Policy reform may hinder German biogas development

European Biogas Association

July 17, 2014

BY Anna Simet

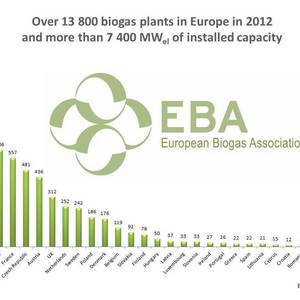

When Germany passed its Renewable Energy Resources Act (EEG) in 2000, it set the stage for the huge success of the country’s biogas industry. Today there are close to 8,000 installations in the country, but that number may be slow to rise any further on account of recent changes to the key policy mechanism.

The EEG established a distributed energy generation model that fixes a purchase price for each type of renewable energy generation, and guarantees a connection to the electrical grid. It has incentivized small- to medium-size systems, paying producers on the kilowatt hours delivered to the grid.

Updated once every three years, the EEG incentives shift and are revised, calling for the industry to adjust as needed. The most recent update to the EEG, passed in late June by the German Parliament, has biogas industry leaders and stakeholders reeling.

While the final version is still not published, the European Biogas Association is describing the amended EEG as “a U-turn in German biogas policies” that “will nearly stop the already weakening growth in Germany, losing its chance to reduce dependence on imported natural gas.”

One of the most significant changes in the EEG is that biogas production in Germany will be capped to 100 MW annually beginning on August 1, and feed-in tariffs will be gradually withdrawn from all new plants above 100 kW, according to the EBA.

Advertisement

Other industry stakeholders say the lowered tariffs would make it uneconomical for projects to utilize nonmanure substrates, including energy crops.

The revised EEG is already impacting planned projects. On July 17, RWE Innogy GmbH announced that it has decided not to build a planned 4.2-MW biogas plant in Germany’s Velen municipality, as the facility will end up being uneconomical once the new EEG takes effect.

RWE had agreed with Naturdunger Munsterland GmbH & Co KG to jointly construct and operate the plant, but said that the two parties have now decided to drop their plans due to certain amendments in the EEG. RWE added that it is putting an end to its partnership with WLV in the biogas sector.

“The revised act, approved by the federal council on July 11, envisages a major reduction of remuneration rates for biogas as well as the removal of the input material remuneration categories and the gas processing bonus without replacement,” RWE stated in a release announcing its decision.

Advertisement

Jan Stambasky, president of the European Biogas Association, said all of Europe looks carefully at the German EEG that served as a pattern followed by numerous countries, and the proposed change will give the governments a very bad and confusing signal.

According to the association, Germany’s biogas industry supports over 40, 000 jobs and represents investment of at least several billion euros.

In other statements the EBA released regarding the new act, it said Germany achieved a remarkable level of biogas industry progress prior to its approval, as today’s [biogas] production is equivalent to 20 percent of German gas imports from Russia. However, it will miss its chance to further reduce that number. “By certain technological development, biogas has potential to cover even half of these imports,” Stambasky said. “This all may be wasted now.”

The new EEG comes into effect on August 1.

Upcoming Events