Working in Biodiesel

June 6, 2024

BY Anna Simet

To better understand and report on workforce compensation and job satisfaction trends, Biodiesel Magazine conducted a e-survey of U.S. industry employees. Although a small amount of collected data was kept confidential to protect identities, most is shared in this story. Questions focused on topics including salary, benefits, hours, job retention and satisfaction, experience and education. Although this survey has variables to consider (i.e., does not currently separate salary by job title) it may help gauge where the industry stands in terms of competitiveness to related sectors, as well as highlight potential areas for improvement.

Plant Operations, Position, Experience

Respondents were asked about the average size of the plant/plants they work at, oversee or manage at their company. The range varied considerably, with most respondents working at plants between 40 MMgy and 50 MMgy, or less than 5 MMgy (see Figure 1).

To better understand the position facilities were in during the past 12 months, they were asked the average capacity percent at which their plant/s operated. Over 65% of respondents reported operating at 90%-100% of capacity, with 19% operating at 80%-89% of capacity. Approximately 7% indicated they operated at an average somewhere between 70 and 79% of capacity over the past year, with less than 4% between 60% and 70% of capacity (See Figure 2).

To gain an idea of the longevity respondents had in the industry, they were asked how long they have been employed by their present facility/at their company, even if there was a break in employment. Responses were quite varied, with 7-9 years being the most common length of time in the industry at 24%, followed by 10-14 years at 20% (see Figure 3).

In a follow-up question that asked how many different plants or companies the respondent had worked at during their careers, nearly all respondents—84%—said they had only worked at only one.

As for the type of role respondents were in, approximately 26% were in positions including president, CEO, COO, CFO or other executive roles. Categories of plant manager, environmental, health and safety manager, and operations manager each consisted of 12.5% of respondents. Other positions included: maintenance manager; commodities, procurement, sales manager/team member; human resources; office assistant and accounting analyst.

The majority of companies/facilities find filling open positions a struggle some of the time, at just under 35%. Approximately 22% of respondents report that most of the time it is difficult to find new employees, and just over 30% said positions are typically filled quickly and easily. About 13% indicated that turnover is extremely low (see Figure 4).

As a follow-up question, respondents were asked which methods are used to fill open positions. Most indicated that word of mouth is the most effective method, with 80% reporting it to be either very or sometimes effective. Promoting from within was reported as the next most effective, being either very or sometimes effective approximately 74% of the time, followed by internet job sites (65% very/sometimes effective. Approximately 59% of respondents reported having succession planning in place for management positions at their respective plants, and 75% said they had been contacted by a headhunter or recruiter within the past 12 months.

Advertisement

Nearly half of respondents reported that COVID-19 is still having effects on their facility, whether operations or staffing, at least to some degree.

When asked to characterize whether their plant was in a growth or transformation stage—i.e., expanding, taking on new projects or actively hiring—18% of respondents said that they were. An additional 55% said they were seeing growth at least to some degree, with the remaining 27% indicating that they were not currently seeing any kind of growth. Respondents were asked to elaborate on their selection if they answered no to growth. One remarked a change in ownership and resulting focus on dividends as being detrimental to growth. Another stated that the Inflation Reduction Act favoring low-carbon-intensity feedstocks was detrimental to growth being that the facility uses virgin oils, as well as the elimination of the Blenders Tax Credit, as it “will impact buyers willingness to purchase biodiesel that isn’t made with animal fats or used cooking oil.” The respondent also remarked that “the California Low Carbon Fuel Standard has incentivized the fuel to move to California, and the BTC becoming a producer credit will cause market shift in profitability for both the buyer and seller.”

For those who said their facility is in a growth or transformation stage at least to a degree, approximately 50% expected to hire one to four employees. More than 13% said they will likely need five or more additional employees, and 36% said they do not see any new hires at this point.

When asked about their current outlook regarding their facility right now, 32% said it is positive and that they perceive it to be in a strong position. About 55% said their feelings are neutral; things are business as usual and generally seem fine. Just under 14% said their outlook is negative or worrisome; their facility does not currently seem to be in a strong position.

Schedule, Job Satisfaction & Compensation

Nearly half of respondents reported workweeks of 45 or more hours, with approximately 34% working 50 to 59 hours. About 45% indicated their typical workweek is from 40 hours to 44 hours.

As for job satisfaction, the survey results indicate that it is high. Regardless of compensation, 100% of respondents reported being satisfied or very satisfied with their current position in the biodiesel industry. When asked if they were looking for a new job, 100% said that they were not, though 24% said they were considering searching. Approximately 14% said they may consider a new job if the right opportunity came along, and about 62% said they would not consider leaving their current position.

Regarding the top three job qualities most important to respondents, by highest-ranked, they were: challenging and exciting work, opportunities to advance and job security, with competitive salary as a close fourth.

Advertisement

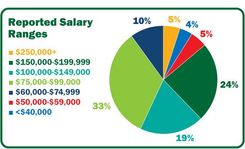

When asked about compensation, most respondents (56%) reported making between $75,000 and $100,000 per year, with approximately 48% receiving over $100,000 per year. (See Figure 6 for additional salary data.) Most were not eligible for overtime compensation (86%), with 9.5% receiving time and a half, and 5% taking PTO in exchange for overtime hours. No respondents reported getting paid hourly. As for their opinions regarding their pay, close to two-thirds (62%) agreed that they were compensated about right, with 38% saying they were compensated too little.

Respondents were also asked about their overall benefits packages, and to answer yes or no to any benefit they knew that was offered or included at their company, to the best of their knowledge. Results are indicated in Figure 5.

As for pay increases, most respondents said they generally receive annual performance reviews along with raises (71%), with 14% indicating they receive annual reviews often without a raise. Within the past 12 months, 81% of respondents have received raises, with 6%-9% being the most common increase (25% of respondents), followed by 5% (20% of respondents) and 3% (25% of respondents). Both categories of 10%-14% raises and 4% raises consisted of 10% of respondents.

As for bonuses, 76% of respondents reported receiving them within the past year. Of those, 25% said they were paid between $25,000 and $50,000, with 10% of respondents reporting bonuses in each of three ranges, which were $1,000-$2,499, $5,000-$7,499 and $10,000-$14,999.

Approximately 25% said they did not receive any bonuses during the past 12 months.

Demographics and Education

The ages of respondents were fairly spread out. Out of all survey takers, 38% were female. The most common age range of all respondents was 45 to 49 years old, at 24% of respondents. An equal 19% of respondents were in both the age ranges of 40-44 and 60-64, 19% were also between the ages of 50 and 59, and nearly 15% were from 25 to 35 years old.

Respondents were also asked about their education. The majority reported having a college/university degree (38%), with nearly a quarter having post-graduate degrees. Nearly 90% had at least some education beyond high school.

*Totals in this survey are rounded to the nearest percent

Contact: Anna Simet

Editor, Biodiesel Magazine

Upcoming Events