The Andersons reports strong Q4 for ethanol

February 21, 2022

BY Erin Krueger

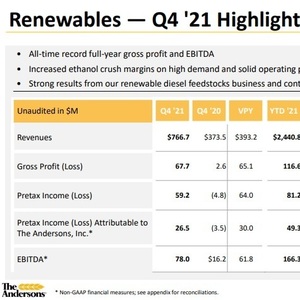

The Andersons Inc. released fourth quarter financial results on Feb. 15, reporting that its renewables segment achieved its best fourth quarter since 2013 and record EBITDA. The company, in part, credited improved ethanol margins and record corn oil prices for the strong segment performance.

"We enjoyed strong renewable fuels margins in the fourth quarter; remained focused on risk management, effective hedging and strong operational performance; and continued to see good returns from co-products, particularly distillers' corn oil," said Pat Bowe, president and CEO of The Andersons. "We continue to diversify revenues for this group into attractive new product lines; an example of this would be renewable diesel feedstocks. You will note that we have renamed our Ethanol segment 'Renewables' to reflect its broader scope of products and services.”

Advertisement

Advertisement

The renewables segment reported pretax income attributable to the company of $26.5 million in the fourth quarter, compared to a pretax loss attributable to the company of $3.5 million for the same period of 2020. Ethanol crush margins were up significantly, the company said, noting that strong corn oil prices also contributed to the improved results. EBITDA was $78 million, up from $16.2 million in the fourth quarter of 2020.

Sales volumes for ethanol, corn oil and feed ingredients were up, driven by higher production and additional third-party sales from the company’s merchandising business. Hedges on forward ethanol sales are in place for a portion of expected 2022 production.

Moving into 2022, The Andersons reported that spot ethanol crush margins have declined and are expected to be closer to historical averages. Corn oil demand is expected to remain high, with merchandising of third-party renewable feedstocks expected to remain strong.

Advertisement

Advertisement

Overall, The Andersons reported pretax income of $43.9 million for the fourth quarter, up from $25 million during the same period of the previous year. Net income was $32.8 million, up from $17.3 million. Diluted earnings per share reached 95 cents, up from 52 cents.

For the full year 2021, pretax income reached $128.9 million, up from a $5.2 million loss in 2020. Net income was $99.7 million, up from $5.9 million in 2020. Diluted earnings per share reached $2.94, up from 17 cents.

Related Stories

The European Commission on July 18 announced its investigation into biodiesel imports from China is now complete and did not confirm the existence of fraud. The commission will take action, however, to address some systemic weaknesses it identified.

Kintetsu World Express Inc. has signed an additional agreement with Hong Kong, China-based Cathay Pacific Airways for the use of sustainable aviation fuel (SAF). The agreement expands a three-year partnership between the two companies.

Broco Energy on July 17 announced a new partnership with the Massachusetts Port Authority (Massport) to deliver and transition Massport's fuel tanks to renewable diesel across its various facilities.

Shell Aviation, Accenture, and Amex GBT on July 10 announced Avelia is in the process of evolving to an industry solution with independent data hosting and a multi-supplier model helping users access the GHG benefits of SAF.

The U.S EPA on July 17 released data showing more than 1.9 billion RINs were generated under the RFS during June, down 11% when compared to the same month of last year. Total RIN generation for the first half of 2025 reached 11.17 billion.

Upcoming Events