New Financing Option for Proposed Energy Projects

PHOTO: TIM PORTZ, BBI IN TERNATIONAL

November 5, 2017

BY Lynn Knox

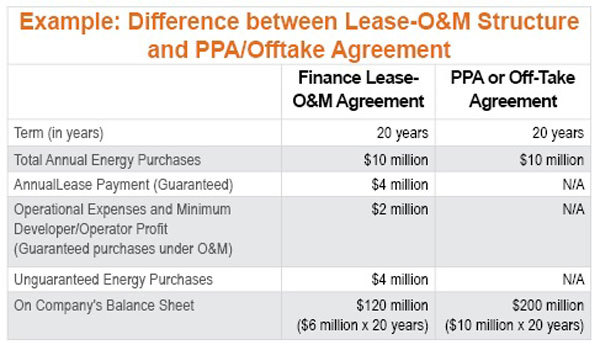

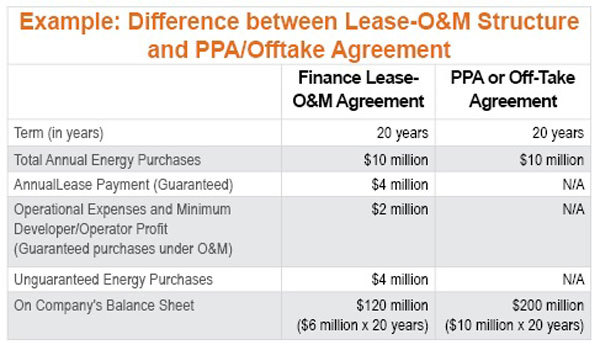

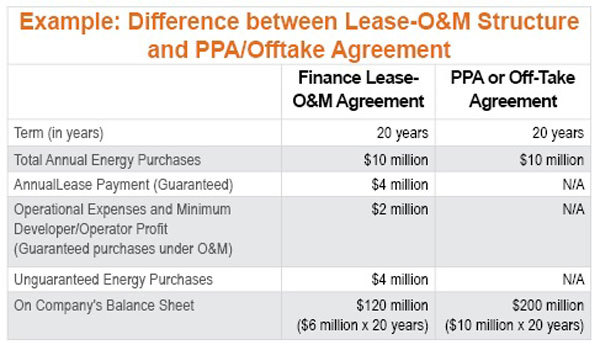

Power Purchase Agreements (PPAs) and offtake agreements have been the commonplace agreements for to-be-built energy projects. In one particular instance, an energy user or offtaker kept the PPA and offtake agreements off its balance sheet, allowing the company to keep its ratios intact on company financial statements. This helped maintain its bond ratings and bonding capacity, but there was a downside, as the company expensed out 100 percent of its energy and product purchases, which negatively affected its bottom line on its statement of income.

After years of accounting deception, Enron filed for bankruptcy in late 2001, which at the time was the largest corporate bankruptcy in our country’s history. After Enron’s bankruptcy, the Financial Accounting Standards Board soon began its work on changing the required accounting procedures for all contracts, including PPAs, offtake agreements and leases. FASB adopted its Topic 842 on Feb. 25, 2016, and it shall be effective on Dec. 15, 2018, regardless of when a PPA or offtake agreement was entered into, wherein all PPAs and offtakes are to be reported in accordance with FASB Topic 842.

FASB Topic 842 requires PPAs and offtake agreements that are entered into prior to the construction of an energy project, to be reported on a company’s balance sheet as both a right-of-use asset and an offsetting liability, both calculated at the present value of all purchases. This will result in a company’s ratios being negatively affected, such as return on assets, as the company’s net income does not change, but its assets increase by the right-of-use asset created by the PPA or offtake agreement. Several other ratios will be negatively affected, including those ratios related to liabilities, as the company’s liabilities will increase significantly.

For years, off-balance sheet PPAs and offtake agreements were preferred by companies over capital leases with $1 buy-out, which were reported on-balance sheet. With the adoption of FASB Topic 842, the game has changed, wherein capital leases (now referred as finance leases by FASB) are far superior, as PPAs and off-take agreements are now considered operating leases, a liability on the company’s balance sheet.

There is a national low-cost finance lease provider that provides developer-operators and energy users or offtakers with 100 percent of project costs in exchange for an initial annual lease payment, generally calculated at 3 to 3.5 percent. After the 2.25 percent annual lease payment escalations, the implicit rate (the interest rate to amortize the principal to zero by the end of the lease term) is generally 4.3 to 4.75 percent, far less than the costs of financing and raising equity under a PPA and offtake agreement.

There are three tiers of energy purchases under the lease-O&M structure—they are as follows:

Tier 1: The developer/operator provides the company with the first amounts of energy/product up to the required lease payments at no charge to the company.

Tier 2: The company, under an O&M agreement with the developer/operator, guarantees energy/product purchases in the amount of the project’s operational expenses and the developer/operator’s minimum profit.

Tier 3: The developer-operator has the right to sell the balance of energy/product produced to other purchasers at a specific price stated in the O&M agreement, wherein the company can also purchase the balance of energy at the same price, if unsold to other energy/product users.

The developer/operator has complete control over the design, implementation and operations of the project. The result of this lease-O&M structure is that the unguaranteed energy purchases should be considered off-balance sheet for the company, subject to approval of the company’s auditors.

Under this low-cost finance lease, the two main benefits for energy projects with a useful life greater than the finance lease term are as follows:

• As opposed to a PPA or offtake agreement, wherein the company expenses out the entire purchase amount, under the finance lease, only a portion of the lease payments are expensed out—only the interest paid, plus the amortization of the right-of-use asset, which is over the useful life, which can be over 50 years for some projects. Thus, the company expenses out less under the lease-O&M structure, resulting in a significant improvement to the company’s bottom line.

• As opposed to a PPA or offtake agreement, wherein the company has no residual asset at the end of the term, the finance lease can substantially improve the company’s balance sheet. When the company buys out the finance lease at the end of the lease term for $1, it receives a new asset, without liability, at the end of the lease term, improving the company’s tangible net worth.

• The company’s expense deduction is less under the finance lease than a PPA or offtake agreement, thus the company’s bottom line on its statement of income improves dramatically.

Other benefits under this lease-O&M structure, even for those energy projects with the same useful life as the finance lease term, are as follows:

4) Finance lease provides 100 percent of project costs.

5) Lower financing costs, as opposed to traditional financing and equity, which results in the company paying less for energy or product.

6) The company guarantees less in purchases—only the amount of the lease payments, the project’s operational expenses and the developer/operator’s minimum profit.

7) After the company buys out the finance lease for $1 at the end of the lease term, the company’s payments for energy/product significantly reduces under the option periods in the O&M agreement.

8) Potential for the company to enjoy partially off-balance sheet treatment.

Once it is understood that there is a low-cost finance lease option with cutting-edge structure, the new reality will be that PPAs and off-take agreements for to-be-built projects may become outdated.

Author: Lynn Knox

President, Commercial Property Lenders Inc.

770-213-4141

jfm@CPLLoans.net

Advertisement

Advertisement

Upcoming Events