EU imports of US soybeans balloon during trade war with China

January 16, 2019

BY UFOP

Following China’s ban on U.S. soybeans, the U.S. has been in need of new buyers. The EU-28 benefits from this situation as its imports of U.S. soybeans have multiplied.

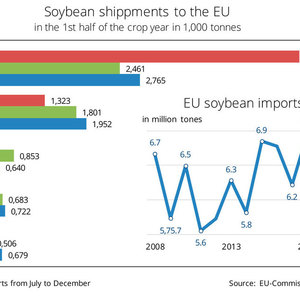

The EU-28 has always depended on oilseed imports from third countries, because EU demand exceeds EU production by around 30 percent. Above all, soybeans are in strong demand, as they have hardly been produced in the EU-28 to date. In the first half of the 2018-’19 marketing year, the EU-28 imported 6.95 million metric tons of soybeans from third countries. This was up 12 percent from the year-earlier period. The U.S. remained the main supplier, with volumes jumping to 5.2 million tons this season compared to 2.3 million tons the previous year. In other words, three quarters of EU soybean imports came from the U.S., according to Agrarmarkt Informations-Gesellschaft mbH (AMI).

The prime reason for the strong rise in shipments from the U.S. is the trade war between the U.S. and China. In response to the import tariffs the U.S. unilaterally imposed on Chinese products, China imposed tariffs on U.S. soybean imports. For the time being, China covers its demand of around 90 million tons mainly from South America. This beats down prices for U.S. soybeans and makes them more attractive to other importers, such as the EU.

Advertisement

The second most important soybean supplier to the EU in the period July-December 2018 was Brazil, delivering 1.3 million tons, which was one-fourth less year-on-year. Canada, Paraguay and the Ukraine share the other places, but with volumes significantly lower than 2017-’18. Brazil could regain its position at the top of EU soybean suppliers towards the end of the marketing year, because the country’s new crop will be available from January onwards. Even if the soybean harvest were to fall slightly short of the previous year’s crop, there would still be enough produce left for exports.

The Union zur Förderung von Oel- und Proteinpflanzen has criticized the fact that price pressure on European rapeseed and grain legume production has increased in the wake of the shift in trade flows. UFOP asks, will this be the future of sustained bioeconomics, where sustainability requirements are rendered ineffective by trade disputes?

Advertisement

Related Stories

A notice published in the Federal Register by the U.S. EPA indicates that far fewer parties than originally anticipated have registered with the agency as biointermediate producers under the Renewable Fuel Standard.

With exclusive licensing to a camelina seed variety, Ash Creek Renewables is breaking down barriers to a renewable future.

The USDA reduced its estimate for 2024-’25 soybean use in biofuel production in its latest WASDE report, released May 12. The agency expects soybean oil use in biofuel to increase during the 2025-’26 marketing year.

HutanBio's microalgal biofuel production shown to be net-negative in an independent life cycle assessment by EcoAct

HutanBio on May 8 announced that the production process for its proprietary HBx microalgal biofuel achieves net-negative carbon emissions, based on an independent cradle-to-gate life cycle assessment (LCA) conducted by EcoAct.

According to a new economic contribution study released by the Iowa Renewable Fuels Association on May 6, Iowa biofuels production has begun to reflect stagnant corn demand throughout the agriculture economy.

Upcoming Events