The Andersons reports strong Q4 for ethanol

February 21, 2022

BY Erin Krueger

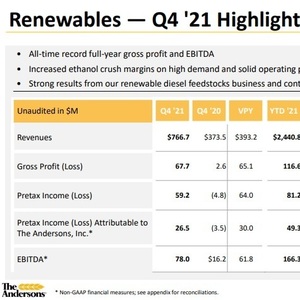

The Andersons Inc. released fourth quarter financial results on Feb. 15, reporting that its renewables segment achieved its best fourth quarter since 2013 and record EBITDA. The company, in part, credited improved ethanol margins and record corn oil prices for the strong segment performance.

"We enjoyed strong renewable fuels margins in the fourth quarter; remained focused on risk management, effective hedging and strong operational performance; and continued to see good returns from co-products, particularly distillers' corn oil," said Pat Bowe, president and CEO of The Andersons. "We continue to diversify revenues for this group into attractive new product lines; an example of this would be renewable diesel feedstocks. You will note that we have renamed our Ethanol segment 'Renewables' to reflect its broader scope of products and services.”

Advertisement

The renewables segment reported pretax income attributable to the company of $26.5 million in the fourth quarter, compared to a pretax loss attributable to the company of $3.5 million for the same period of 2020. Ethanol crush margins were up significantly, the company said, noting that strong corn oil prices also contributed to the improved results. EBITDA was $78 million, up from $16.2 million in the fourth quarter of 2020.

Sales volumes for ethanol, corn oil and feed ingredients were up, driven by higher production and additional third-party sales from the company’s merchandising business. Hedges on forward ethanol sales are in place for a portion of expected 2022 production.

Moving into 2022, The Andersons reported that spot ethanol crush margins have declined and are expected to be closer to historical averages. Corn oil demand is expected to remain high, with merchandising of third-party renewable feedstocks expected to remain strong.

Advertisement

Overall, The Andersons reported pretax income of $43.9 million for the fourth quarter, up from $25 million during the same period of the previous year. Net income was $32.8 million, up from $17.3 million. Diluted earnings per share reached 95 cents, up from 52 cents.

For the full year 2021, pretax income reached $128.9 million, up from a $5.2 million loss in 2020. Net income was $99.7 million, up from $5.9 million in 2020. Diluted earnings per share reached $2.94, up from 17 cents.

Related Stories

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

EcoCeres Inc. has signed a multi-year agreement to supply British Airways with sustainable aviation fuel (SAF). The fuel will be produced from 100% waste-based biomass feedstock, such as used cooking oil (UCO).

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Upcoming Events