Viable Options

PHOTO: ALOTERRA ENERGY

April 25, 2012

BY Luke Geiver

U.S. Endowment for Forestry and Communities Inc. works to maintain forested acres across the country and the communities that depend on those acres. But it’s a tough task to carry out.

“We are a very underfunded sector for how important we are,” says Carlton Owen, president of the South Carolina-based organization. He says part of that sector includes biomass utilization that could not only help sustain the forested acres in a certain region, but also the pocketbooks of those who live there. The good news for Owen is that the majority of the biomass industry would agree that the sector is important and needs funding streams from the federal and local levels, as well as the private sector. The bad news is much more complex.

First, a funding source or subsidy provider who recognizes the importance of the biomass sector is needed. That source then has to find a way to navigate through the current political atmosphere and economic climate, and that’s a difficult goal. But that’s not even the bad news.

Many federal biomass-based programs that provide financial or project development aid are set to expire or already have. Although Sen. Tom Harkin, D-Iowa, Sen. Kent Conrad, D-N.D., and others have introduced legislation that would continue portions of the energy title under the current Farm Bill, including the Biomass Crop Assistance Program, there are no clear indications of whether the legislation will pass. Currently, BCAP has no funding beyond a mere $17 million allocated for 2012.

Aloterra Energy has thrived the past two years on its ability to utilize BCAP funding in Ohio, Missouri and Arkansas for its miscanthus fields. Losing that funding is a major concern. “We think this is going to be a massive industry,” says Scott Coye-Huhn, senior vice president of corporate development and the chief legal officer for Aloterra Energy. The company has made significant progress in its miscanthus development, decreasing the price per acre from thousands of dollars to roughly $750, in just one year. But without BCAP, progress could be stagnant and any further price decline limited.

Coye-Huhn says the company believes BCAP can transform the energy crop industry into a truly viable market, if only it could stick around to finish what it started. Aloterra has even offered to sign a contract for only three more years of BCAP funding, agreeing to operate without it after that period. “We believe more strongly than ever that BCAP is a sleeper program that is really going to change this country,” he says.

Unfortunately, Coye-Huhn and his team at Aloterra may never get a chance to sign that three-year contract. But other options for project funding do exist, and his team has begun to explore a few.

Say Goodbye to Risk

Advertisement

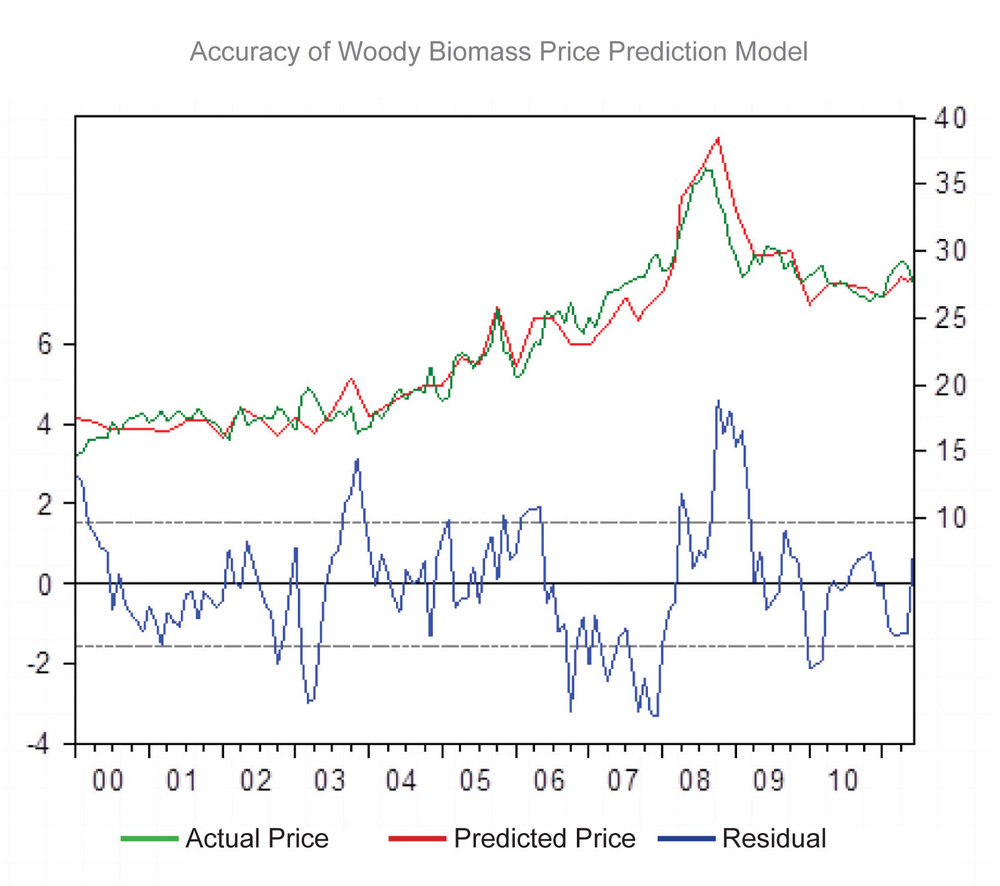

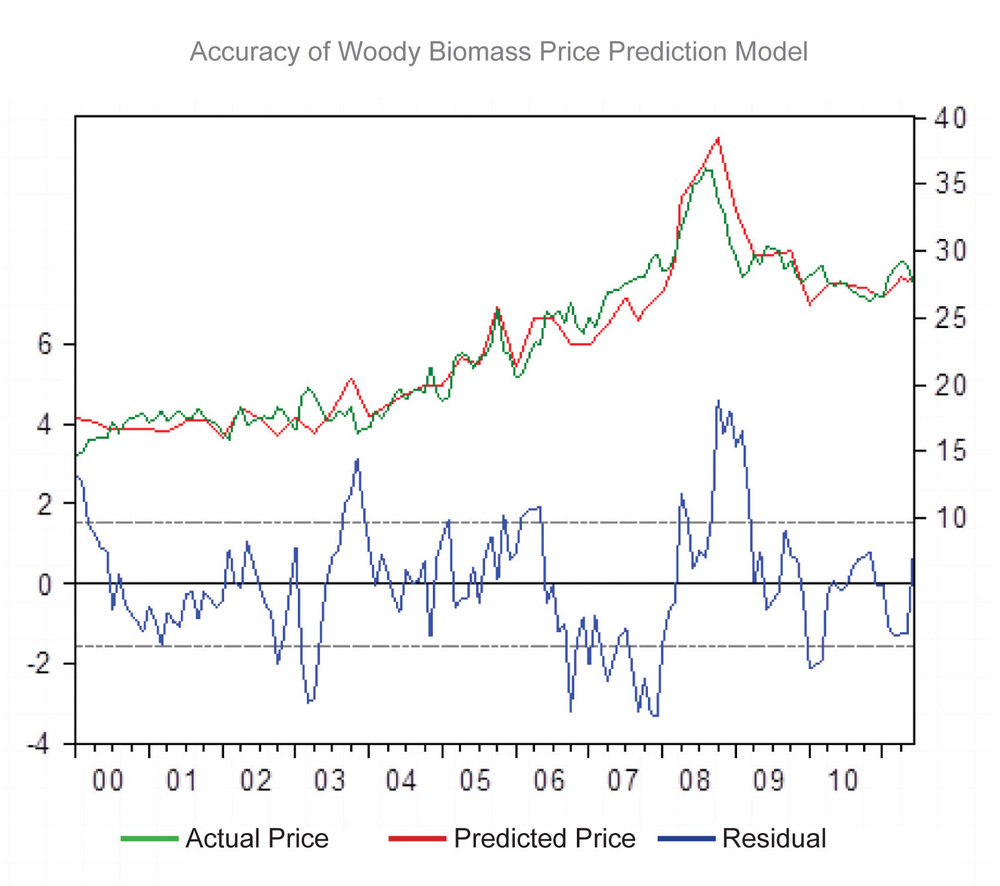

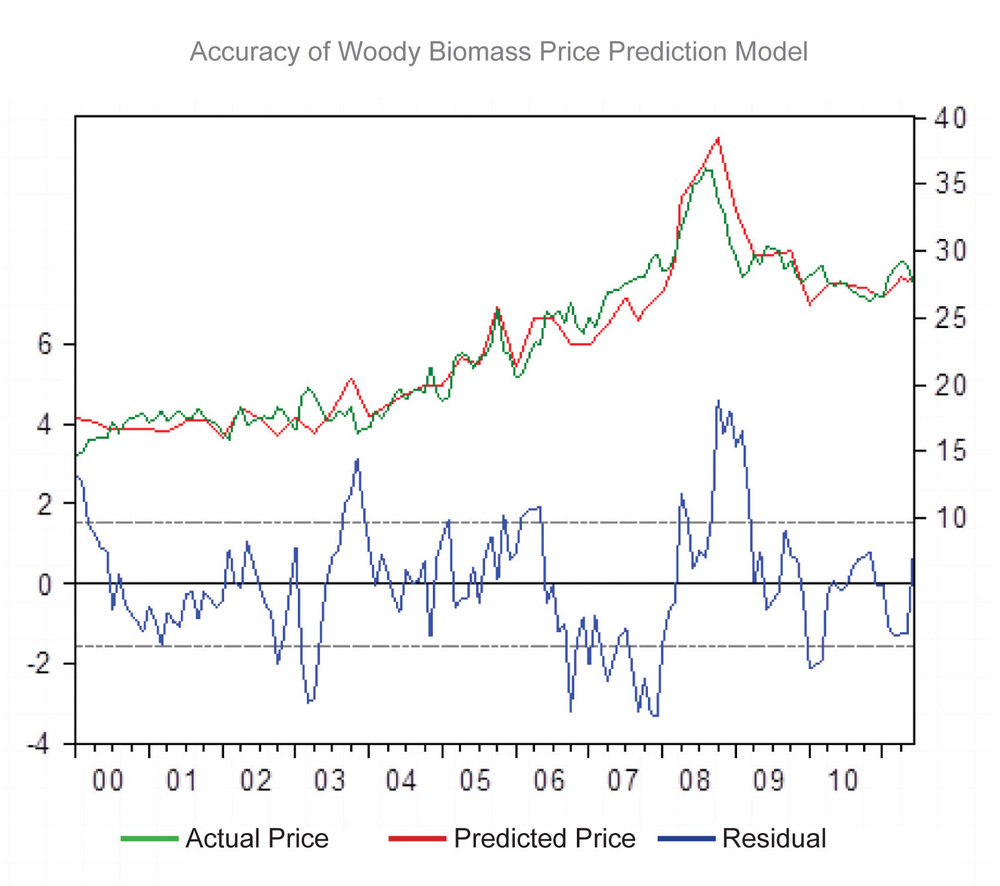

William Strauss, president of FutureMetrics LLC, and Eric Kingsley, vice president of Innovative Natural Solutions, have developed a tool to not only predict the risk associated with woody biomass feedstock pricing, but also provide a way to hedge against that risk.

Kingsley has worked in the biomass industry for more than 17 years and admits he’s been part of several large projects that have failed. “I’ve had a number of perfectly good projects die,” he says. So Kingsley decided to figure out what financers really want. He explains that they always want projects with 20-year feedstock supplies from known entities with little risk, but that’s not in the cards. “You can’t have that,” he says. “It’s simply not possible.” Instead, he says, those project financers really need to know if they can manage and understand price risk.

“I spent a couple of years looking all over the country to figure out what moved biomass prices and why,” Kingsley says. That work helped him uncover six variables that impact biomass prices. Diesel pricing is an obvious one, he says, and the other five are secrets to the tool’s accuracy. “I took the six variables and put together a mathematical model.” That model can predict actual biomass prices out for five to seven years at nearly 94 percent accuracy. Anything over 80 percent is very good, according to Kingsley.

But a project developer needs more than just a prediction for the price of woody biomass. The hedging aspect of the tool shows an innovative way for project developers to overcome the reduction in federal support. In Kingsley’s perspective, programs like BCAP are good, but a left-right pocket strategy is better.

Each of the six variables used to make the tool effective have an existing over-the-counter hedge, which allows a user to hedge price risk on biomass. For example, a biomass facility operator or developer would buy diesel futures in August. “If diesel prices go up, and they may, you would sell that future in August and it would be that much more,” Kingsley says. “So you would be paying more for your wood out of your left pocket.” The higher the diesel price, the higher the wood price, he explains. “But at the same time, you would be getting the equivalent sum into your right pocket.” That money is made from the difference gained between the August future’s price of diesel, and the price of diesel at the time the hedge on diesel is sold. “You paid more for the wood, but by using the hedge, you made that money back,” he says.

The important part of a hedge, he adds, is that it works both ways. If diesel prices in the example above turned out differently—if the price of diesel in August actually dropped below the price of the purchased August diesel future hedge—then the purchaser is actually paying less for the wood, while losing money when the diesel future is sold. “But by putting together the right basket (of hedges), we can show clients how to manage 90-plus percent of the risk involved in biomass purchases,” Kingsley explains.

The tool is designed for large project managers, Kingsley says, and right now some people are using the predictive portion of the tool and others are using some of the hedging aspects. Companies using the hedging must have access to an active trading desk because Kingsley and Strauss can’t legally trade for a client. But they are already in talks with a number of brokers to partner on the hedging. Looking for a way to make a project more attractive or save money? There’s a tool for that.

Forget GHGs, Think Jobs

Advertisement

Not all federal funding for biomass applications face the possibility of expiration. The New Market Tax Credit is one that is enduring. But in order to access NMTCs, project developers need to retune their message from a greenhouse gas benefit and carbon footprint focus, to jobs. “You have to keep coming up with new ideas,” says John May, managing director at Stern Brothers and Co. His firm is making a new push to help clients access NMTCs for project development. “The old ideas just don’t work anymore,” he says.

May explains that almost all the tax credits available at the federal level are under attack, and loan guarantees offered by the U.S. DOE and USDA are being questioned. NMTCs, however, are predated before any renewable energy tax package, and perhaps more important, are not predicated on a project’s ability to reduce GHG’s or produce renewable energy. NMTCs are simply used to provide certain census track areas across the country with economic help to develop jobs and improve the community.

The truth about NMTCs is that they are on the upper echelon of paperwork complexity, application comprehension and company usability. But, as May says, it’s not about how NMTCs work; it’s about what they do. “Renewable energy has become one of the major industries in the U.S., and green jobs have become one of the major categories of new jobs that are available to people,” he says. So, this tax credit offers economic help for renewable energy project developers, as long as the project can create or sustain jobs. And it doesn’t matter that the tax credits will be going to a renewable energy project.

NMTCs aren’t just viable for project developers. Both May and Kingsley imply that the tax credit is almost free money. The credits are administered through the U.S. Department of the Treasury every year. The agency accepts applications from community development entities (CDEs). CDEs are essentially brokers or middlemen who take in and review applications from project developers, and allocate the amount of funding the project proposal should be given by the treasury. But it’s all based on the project’s ability to create jobs in a given census track.

After an application is approved by the treasury for a given amount, the CDE then finds a private investor, such as a wealthy person, corporation, or hospital. The private partner is then awarded the amount of funding approved for the developer in the form of tax credits that can replace the taxes of the private partner dollar-for-dollar. In addition, the private partner provides a matching fund to the project developer totaling the amount of tax credits allotted to the project developer.

For project developers, the tax credits behave like free money for several reasons. The money is given as a subordinated loan that doesn’t require the developer to relinquish any ownership stake in the project, or any resulting profits from that project. After seven years, the loan is forgiven. “The developer doesn’t have to pay back the principal amount of the loan,” May says. “They only have to pay interest.” He explains it as a subordinated, forgivable, nondilutive piece of debt subsidized by the federal government that replaces equity that would otherwise have to be raised by a project developer. “It is essentially not free money, but it is nearly free.”

The tax credit is best suited for companies that have seed money available, or have received angel funding or an A round of funding, May says. And, aside from the complexities of setting up the tax credit in a way that reduces risk for all parties involved, May says this tax option could be very important to an energy crop developer or a biomass company. “Let’s say they are struggling to raise equity, not because the money isn’t there, but because the economics of their project are such that the returns aren’t high enough to interest the equity investor,” he says. “One way to alleviate that is to take a portion of the capital costs of the project and pay for it with the New Market Tax Credit, which essentially is nearly free money. That boosts the economics of the project, meaning it requires less debt or less equity, or provides a higher return to equity, however you want to look at it.”

May offers yet another perspective. “If I say to you, ‘let’s go build a project and we can get $5-10 million in free money from the government,’ you are going to say, ‘we are off to a good start.’”

Parties interested in the NMTC can get help from firms like Stern Brothers and Co. and Innovative Natural Resource Solutions to find out how to utilize the tax credit. For the risk tool, contact Kingsley or Strauss.

And don’t panic. People like Strauss, May and Kingsley will be around to find ways to make projects happen in the absence of federal funding programs.

Author: Luke Geiver

Associate Editor, Biomass Power & Thermal

lgeiver@bbiinternational.com

(701) 738-4944

Upcoming Events