Groups call on EPA to open RFS to biomass power during hearing

July 31, 2019

BY Erin Voegele

The U.S. EPA held a hearing July 31 in Ypsilanti, Michigan, to gather public input on its proposed rule to set 2020 renewable volume obligations (RVOs) and the 2021 RVO for biomass-based diesel under the Renewable Fuel Standard. Representatives from a wide range of biofuel groups testified at the event.

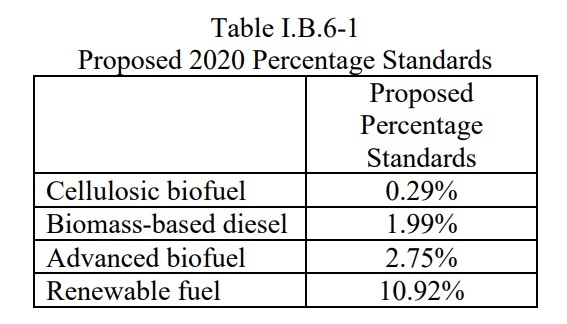

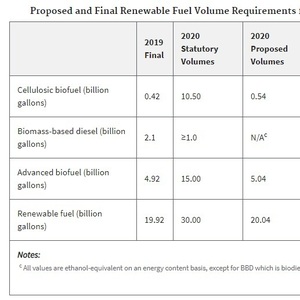

The EPA released the rulemaking earlier this month. The rule proposes to require 20.04 billion gallons of renewable fuels to be blended with the U.S. fuel supply next year, up from 19.92 billion gallons in 2019. The proposed RVO includes 5.04 billion gallons of advanced biofuels, 2.43 billion gallons of biomass-based diesel, and 540 million gallons of cellulosic fuel. The 2020 RVO for biomass-based diesel was finalized in a separate rulemaking last year. The rulemaking also proposes to set the 2021 RVO for biomass-based diesel at 2.43 billion gallons, level with the 2020 RVO.

When compared to the 2019 RVOs, the proposal would increase the RVO for cellulosic biofuel by 120 million gallons. Due the nested nature of the RFS RVOs, the implied RVOs for advanced biofuel and renewable fuel would remain at the 2019 level.

Two representatives of the RFS Power Coalition offered testimony at the event, including Tom Vine, board member of the Biomass Power Association, and Maureen Walsh, director of policy at the American Biogas Council. Both called on the EPA to process applications that will allow biogas, biomass and waste-to-energy electricity producers participate in the RFS, as intended by congress when the bill establishing the current RFS became law nearly 12 years ago.

Vine serves as plant manager of Viking Energy of McBain, a 17 MW biomass plant located in McBain, Michigan, and owned by Engie North America. “It has been nearly 12 years since Congress authorized electricity to be part of the RFS; 9 years since this Agency formally included electricity—along with renewable natural gas—into the final RFS rule; 5 years since electricity from biogas became an authorized pathway; and 2 years since the former Assistant Administrator, Mr. Wehrum, promised us that the delay was a function of resources and that EPA would make it a priority,” Vine said. And yet here we sit, with the agency refusing to process pending registrations for an approved pathway; and refusing to complete pathway processing for woody biomass. Not surprisingly and for a fifth year in a row, the Agency put out an annual RVO that makes not a mention of electricity. Not a word.”

“To be clear, the Congressional mandate to include electricity is unequivocal,” Vine continued. “Provided electricity is derived from renewable biomass pursuant to an approved pathway, it must be counted in the RVO. That was plainly recognized back in 2012, when the agency—as part of that RVO—used data from the U.S. Energy Information Administration asserting that more than 300 million RINs could come from electricity but would not be recognized without an approved pathway. That hurdle was overcome, we thought, in 2014 when biogas-to-power became a pathway. Companies immediately filed registrations and following that, woody biomass companies filed pathway screening tools and petitions. EPA’s response? It filed a notice in the federal register seeking comments on a rule that it already made final two years before and now, remarkably, two years have since passed without any action or proposed change.”

According to Vine, the 2020 RVO for D3 RINs should be set at a minimum of 662 million, which reflects only the approved biogas pathway. It does not reflect the biomass or waste-to-energy pathways that have yet to be approved, or the greatly increased efficiency of an electric drivetrain compared to a traditional combustion engine. "EPA is statutorily required to recognize this volume, and should immediately formally establish a pathway for other electricity sources derived from RFS-qualified feedstocks,” Vine said.

Walsh said that over the past few years, the RFS has been one of the strongest drivers helping the biogas industry develop new biogas systems. That impact, however, has weakened over the past 12 months, she said. “We need to strengthen the RVOs and limit small refinery waivers to ensure that the RFS operates the way Congress intended,” Walsh continued.

“The proposed RVOs, while recognizing the continued growth in the biogas industry, misses the mark in three ways: it does not come close to accounting for the full growth the biogas and RNG industry is experiencing today; it does not reallocate any of the 56 million gallons that have been eliminated by the flagrant and frequent issuance of hardship waivers; and once again, the RVO misses accounting for the gallons associated with the activation of the renewable electricity pathway that was approved in 2014 which should be calculated using data from the Energy Information Administration,” Walsh said.

According to Walsh, the ABC is calling on the EPA to increase the D3 RVO by at least 770 million gallons compared to the 540 million gallons proposed by the agency. That figure includes 60 million gallons for renewable natural gas (RNG) projects that are already being developed and are set to come online next year, 662 million gallons for the renewable electricity pathway, and 50 million gallons to counterbalance the issuance of small refinery exemptions (SREs).

More than two dozen representatives of the renewable natural gas (RNG) industry also testified at the hearing, including representatives of the Coalition for Renewable Natural Gas. “The RNG Coalition is the RNG industry,” said David Cox, co-founder and director of operations for the RNG Coalition.“We have built over 100 facilities that are turning waste into biofuel, and we are currently, today, moving our nation’s packages, our food and our freight.”

Comments from RNG stakeholders impressed the importance of EPA setting a 2020 cellulosic biofuel volume of at least 650 million gallons to incorporate all RNG produced and available next year, including new volumes from more than 30 production sites currently being built and millions of stranded gallons as a result of SREs granted by EPA.

Advertisement

“The 2020 [volume] must fully reflect the continued growth of the RNG industry as we have demonstrated, account for any carry over RINs and remove the uncertainty around the small refinery exemptions,” said Sheila Miller of Aria Energy. “Policy and regulatory certainty is vital to allow companies like Aria to attract the capital investment required to continue developing RNG projects.”

“The RFS has been a great tool to help American small businesses like ours participate in recovering vast amounts of energy from our nation’s waste, turning a societal liability into an energy asset,” said Luke Morrow, president of Morrow Renewables. “When [EPA] refuse[s] to account for our actual growth rates, grants SREs that destroy almost 10-percent of our market without reallocation, and fail to account for carry forward volumes in the current RVO…many will lose all they have invested, and hard-working Americans will lose high paying technical jobs.”

“Ameresco has invested approximately $80 million in our existing [sites], and our new facilities are requiring approximately $120 million in investment,” said Jeff Stander, senior project developer for Ameresco. “We are proud to promote the success and advances of RNG, and we intend to continue supporting this exciting sustainable technology.”

Several executives from the National Biodiesel Board also testified at the event, including Kent Engelbrecht, chairman of the NBB, Kurt Kovarik, vice president of federal affairs at NBB, Doug Whitehead, chief operating officer of the NBB, and David Cobb, director of federal affairs at the NBB. These NBB representatives stressed the EPA is sending a negative signal to the biodiesel industry by proposing flat volumes and then rolling them back through retroactive SREs.

"EPA has selected volumes for the biomass-based diesel market that are simply too low. Year after year, the U.S. biodiesel and renewable diesel industry continues to demonstrate sustainable growth. We can achieve still higher volumes over the coming years," said Engelbrecht, who is also the biodiesel trade manager at Archer Daniels Midland Co. "When EPA sends the wrong signals for this program, biodiesel producers see significant investments put at risk. Flat lined volumes block achievable growth and undermine the goals of the RFS."

Kovarik emphasized, "Without properly accounting for small refinery exemptions, EPA is failing its duty to ensure that the annual required volume obligations are met. What that means for the current rule is that the agency must find a way to reconcile small refinery exemptions. And there are multiple options."

Whitehead added, "As it finalizes the current rule, EPA has several options to ensure that the volumes it sets are reliable and will be met. First and foremost, the agency must only grant exemptions to small refineries that actually qualify. Second, EPA must account for the exemptions in the annual RVO formula. The agency does have authority to include volumes that it has exempted or plans to exempt."

Cobb also commented on EPA's proposed handling of the Americans for Clean Energy V. EPA case, remanded by the U.S. Court of Appeals for the DC Circuit in July 2017. "Two full years after receiving the remand from the Court, EPA is now proposing to ignore it. Worse, the agency's reason for ignoring the Court's directive—that there is a lack of demand for renewable fuel by the oil industry—is exactly the same reasoning the Court struck down. The proposed rule openly contradicts the DC Circuit Court's explicit direction to EPA," he said.

Testimony offered by representatives of the ethanol industry largely focused on the negative impact of SREs.

Scott Richman, chief economist of the Renewable Fuels Association, called on the agency to ensure its final 2020 RVOs prospectively account for expected SREs and properly addresses a 2017 court former to restore 500 million gallons of blending requirements illegally waived by the EPA in 2016.

“Unfortunately, the market has no faith that the proposed 2020 renewable volume obligations will result in biofuel blending volumes consistent with the RFS standards set by law, including the 15-billion-gallon conventional renewable fuel requirement,” Richman said. “It is a misnomer to call the numbers in the proposal ‘obligations’ as long as small refinery exemptions (SREs) continue to transform the RFS into a voluntary program for roughly one-third of the nation’s refineries.”

Saying that EPA’s proposed rule betrays President Trump’s commitment to uphold the RFS, Richman noted that EPA approved 54 SREs retroactively for compliance years 2016 and 2017, which caused ethanol consumption and the ethanol blend rate to fall in 2018 for the first time in 20 years. Not a single exemption request has been denied by EPA since 2015, he said, and 38 petitions for compliance year 2018 are still pending.

Advertisement

Making matters worse, Richman said, EPA’s proposal incomprehensibly ignores the D.C. Circuit Court’s 2017 order requiring the Agency to restore 500 million gallons it illegally waived from the 2016 RVO. “EPA’s claim that ‘there are very limited opportunities to use biofuels beyond the volumes we are proposing for 2020’ echoes the Agency’s reasoning in its 2016 rule that was specifically rejected by the court.”

“Congress gave EPA the direction and tools necessary to enforce the statutory RFS volumes,” Richman concluded. “That includes prospectively redistributing volumes from SREs to non-exempt parties. It also includes complying with a court order to restore illegally waived volumes from 2016. We urge EPA to do both in the final rule.”

Katie Fletcher, communications director of the American Coalition for Ethanol, also focused on the impact of SREs and the need for EPA to reallocate gallons associated with past SREs and the 2017 court ruling. She also addressed the economic hardship currently facing farmers and U.S. ethanol producers.

“The proposed 2020 RVO marks the second compliance year EPA is professing to follow statutory volumes on paper but, in reality, is allowing refiners to escape their lawful responsibility to blend renewable fuel with the petroleum products they make,” Fletcher said.

“The severity of demand destruction from EPA’s use of SREs is a topic of debate, but it is without question year-over-year domestic ethanol use declined in 2018 for the first time since 1998, falling from 14.49 billion gallons in 2017 to 14.38 billion gallons in 2018,” she continued. “The national ethanol blend rate retreated from 10.13 percent in 2017 to 10.07 percent in 2018. ACE members are convinced EPA refinery waivers contributed to these historic setbacks.

“We are grateful EPA finalized the rule extending the 1-psi Reid vapor pressure waiver for E15, but the net effect of this final rule without reallocating waived gallons means we are still “in the hole” from an RFS demand perspective” Fletcher continued.

“For EPA’s proposal to blatantly ignore the court order based on the ‘retroactive nature of an increase in the volume requirement’ and the ‘additional burden that such an increase would place on obligated parties’ undermines the integrity of the RFS and flies in the face of Congressional intent.

“EPA’s mismanagement of the RFS has placed an artificial lid on domestic ethanol demand causing dozens of ethanol plants to consider slowing production or shutting down,” Fletcher said.

Chris Bliley, vice president of regulatory affairs at Growth Energy, condemned the EPA for providing no avenue to offset SREs that consistently undercut federal blending goals, disrespecting the court’s decision on the 2016 RVO and failing to approve pathways for millions of gallons of current cellulosic biofuel production from kernel fiber technology.

“Once again, the proposal assumes that despite exempting at least 190 million gallons of biofuel every year since 2013, that there will be ZERO gallons exempted in 2020,” Bliley said. “If EPA is going to waive billions of gallons, it must properly account for those gallons in the RVO calculation, so that demand-loss is not borne by biofuel producers and America’s farmers.”

Bliley also blasted the EPA’s choice to flout the 2017 court ruling requiring the agency to revisit 500 million gallons of biofuel that were inappropriately waived. “Ethanol plants have closed, employees have been laid off, trade has been cut, all on top of farmers’ crops being devastated—and EPA claims it is too difficult for refiners to blend 500 million gallons of biofuel as the law requires,” he said. “What kind of signal does that send to farmers? What message does that send to companies seeking to invest in American biofuels? It speaks volumes.”

Written comments on the proposed rule can filed online through Aug. 30 on www.Regulations.gov under Docket ID No. EPA-HQ-OAR-2019-0136.

Upcoming Events