EU imports of US soybeans balloon during trade war with China

January 16, 2019

BY UFOP

Following China’s ban on U.S. soybeans, the U.S. has been in need of new buyers. The EU-28 benefits from this situation as its imports of U.S. soybeans have multiplied.

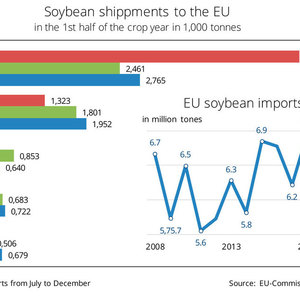

The EU-28 has always depended on oilseed imports from third countries, because EU demand exceeds EU production by around 30 percent. Above all, soybeans are in strong demand, as they have hardly been produced in the EU-28 to date. In the first half of the 2018-’19 marketing year, the EU-28 imported 6.95 million metric tons of soybeans from third countries. This was up 12 percent from the year-earlier period. The U.S. remained the main supplier, with volumes jumping to 5.2 million tons this season compared to 2.3 million tons the previous year. In other words, three quarters of EU soybean imports came from the U.S., according to Agrarmarkt Informations-Gesellschaft mbH (AMI).

The prime reason for the strong rise in shipments from the U.S. is the trade war between the U.S. and China. In response to the import tariffs the U.S. unilaterally imposed on Chinese products, China imposed tariffs on U.S. soybean imports. For the time being, China covers its demand of around 90 million tons mainly from South America. This beats down prices for U.S. soybeans and makes them more attractive to other importers, such as the EU.

Advertisement

The second most important soybean supplier to the EU in the period July-December 2018 was Brazil, delivering 1.3 million tons, which was one-fourth less year-on-year. Canada, Paraguay and the Ukraine share the other places, but with volumes significantly lower than 2017-’18. Brazil could regain its position at the top of EU soybean suppliers towards the end of the marketing year, because the country’s new crop will be available from January onwards. Even if the soybean harvest were to fall slightly short of the previous year’s crop, there would still be enough produce left for exports.

The Union zur Förderung von Oel- und Proteinpflanzen has criticized the fact that price pressure on European rapeseed and grain legume production has increased in the wake of the shift in trade flows. UFOP asks, will this be the future of sustained bioeconomics, where sustainability requirements are rendered ineffective by trade disputes?

Advertisement

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

Upcoming Events