Growing Supply of Low-fat DDGS Impacts Market Dynamics

PHOTO: University of Minnesota

July 10, 2012

BY John Harangody

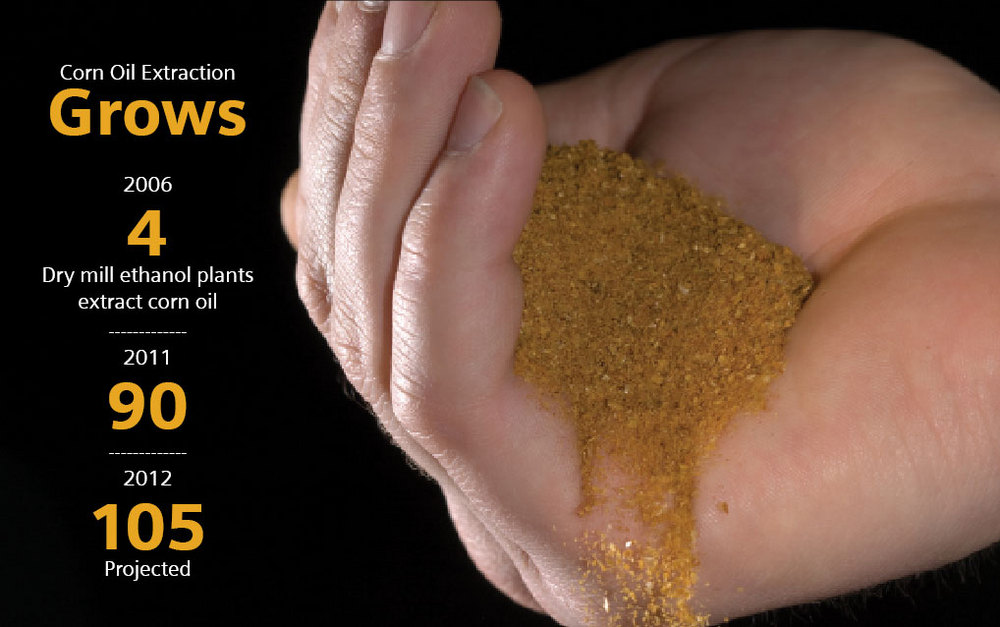

In 2006, there were four dry mill ethanol plants that extracted corn oil from distillers grain. Today, approximately 90 of 200 corn dry mills have oil extraction capabilities, and that number is expected to rise to 105 by this summer. Low-oil distillers dried grains with solubles (DDGS) is approaching 60 percent of the market. Initially, corn oil flowed into the animal feed market. Today, most demand comes from biodiesel due to corn oil prices being typically lower than soy. For ethanol producers, the biodiesel market generally returns a higher price than the feed market.

There are two basic options for corn oil extraction: in the front-end before fermentation or as a back-end process where the oil is removed after distillation. The front-end process extracts 50 percent more product and a cleaner corn oil, however, the cost is triple that of the back-end process. Hence, recent investments favor back-end processes. Corn oil extraction equipment is relatively low-cost. Most plants anticipate a payback of less than two years. Depending on the technology employed, extraction rates can vary from approximately 0.5 to 2 pounds of corn oil per bushel of corn.

The variability of oil content in distillers grains adds an additional level of complexity to an unresolved issue. Jay O’Neil, senior agricultural economist with the International Grains Program at Kansas State University explains that “high-fat DDGS have been part of the feed ration for the past seven to 10 years. Nutritionists have had the opportunity to conduct a number of feed trials and subsequently have developed a good understanding of how adding DDGS to an animal’s diet impacts performance. However, there is only anecdotal information related to how low-fat DDGS in a ration impacts performance. We’re going through a learning curve where nutritionists don’t know for certain and are having to make calculated guesses.”

As we enter this new era of distillers grains production, end users of DDGS will have to redefine their buying specifications to fit each species and company needs. Product variability will increase and make ration formulations more challenging. Relative value, defined as a product’s nutrient composition as it compares to another product for conversion of energy in animals, will need to be continually assessed.

Advertisement

Previously, the most widely accepted standard protein/fat composition for DDGS was 28/8 for a combined 36 percent. This year, the domestic market has defined this composition as 27 percent protein, 7 percent fat. The combined 34 percent benchmark represents a majority of the DDGS volume today and is likely to rise as more oil is “spinned.”

Bart Vance, Atlas physical grains managing director confirms that. “It appears 34 percent will be where the standard will settle for the coming crop year,” he said. “The market can adapt for these variances, but it is imperative that defined specifications be outlined within contracts. Understanding the ‘flavor’ of a particular production of DDG will be critical in determining its value for various livestock sectors. It is highly probable we will see a range evolve as the market changes.”

If 34 percent pro/fat becomes the benchmark, it’s widely thought that DDGS’ relative value to corn will drop. That logic may be flawed, particularly when one considers that the market has been saturated in recent years. In hindsight, DDGS may have been a bargain for many end users, which is one reason there was an initial backlash as specifications dropped and prices for the most part did not. The developing export market, competition for corn and limited flaking capacity may assist in holding DDGS to a higher, although slightly discounted, value relative to corn.

Demand Curve Factors

When defining the demand curve for low-fat DDGS, geographic location and animal species play a significant role. In 2011, U.S. ethanol producers exported 7.65 million metric tons (mmt) of DDGS, about 23 percent of total production. Of that number, 3.39 mmt went to Asia, or 44 percent of total exports. In economically less-evolved southeast Asia countries, there is limited access to alternative sources of fat and, therefore, a high dependence on high-fat DDGS. A reduced-fat DDG product may prove to be less desirable. In China, which accounted for 21 percent of total exports, the enormity of their overall feedstock needs may take priority over a desire for high-fat DDGS. In Mexico, the largest importer of DDGS at 1.78 mmt, the market has access to alternative sources of fat, and low-fat DDGS may not be an issue. From a domestic perspective, livestock feeders have numerous alternative sources. The question only remains as to the fair discount for low-fat DDGS relative to the high-fat product.

The second looming issue in defining the demand curve for low-fat DDGS revolves around the species of animal. Although animal nutritionists have yet to conduct conclusive empirical tests to determine the performance impact of low-fat DDGS, they are not without opinion. For example, many nutritionists suspect that, in general, ruminants will handle a low-fat ration better than nonruminants. In the case of dairy producers, O’Neil says, “They’ll like the new DDGS because they already feed almost too much fat, and a higher protein, lower fat DDGS ration will work well. As for fat cattle, questions exist whether they’ll like the change as much, and for poultry, it is doubtful low-fat DDGS will work well for broilers. On the other hand, layers may find it to their liking.”

Unfavorable economic conditions, particularly in the dairy sector, may challenge DDGS inclusion rates, if values trend too high relative to corn and other products. Vance believes that “as low-fat DDG production expands, the dairy industry will be a prime target market. We have seen as wide as $20 per ton, and as narrow as $5 per ton, spread on DDGS within the same market, depending on the type of consuming animal unit. This will elevate the 36 percent pro/fat product to premium status where it once was the standard.”

Advertisement

As the world market share of DDGS increases, suppliers of competing products may revisit old customers. Bank lenders’ growing involvement in feed and cash management decisions will challenge nutritionists to evaluate all feed options in their quest for least-cost formulation. As other byproducts need homes, they will target the dairies once again and be formidable competitors.

There may also be a mixed reception for low-fat DDGS within the hog industry. The lower fat content may not work well in the diets of growing pigs. Recent research, however, conducted by Purdue University’s Department of Animal Sciences indicates that the abundance of linoleic acid in high-fat DDGS is substantial and a contributor to “soft belly.”

As production of low-fat DDGS expands and the feed industry acquires empirical evidence of its performance impact on specific animal species, the economics of production may look distinctly different than today. It will be imperative to find new sources of demand and to confirm attractive nutritional values to insure its long term success.

Author: John Harangody,

Chief Operating Officer, Atlas Commodity Markets

(713) 574-5005

John.Harangody@atlasmarkets.com

The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Ethanol Producer Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

Upcoming Events