Neste reports strong Q2 financial results for renewable diesel

Source: Neste Corp.

July 30, 2019

BY Erin Krueger

Neste Corp. released financial results July 25 for the first half of 2019, reporting increased earnings for its renewable products segment, a new quarterly sales record for renewable products, and a high utilization rate of its renewable diesel capacity.

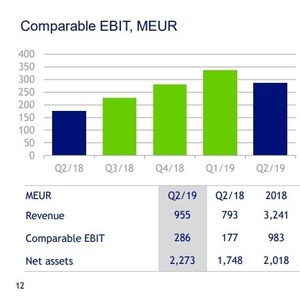

According to Neste, its renewable products division reported comparable operating profit of €286 million ($318.76 million) for the second quarter of the year, up from €177 million during the same period of 2018. For the first half of the year, comparable operating profit for the renewable products division was €623 million, up from €473 million during the same period of last year.

The company said the renewable diesel market continued to be favorable during the second quarter. Feedstock prices, however, increased. Sales volumes reached 745,000 tons during the second quarter, a new quarterly record. The comparable sales margin averaged $568 per ton, up from $508 per ton last year. During the second quarter, 65 percent of volume were sold into European markets, with 35 percent into North American markets. Neste said its renewable diesel production facilities operated at a utilization rate of 105 percent during the second quarter, with the share of waste and residue feedstock at 77 percent.

Advertisement

Advertisement

Moving into the third quarter, sales volumes and utilization rates for the company’s renewable products are expected to remain high. A catalyst change at the Rotterdam renewable products refinery is scheduled to take place in the fourth quarter.

Overall, Neste reported €367 million in operating profit for the second quarter, up from €277 million during the same quarter of 2018. Operating profit was €358 million, up from €172 million during the second quarter of last year.

Advertisement

Advertisement

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events