Prices to stay below historic average

December 27, 2010

BY Casey Whelan

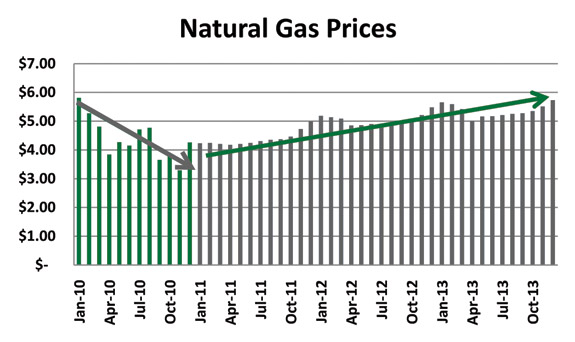

Nov. 29-The natural gas market was, as usual, fairly volatile in the year just closed. We started with the highest monthly closing price for the entire year-$5.81/MMBtu. Generally, prices declined throughout the year with a market low of $3.29/MMBtu in November. As the chart shows, there was a strong downward trendline during most of the year. Prices should rebound starting in 2011. Note the positive trendline starting in 2011 and extending three years. The rebound never gets back to January 2010 levels and instead tops out at $5.73/MMBtu in December 2013.

Actual and projected prices reflect the extreme bearish factors dominating the natural gas market. Drilling levels and production numbers continue to be strong even though prices are weak. Industrial demand is far from pre-recession levels with little improvement expected soon. Finally, funding seems to be readily available for production activities with low interest rates and foreign money interest.

Current market prices for 2011-'13 are attractive by historic standards. The projected average for 2011-'13 is $4.92/MMBtu, while the actual average in 2006-'09 was $6.77/MMBtu. It is tempting to layer-in hedges since gas prices now can be locked-in at levels lower than historic prices. Could prices go lower? Our view is they reflect weak fundamentals and when, and if, any of those fundamental factors change, prices will likely rebound. If you are risk averse, defensive hedges may be appropriate. On the other hand, if you are a risk taker, monitor fundamentals and move into the market when and if drilling/production turns negative and/or demand begins to rebound.

Advertisement

Advertisement

Upcoming Events