EIA: Summer US gasoline, diesel prices to be highest since 2014

April 19, 2022

BY U.S. Energy Information Administraton

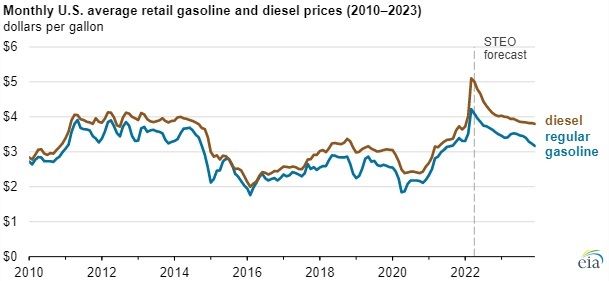

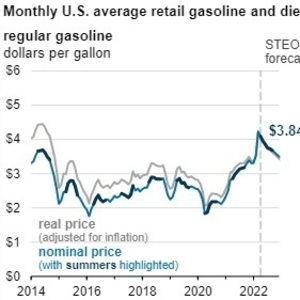

In our Summer Fuels Outlook, a supplement to our April 2022 Short-Term Energy Outlook, we expect retail gasoline prices to average $3.84 per gallon (gal) this summer driving season, April through September, compared with last summer’s average price of $3.06/gal. After adjusting for inflation, this summer’s forecast national average price would mark the highest retail gasoline and diesel prices since 2014.

We expect the ongoing effects of the COVID-19 pandemic will have a smaller effect on gasoline and diesel consumption in the United States during the 2022 summer season compared with the past two summers. U.S. gasoline and diesel consumption continue to remain below their 2019 averages.

We expect higher fuel prices this summer as a result of higher crude oil prices. Crude oil prices have generally risen since the start of the year partly as a result of geopolitical developments, particularly Russia’s war against Ukraine.

Advertisement

Advertisement

We expect U.S. economic activity to increase through the summer, resulting in more demand for petroleum fuels. Greater demand will contribute to higher crude oil prices. We expect Brent crude oil will average $106 per barrel (b) this summer, which would be $35/b higher than last summer.

Recently, increased volatility of crude oil prices, which account for around 60% of total retail gasoline prices, indicates our crude oil price forecast could change, depending on several factors that remain highly uncertain. Notably, our outlook takes into account all sanctions on Russia announced as of April 7, but the range of possible outcomes for resulting oil production in Russia is wide.

Advertisement

Advertisement

Gasoline and diesel prices have already declined since their peaks in March, when the U.S. average gasoline price surpassed $4.00/gal and the average diesel price surpassed $5.00/gal. We expect these prices to continue falling throughout the summer.

As U.S. refineries increase gasoline and distillate production, we expect this increased production to gradually place downward pressure on wholesale gasoline margins and retail prices during the summer. As a result, we forecast the average U.S. retail gasoline price will fall to $3.75/gal in July and to $3.68/gal in September. Similarly, we expect the average U.S. retail diesel price to fall to $4.44/gal in July and $4.20/gal in September.

Related Stories

Neste and DHL Express have strengthened their collaboration with the supply of 7,400 tons (9.5 million liters) of neat, i.e. unblended, Neste MY Sustainable Aviation Fuel to DHL Express at Singapore Changi Airport starting July 2025.

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

Upcoming Events