Deinove releases financial results, reports reduced net loss

Deinove

March 31, 2016

BY Deinove

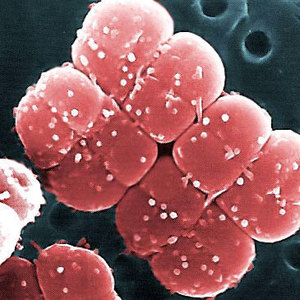

Deinove, an industrial biotechnology company developing innovative processes for producing biofuels and bio-based chemicals by using Deinococcus bacteria, recently announced that its board of directors had examined and approved the 2015 annual accounts. It also called the annual general meeting for May 10.

Net result for 2015 is a loss of €6.34 million ($7.23 million), compared to a loss of €6.46 million the previous year. This 2 percent reduction in net loss was the result of good control of the company’s operating expenses in a context of strong growth in research programs, and a favorable comparison base, in terms of non-recurring items, and, to a lesser extent, R&D tax credit (CIR - Crédit Impôt Recherche).

Advertisement

Advertisement

During 2015, research programs were pursued and expanded, reaching key milestones in the company’s two main programs: Deinol in biofuels and Deinochem in green chemistry. A new research platform was launched, dedicated to the production of biobased muconic acid, while the carotenoid platform evolved toward an integrated production model targeting its first commercial revenues by the year 2018. New industrial partnerships were forged in animal nutrition (Flint Hills Resources) and in the industrial exploitation of new sources of biomass (energy tobacco - Tyton BioEnergy Systems, forest residues - Arbiom). Technological capacities were consolidated through substantial investments in the fermentation and metabolic engineering platforms.

The net cash position reached €12.4 million at Dec. 31, compared with €2.2 million at Dec. 31, 2014. During the 2015 fiscal year, Deinove received €2.2 millionin milestone payments from Bpifrance and ADEME, as well as a total of €1.7 million in R&D tax credit. The company also raised €4.6 million through the equity line funding set up with Kepler Cheuvreux at the end of 2014. Lastly, in December 2015, Deinove successfully undertook a €10.7 million (gross) capital increase. Deinove considers it has the resources needed to ensure its financing through the end of 2017, not counting the aforementioned equity line funding.

Advertisement

Advertisement

“In 2015, we moved forward on all of our main programs, confirmed new opportunities for creating value with the development of our carotenoids and muconic acid and secured our financial situation thanks to the renewed trust of investors,” said Emmanuel Petiot, CEO of Deinove. "We plan to pursue our R&D efforts for all our programs in 2016 and we are actively working to develop new industrial partnerships for the different applications that can be served by Deinotechnologies. We continue to focus on our founding ambition: developing new production methods that are more responsible and more sustainable, and whose needs were recently confirmed by the COP21 conference.”

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events