On Multiple Tracks

July 1, 2006

BY Ron Kotrba

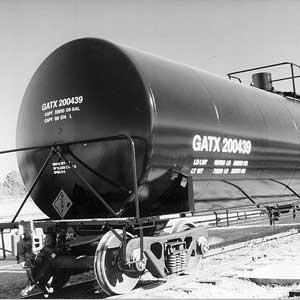

GATX Corp. has been an active, reliable vendor to the U.S. ethanol industry for years, known best for its role as a railcar lessor and maintenance provider. For an established company with century-old American roots, this committed player continues to reinvent itself and strengthen its ties with ethanol. The company's sound business principles dictate as much.

Full-service railcar leasing, specialized railcars and minimum-downtime railcar maintenance are still the things that make this company what it is today, but a recent finance deal with a significant ethanol producer—the first of what GATX hopes to be many more—could help shape the future of its relationship with ethanol.

Core Competencies

GATX is an international transportation giant that offers leasing services for the rail, air and water modes of hauling freight. In North America, it is one of the largest railcar lessors in the business.

With nearly 168,000 railcars and 874 locomotives in a variety of operations worldwide, the company has a significant portfolio of rail assets in its fleet leased specifically to ethanol producers. According to Rob Zmudka, vice president of the GATX ethanol service division, his company leases and services one out of every four railcars used in the ethanol business.

Zmudka shares with EPM what he believes to be one of the rail lessor's competitive advantages. "Every railcar company is adding cars," he says. "What our company provides is a full-service lease. People don't want to buy railcars; there's a lot of regulations surrounding their operation. As cars get older, there can be a lot of maintenance, too."

Zmudka has a good point. Ethanol producers make ethanol, and transportation companies like GATX specialize in rail assets. For an ethanol producer to consume the added responsibilities and capital costs associated with owning railcars is often impractical—not to mention the risk it poses in distracting an ethanol plant's management team from its core competency of maximizing production efficiencies while making a renewable fuel of the highest quality.

A novel rail asset that's been practical at decreasing the time and labor spent at distribution centers loading or unloading crude and diesel fuel is GATX's TankTrain, a string of 18 tanker cars interconnected by a common line. This allows the group of 18 cars to be either loaded or unloaded in one shot, rather than 18 individual hookups and disconnections. "Some call it a pipeline on wheels," Zmudka says. Since ethanol cannot be shipped in a majority of the current pipelines, GATX invented its own. TankTrains can also be shipped in unit trains.

This simple yet clever idea—and the best ideas always seem simple once they've been consciously aroused—could offer real time savings, and with the nation's ethanol production capacity soon to reach blinding new highs, a product like this that could increase overall rail efficiency might be worth its weight in gold soon enough. Zmudka says GATX is gauging the ethanol industry to see whether—or more likely when—this time-, labor- and, in the end, money-savings asset might be of interest to progressive ethanol producers.

Maintenance Around the Customers' Schedules

Like any prudent business, GATX is looking ahead for future opportunities. "As a company, we asked ourselves, ‘How can we improve on our business with the ethanol industry?'" Zmudka says. "We had to make sure we're prepared to capture future opportunities that'll further our relationship with our ethanol customers and the ethanol industry as a whole, so we moved to the next level." Zmudka refers to the company's acute focus on the maintenance side of the rail leasing business. "There aren't a lot of companies leasing railcars that have a major, wide-service network like we do," he says.

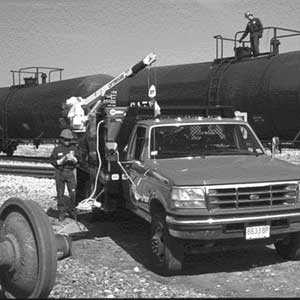

To home-shop a railcar, or put that car in a major repair facility, means a loss of productivity for that car—a monetary loss. The longer it's "in the shop," so to speak, the higher the loss. In its array of maintenance services, GATX offers its customers the efficiency of mobile repair units (MRU).

These trucks are loaded to the hilt with whatever parts and tools of the trade that will be needed—including the skilled technicians to do the work—whenever an MRU gets dispatched on-site to one of GATX's ethanol customers. "We have stations sprinkled throughout the country where we house these MRUs," Zmudka says. Sioux City, Iowa, and Kansas City, Mo., accommodate two of the several MRU locales from which it would only take a day to get service on-site, anywhere throughout the Midwest.

With many new producers onboard, rail maintenance might not be the first thing on people's minds in this industry; but as cars begin to hit seven, eight or nine years old, Zmudka says maintenance requirements begin popping up. A good bet is to hedge any losses in productivity that may arise in the future through a comprehensive railcar service agreement like the ones GATX offers.

A Financial First

According to Andy Vestergaard, the company's vice president of specialty finance, GATX has upped its ante in the ethanol industry. The company with its transportation-only reputation recently finalized significant financing for an established ethanol company's mid-sized facility. GATX collaborated with a well-known financial institution to make it happen. "We've done this in other industries, but it's the first ethanol plant for which we've done full financing," Vestergaard tells EPM.

Ethanol is red hot right now, and everyone wants a piece—or a bigger piece—of the action. GATX is no different. It's found success thus far in the industry through its rail asset leasings, so with previous experience and a powerful financial institution's backing, it decided to enter the project finance arena. "Usually project finance is a non-recourse debt," Vestergaard says. "In what we're offering, we assume all the risk." It's quite possible that, through this type of financial arrangement, a candidate project could skip the equity drive process altogether."

It took a lot of corporate consideration before, during, and after this initial breakthrough into ethanol project finance, for GATX to come to the collective realization that, yes indeed, the company does intend to pursue more financing opportunities within the ethanol industry.

Ron Kotrba is an Ethanol Producer Magazine staff writer. Reach him at rkotrba@bbibiofuels.com or (701) 746-8385.

Full-service railcar leasing, specialized railcars and minimum-downtime railcar maintenance are still the things that make this company what it is today, but a recent finance deal with a significant ethanol producer—the first of what GATX hopes to be many more—could help shape the future of its relationship with ethanol.

Core Competencies

GATX is an international transportation giant that offers leasing services for the rail, air and water modes of hauling freight. In North America, it is one of the largest railcar lessors in the business.

With nearly 168,000 railcars and 874 locomotives in a variety of operations worldwide, the company has a significant portfolio of rail assets in its fleet leased specifically to ethanol producers. According to Rob Zmudka, vice president of the GATX ethanol service division, his company leases and services one out of every four railcars used in the ethanol business.

Zmudka shares with EPM what he believes to be one of the rail lessor's competitive advantages. "Every railcar company is adding cars," he says. "What our company provides is a full-service lease. People don't want to buy railcars; there's a lot of regulations surrounding their operation. As cars get older, there can be a lot of maintenance, too."

Zmudka has a good point. Ethanol producers make ethanol, and transportation companies like GATX specialize in rail assets. For an ethanol producer to consume the added responsibilities and capital costs associated with owning railcars is often impractical—not to mention the risk it poses in distracting an ethanol plant's management team from its core competency of maximizing production efficiencies while making a renewable fuel of the highest quality.

A novel rail asset that's been practical at decreasing the time and labor spent at distribution centers loading or unloading crude and diesel fuel is GATX's TankTrain, a string of 18 tanker cars interconnected by a common line. This allows the group of 18 cars to be either loaded or unloaded in one shot, rather than 18 individual hookups and disconnections. "Some call it a pipeline on wheels," Zmudka says. Since ethanol cannot be shipped in a majority of the current pipelines, GATX invented its own. TankTrains can also be shipped in unit trains.

This simple yet clever idea—and the best ideas always seem simple once they've been consciously aroused—could offer real time savings, and with the nation's ethanol production capacity soon to reach blinding new highs, a product like this that could increase overall rail efficiency might be worth its weight in gold soon enough. Zmudka says GATX is gauging the ethanol industry to see whether—or more likely when—this time-, labor- and, in the end, money-savings asset might be of interest to progressive ethanol producers.

Maintenance Around the Customers' Schedules

Like any prudent business, GATX is looking ahead for future opportunities. "As a company, we asked ourselves, ‘How can we improve on our business with the ethanol industry?'" Zmudka says. "We had to make sure we're prepared to capture future opportunities that'll further our relationship with our ethanol customers and the ethanol industry as a whole, so we moved to the next level." Zmudka refers to the company's acute focus on the maintenance side of the rail leasing business. "There aren't a lot of companies leasing railcars that have a major, wide-service network like we do," he says.

To home-shop a railcar, or put that car in a major repair facility, means a loss of productivity for that car—a monetary loss. The longer it's "in the shop," so to speak, the higher the loss. In its array of maintenance services, GATX offers its customers the efficiency of mobile repair units (MRU).

These trucks are loaded to the hilt with whatever parts and tools of the trade that will be needed—including the skilled technicians to do the work—whenever an MRU gets dispatched on-site to one of GATX's ethanol customers. "We have stations sprinkled throughout the country where we house these MRUs," Zmudka says. Sioux City, Iowa, and Kansas City, Mo., accommodate two of the several MRU locales from which it would only take a day to get service on-site, anywhere throughout the Midwest.

With many new producers onboard, rail maintenance might not be the first thing on people's minds in this industry; but as cars begin to hit seven, eight or nine years old, Zmudka says maintenance requirements begin popping up. A good bet is to hedge any losses in productivity that may arise in the future through a comprehensive railcar service agreement like the ones GATX offers.

A Financial First

According to Andy Vestergaard, the company's vice president of specialty finance, GATX has upped its ante in the ethanol industry. The company with its transportation-only reputation recently finalized significant financing for an established ethanol company's mid-sized facility. GATX collaborated with a well-known financial institution to make it happen. "We've done this in other industries, but it's the first ethanol plant for which we've done full financing," Vestergaard tells EPM.

Ethanol is red hot right now, and everyone wants a piece—or a bigger piece—of the action. GATX is no different. It's found success thus far in the industry through its rail asset leasings, so with previous experience and a powerful financial institution's backing, it decided to enter the project finance arena. "Usually project finance is a non-recourse debt," Vestergaard says. "In what we're offering, we assume all the risk." It's quite possible that, through this type of financial arrangement, a candidate project could skip the equity drive process altogether."

It took a lot of corporate consideration before, during, and after this initial breakthrough into ethanol project finance, for GATX to come to the collective realization that, yes indeed, the company does intend to pursue more financing opportunities within the ethanol industry.

Ron Kotrba is an Ethanol Producer Magazine staff writer. Reach him at rkotrba@bbibiofuels.com or (701) 746-8385.

Advertisement

Advertisement

Advertisement

Advertisement

Upcoming Events