The Challenge of Forecasting Pellet Demand

March 24, 2014

BY Sue Retka Schill

A winter like this one promises to give the pellet industry a big boost with more homeowners turning to economical pellet heat in the face of soaring propane prices and continued high heating oil costs. Pellet producers have been running hard this winter to keep up with demand and several Northeast producers report they sold out on their production by midwinter. Producers in the West who have seen excess supply and production relative to demand in recent years welcomed the opportunity to bolster supplies in the East.

Will this winter’s boost be the start of a long-term trend? A look at the recent past raises the question whether the increased demand can be sustained and turned into something more like Europeans’ embrace of pellet heat.

One place pellet producers look for patterns in the market to project future demand is the annual statistics report from the Hearth, Patio and Barbeque Association. Don Johnson, director of market research for HPBA, tracks the number of pellet stoves shipped to dealers in an annual survey of heating appliance manufacturers that also includes fireplaces, cordwood and gas stove shipments. He estimates the survey covers about 90 percent of the industry. While the results are only reported in the aggregate, given the relatively small number of manufacturers, they do provide a glimpse of the market dynamics behind the adoption of the appliances that drive fuel pellet sales.

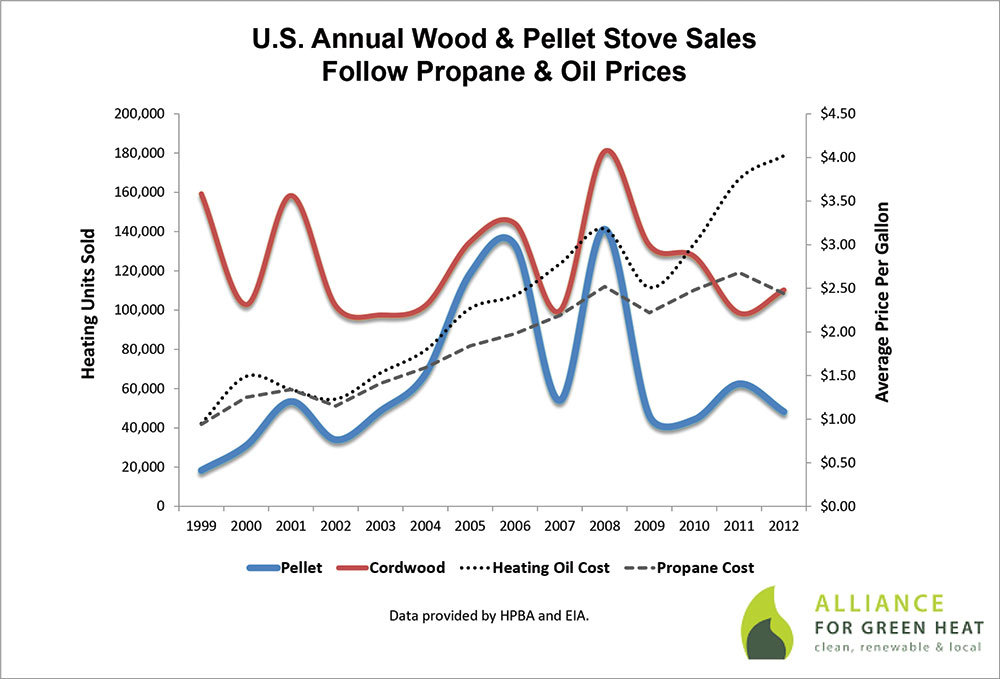

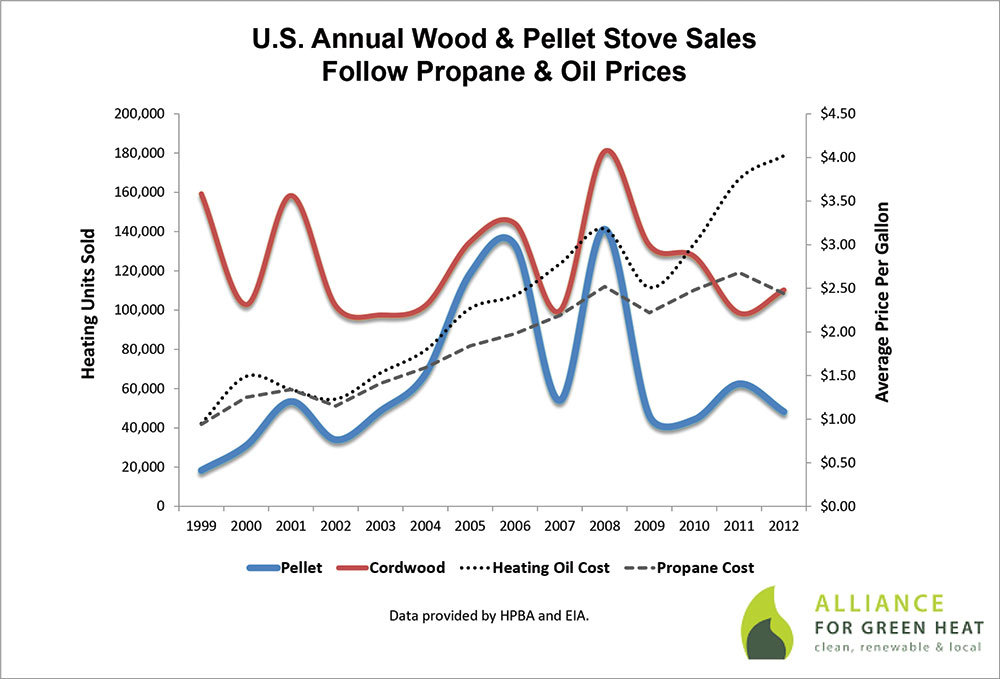

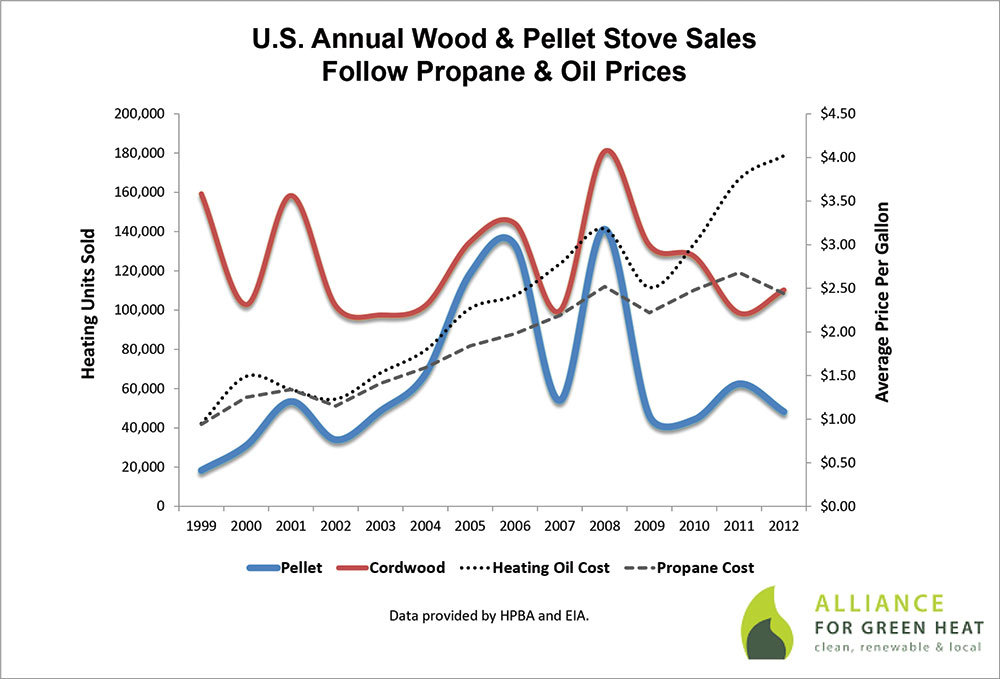

The pellet stove segment is the most volatile portion of the hearth industry, Johnson says. “When consumers view the price of heating their homes as expensive or unstable, pellet stove sales jump up, higher than wood stoves.” But, he adds, when there’s no crisis bringing instability to oil market and as consumers get used to higher prices, pellet stove movement is affected. “These are the first hearth product sales that decline. And when price becomes higher, these are the first to go up. They go down lower and go up higher.”

Pellet stove sales were growing nicely a decade ago, from just under 34,000 in 2002, growing rapidly each year to 119,000 in 2005 and 133,000 the year after. A big dip in 2007 to 54,000 appliances was followed in 2008 by the record-holding peak of 141,000 pellet appliances shipped from manufacturers. That peak was partly due to the energy efficiency tax credits introduced as part of the stimulus package that offered a maximum $1,500 credit for new windows, insulation and renewable heating conversions, including pellets stoves. Some theorize the bump in 2008 is directly responsible for the dive in 2009 sales to 46,000. Shipments dropped a bit lower once again in 2010 before rebounding to 62,000 in 2011. The most recent figures available for this article were 48,000 pellet stoves shipped in 2012. Last year’s numbers were due out March 1, but it will be another year before the full impact of this year’s cold winter will be known, when 2014 appliance shipments are reported in early 2015.

Fluctuating sales present a challenge for appliance manufacturers when planning production schedules. “Companies have a hard time forecasting how many stoves to make,” Johnson says. There were years in the recent past when there weren’t enough stoves nor pellets to fuel them, he says.

Forecasting the demand for pellets to fuel those stoves is equally challenging as this year demonstrates so well. “A lot of the mills are working 24/7 now, they can’t make them fast enough,” says John Ackerly, president of the Alliance for Green Heat. The average pellet stove uses between 2 and 3 tons of pellets each year, he explains. Doing the math and using an average of 2.5 tons expected demand per stove, the 48,000 stoves shipped to dealers in 2012 would have added about 120,000 tons of demand for fuel pellets. Everyone knows this winter will boost pellet stove sales, and thus, demand for pellet fuel. The question is by how much?

Advertisement

Pellets Are Local

Complicating the challenge of properly forecasting demand growth is the local and regional nature of pellet production and the corresponding regional market structure that can cause distribution problems, Johnson says. “One year out West, they were looking for pellet fuel and ran out. The people there made contracts with producers out East to get more fuel the next year, then a problem developed out East.”

This year’s cold-driven demand presents a similar scenario, along with the concern that perceived supply problems would dampen the prospects for growth. “There isn’t a pellet shortage, but the pellets aren’t necessarily getting to where they need to be,” Ackerly says. “If the media gets on to that and it becomes a big story, then that makes people shy away from pellets. That happened three or four years ago, and that still is in the mind of consumers. What if there’s a pellet shortage?”

There also is confusion about the pellets made in the South, he adds. “That huge development of companies in the South, building for export, is for making totally different pellets. It’s not as though those pellets could be shipped up North for heating. These are industrial pellets and you can’t put them in a wood stove. The ash content is really high and it’s a bigger-sized pellet.”

Promise of Efficiency

Advertisement

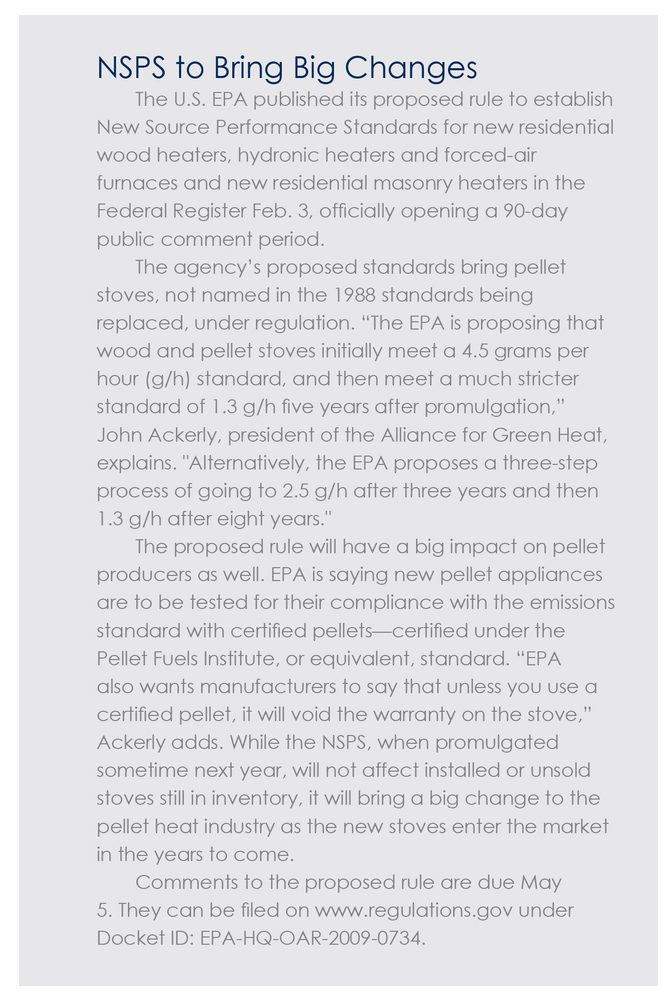

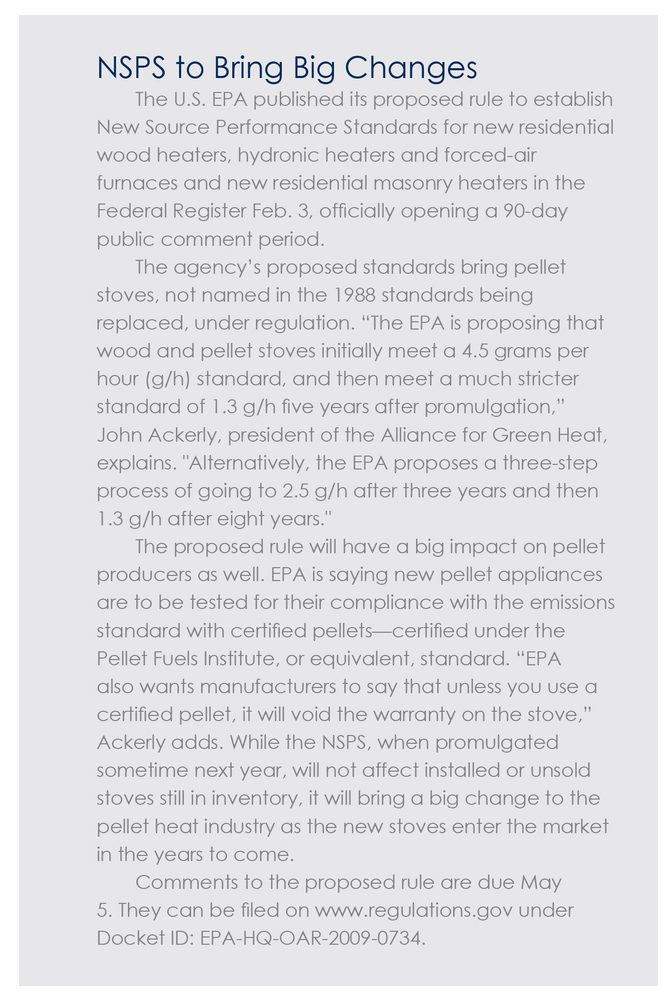

The best pellet stoves are finely tuned, efficient stoves that rely upon those high quality pellets for the best performance. The U.S. EPA is pushing to make that the norm with its new standards for heating appliances. In 2010, the agency initiated a lengthy process that included outlining its goals early on for the development of third-party certification to beef up the voluntary pellet quality program developed by the Pellet Fuels Institute. EPA’s new regulations for wood stoves are up for public comment now. “We will see the average efficiency of pellet stoves go way up. The efficiency standard will be really good for consumers,” Ackerly says. “And honestly, I don’t think it’s going to be much of a burden for the manufacturers because it’s not that hard to make an efficient pellet stove. A lot haven’t focused on that because they haven’t had to. These efficiency standards are really good for consumers. They do cost manufacturers money, but I think it gets consumers higher efficiency in stoves. It gives consumers better experiences and they’ll more likely tell their neighbors. I think it will help pellet stoves take off—the higher in efficiency they are, the more folks can save money with them.”

European Experience

Pellet quality standards have been part of the pellet industry in Austria since the early days of the industry, says Christiane Eggers, head of a state agency program in Upper Austria that supports the work of a cluster of 160 companies in the energy efficiency and renewable sector. Upper Austria was the first to adopt a pellet standard that provided the foundation for what is now the EN standard. “With a standardized fuel, the manufacturers could develop an appliance that was much better, with higher efficiency and low emissions,” she says.

There are a number of factors behind the enviable growth in the European pellet market. Energy cost is the big one. Europeans face extremely high prices for fossil fuels and electricity. “In Austria, it’s three or four times more than the U.S. and Italy is double that,” Eggers says. Those high costs fed into an interesting reaction by consumers in some countries facing deep economic downturns. “In the central parts of Spain that have a cold climate and use central heating, sales for biomass boilers were pretty good,” Eggers says. While installing a pellet boiler heating system can cost upwards of $20,000, it is seen as a good investment. “If unsure about the banks, many bought a biomass boiler because they knew, while it’s a high investment at the moment, it will guarantee low fuel prices for the next 20 years.”

Upper Austria’s work with pellet heat goes back 20 years. The state was promoting biomass heat in the mid-1980s when pellets were first developed. Eggers says boilers for central heating were the focus in her state from the beginning. She remembers well the trade show in 1998 when the first automated pellet boilers were introduced and pellets were still uncommon. “People came up to me with pellets in their hands saying, ‘What is this?’” she recalls. People liked the idea of buying a local fuel that was environmentally responsible. The new bulk handling systems and automated controls made the pellet appliances much less work to use. “Plus it was cool and new,” she says. Consumers ordered 1,000 units that first year.

The 10 or so pellet appliance manufacturers she works with have gone on to capture a 25 percent share of the European market for boilers, producing around 55,000 units per year. She has made multiple trips to the U.S. to help introduce seven of those companies to the U.S. market.

In response to the initial question of whether consumers get used to high energy prices, Eggers says the Upper Austria and European experience suggests that consumers respond to alternatives that meet their needs. One of the services her agency offers to consumers is product-independent evaluations of energy efficiency and alternative energy options. People like to use wood, she says, but they don’t want extra work. Pellet heating alternatives that reduce energy costs and are convenient, efficient, stylish and high-tech, even though costly, do attract consumers.

Author: Susanne Retka Schill

Managing Editor, Pellet Mill Magazine

sretkaschill@bbiinternational.com

701-738-4922

Upcoming Events