EIA: Rail traffic up 4.5% from last year

U.S. Energy Information Administration

November 13, 2014

BY U.S. Energy Information Administration

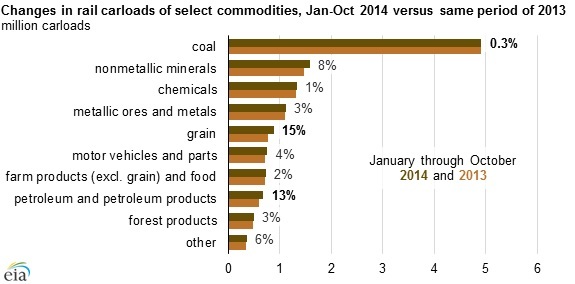

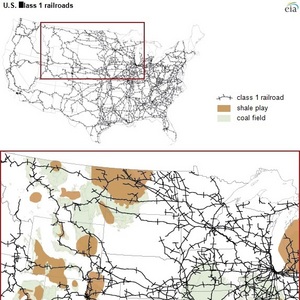

U.S. rail traffic, including carloadings of all commodity types, has increased 4.5 percent through October 2014 compared to the same period in 2013. Crude oil and petroleum products had the second-biggest increase in carloadings through the first 10 months of this year, with these shipments occurring in parts of the country where there is also strong demand to move coal and grain by rail. In response to shipper concerns over the slow movement of crude oil, coal, grain, ethanol, and propane, federal regulators are closely tracking service among the major U.S. freight railroad companies.

Rail carloadings of oil and petroleum products totaled 672,118 tank cars during January-October 2014, 13.4percent higher compared to the same period last year, according to the Association of American Railroads . Rising U.S. crude oil production, particularly in North Dakota's Bakken Shale formation, where pipeline takeaway capacity is limited in moving the state's growing oil volumes to market, is one of the main reasons for this increase in rail shipments of petroleum and petroleum products.

Advertisement

Rail shipments of coal were up a relatively small 0.3 percent during the same period, but coal is still by far the largest commodity volume moved by rail, with 4.9 million carloadings. Power plant operators are seeking more coal deliveries by rail to rebuild their coal stockpiles, which were drawn down during last winter's colder-than-normal weather. Rail also moves U.S. coal to various points for export. At the national level, coal exports were down nearly 16 percent during the first half of this year, but coal exports from the Seattle Customs District (mostly sourced from Wyoming's Powder River Basin) were up 2.4 percent during the first half of 2014.

Increased movement of grain represents the biggest commodity increase in rail traffic so far this year, up about 15 percent to 878,824 carloadings, according to AAR. The USDA forecasts a record harvest of corn and soybean crops this year. Harvesting of these crops is well underway in the major growing areas in the northern Great Plains states, according to USDA's crop progress reports.

Advertisement

On October 22, the U.S. Department of Transportation's Surface Transportation Board began requiring major freight rail carriers to file weekly updates on their service performance in delivering goods and commodities. These filings will lead to a better understanding of commodity movements by rail and the potential issues associated with increased demand from multiple types of commodities.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

Upcoming Events