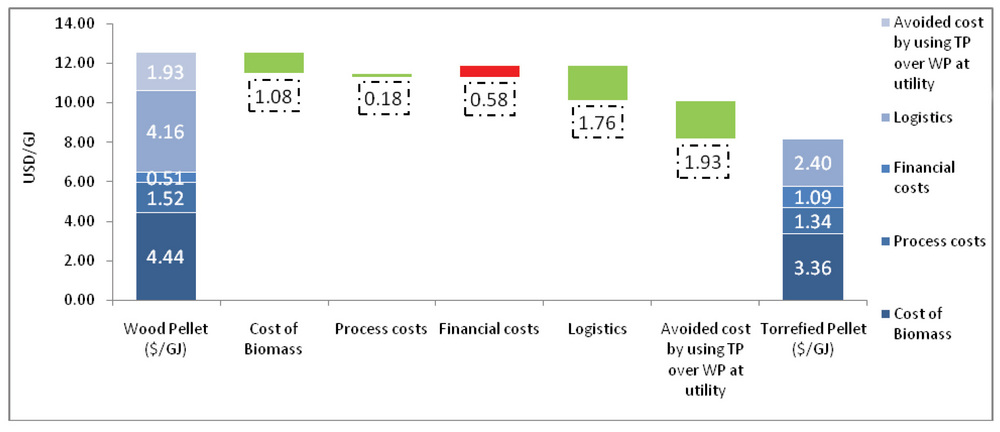

Van der Burg agrees there isn’t much difference between wood pellets and torrefied biomass. “Torrefied pellets come cheaper per metric ton, but you get paid for wood pellets and torrefied wood pellets per gigajoule, so considering the 25 to 30 percent higher energy density a torrefied wood pellet has over a regular wood pellet, you see the cost comparison.”

In a typical case in the Southeast U.S., considering the whole integrated value chain of the product, van der Burg says wood baskets/assets/fiber baskets that were previously considered idle because they were difficult to get at will become economical because of the enormous reduction in transport costs and substantial increase in energy density. “Transport costs will become much lower than they are for wood pellets, and incomparable for untreated biomass,” he says. “Torrefied wood pellets can be handled with coal infrastructure, in the same coal pile at the same coal mill. To get it there you can transport in open rail cars, to a port where there’s an outside terminal, no warehouses needed, and then load it into a ship and off to Europe, again no need for closed storage. All of this is needed for wood pellets.”

Topell and investor RWE Innogy participated in a study that aimed to calculate fuel costs for coal, conventional wood pellets and torrefied pellets at the gate of an ordinary coal plant in Western Europe. In comparing electricity production costs of cofiring (torrefied) pellets with solely coal combustion at the same coal plant, it was found that, in all cases, cofiring torrefied pellets is more cost-effective than cofiring conventional wood pellets.

The majority of that cost advantage comes from avoided additional capital costs. Regarding electricity production costs, coal still has a major cost advantage over torrefied pellets, the study finds, but differences can be bridged, and it is likely torrefied pellets will start to compete with coal eventually.

“Utilities like RWE are looking at black pellets to replace any wood pellet they can, in the near future,” van der Burg says. “There isn’t serious production of torrefied wood pellets right now, but it’s going to happen. Wood pellets are the best solution at this moment, but there are enormous efficiency improvements to be made in the next few years.”

More people are becoming aware of the correct economics of torrefaction and what the improvements are, van der Burg adds. “They are a lot bigger than people originally thought.”

Author: Anna Austin

Associate Editor, Biomass Power & Thermal

(701) 738-4968

aaustin@bbiinternational.com

Upcoming Events