AEE report: Global biodiesel sales grew 23 percent from 2011-'14

March 23, 2015

BY Erin Krueger

The Advanced Energy Economy recently commissioned a study completed by Navigant Research that found the U.S. advanced energy market grew by 14 percent last year, which is five times the rate of the U.S. economy overall. The report, titled, “Advanced Energy Now 2015 Market Report,” estimates the U.S. advanced energy market was worth an estimated $199.5 billion last year.

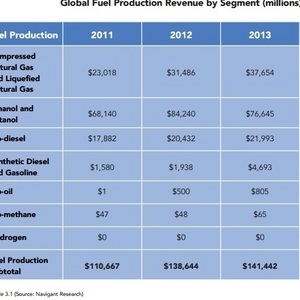

According to the report, fuel production was the fourth largest advanced energy segment last year, with an estimated $148.1 billion in global revenue. The segment grew by an estimated 4 percent from 2013 to 2014, with a 34 percent increase from 2011 to 2014. “Ethanol and butanol, including both sales of fuel and investment in refinery infrastructure, continued to be the leading source of revenue with a combined $78 billion in revenue, representing 2 percent growth over 2013,” said Navigant Research in the report.

Sales of ethanol and butanol reached approximately 25.8 billion gallons last year, up from 23.4 billion in 2011. Ethanol made up the majority of volume. While biodiesel sales and new biodiesel refinery infrastructure experienced a 3 percent dip in 2014, falling to $21.3 billion, that level is still 19 percent higher than in 2011, which was close to $17.9 billion. The report indicates biodiesel sales totaled 7.4 billion gallons last year, up from 6 billion gallons in 2011. Sales of bio-oil and biomethane, including revenue from refineries and production plants, also fell last year, with reductions ranging from 5 percent to 98 percent. The report notes much of the drop was with refinery investment in these-still developing fuel types.

Advertisement

Advertisement

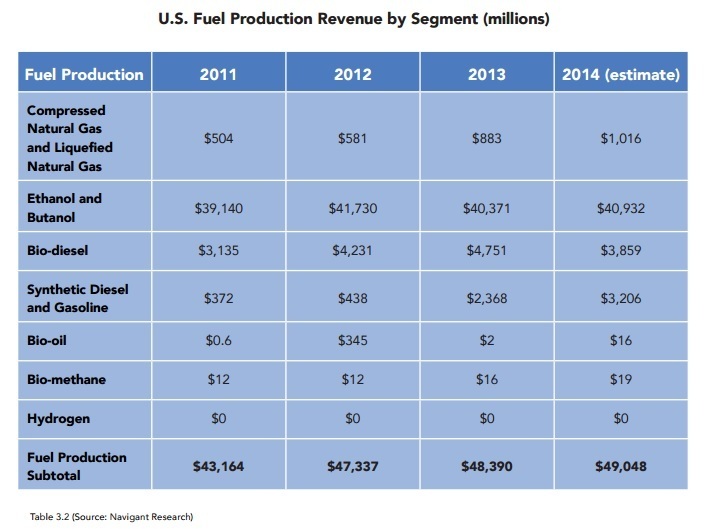

In the U.S., the fuel production segment reached $49 billion last year, up from $48.4 billion in 2013, and an 18 percent increase over 2011. U.S. sales of ethanol totaled an estimated 14.2 billion gallons, equating to $39.1 billion in revenue. Biodiesel sales and biorefinery infrastructure were the next largest sources of revenue, with a combined $3.9 billion. The report also notes that 137 million gallons of new biodiesel refinery infrastructure capacity was added last year. In addition, biomethane, bio-oil and synthetic diesel and gasoline reached a combined $3.2 billion in revenue from fuel sales and infrastructure investment in the U.S. during 2014.

The report also addresses waste-to-energy (WTE), noting energy recovery represents the largest and most mature segment in the municipal solid waste (MSW) value chain. According to Navigant Research, in the U.S. and other developed economies, MSW is increasingly being diverted from landfills to facilities where it is used as a feedstock for renewable power or advanced biofuels. Combustion-based WTE infrastructure and landfill gas recovery projects alone contributed nearly $500 million in annual revenue in the U.S.

Advertisement

Advertisement

The report estimates more than 800 WTE facilities are deployed in at least 40 countries around the world. These facilities, which are must more advanced that incinerators, typically employ sophisticated emissions control systems. It also addresses landfill gas-to-energy, anaerobic digestion, and several other advanced technologies.

The report also briefly addressed biomass electricity generation, noting that global revenue from biomass ranged from $10.5 billion in 2011 to $7.2 billion in 2012, $14.7 billion in 2013 and $13.5 billion last year. In the U.S. revenue from biomass power generation tripled from 2011 to 2013, and then dropped off slightly last year. In 2011, U.S. biomass power generated $300 million in revenue, increasing to $600 million in 2012 and $900 million in 2013. Last year revenue was reduced slightly, at $882 million.

A full copy of the report, which addresses transportation, fuel production, fuel delivery, building efficiency, industry, electricity generation, and electricity deliver and management, can be downloaded from the AEE website.

Related Stories

Biodiesel capacity in the U.S. and Canada dipped slightly stable in 2024, with several renewable diesel producers reporting headwinds and lower margins alongside a drove of SAF projects in various stages of development.

The IEA’s Task 39 group has new research regarding the development and status of the sustainable aviation fuel industry.

The U.S. EPA on Nov. 16 released updated RIN data, reporting that nearly 2.11 billion RINs were generated under the RFS in October, up from 1.81 billion generated during the same month of last year.

Conestoga to host SAFFiRE cellulosic ethanol pilot plant

Conestoga Energy and SAFFiRE Renewables LLC announced on Nov. 16 their agreement for Conestoga to host SAFFiRE’s cellulosic ethanol pilot plant at Conestoga’s Arkalon Energy ethanol facility in Liberal, Kansas.

Officials at Calumet Specialty Products Partners L.P. discussed the company’s proposed plans to boost sustainable aviation fuel (SAF) production at its Montana Renewables biorefinery during third quarter earnings call, held Nov. 9.

Upcoming Events