REG reports increased biodiesel sales in Q2 earnings

August 6, 2015

BY Katie Fletcher

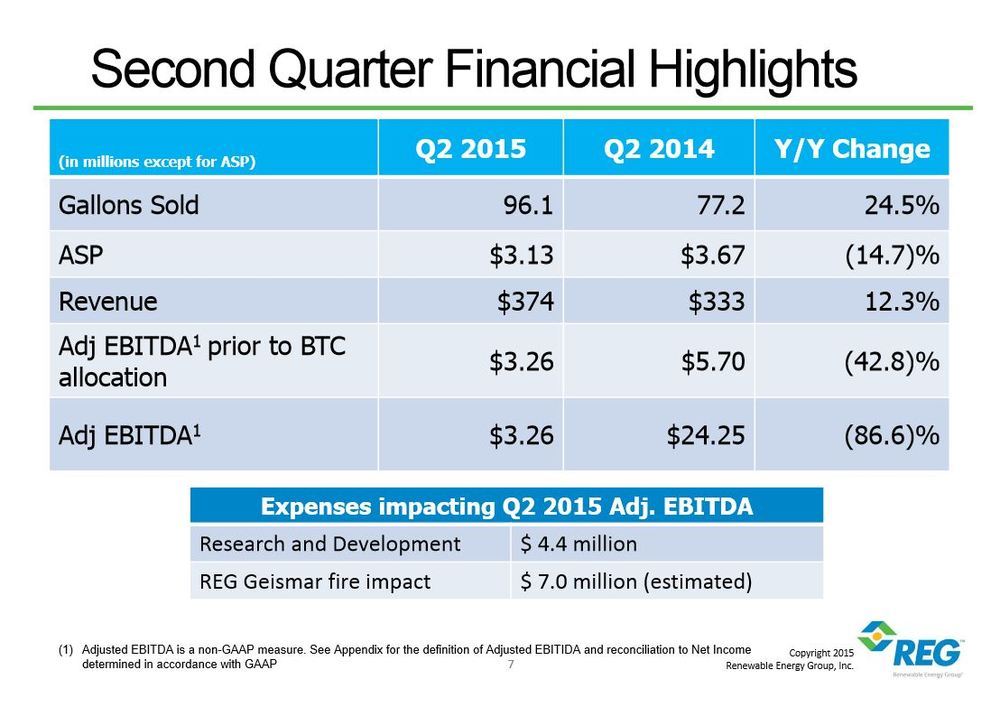

Renewable Energy Group Inc. recently announced its financial results for the second quarter ended June 30, reporting 96.1 million gallons of biomass-based diesel sales, 24.5 percent more than the comparable period in 2014.

The average price per gallon of biomass-based diesel sold during the second quarter was $3.13, or 14.7 percent lower than in the same quarter of 2014. REG stated in their financial release that prices improved and stabilized in the second quarter compared to the prior quarter, but were still significantly lower than the prior year period.

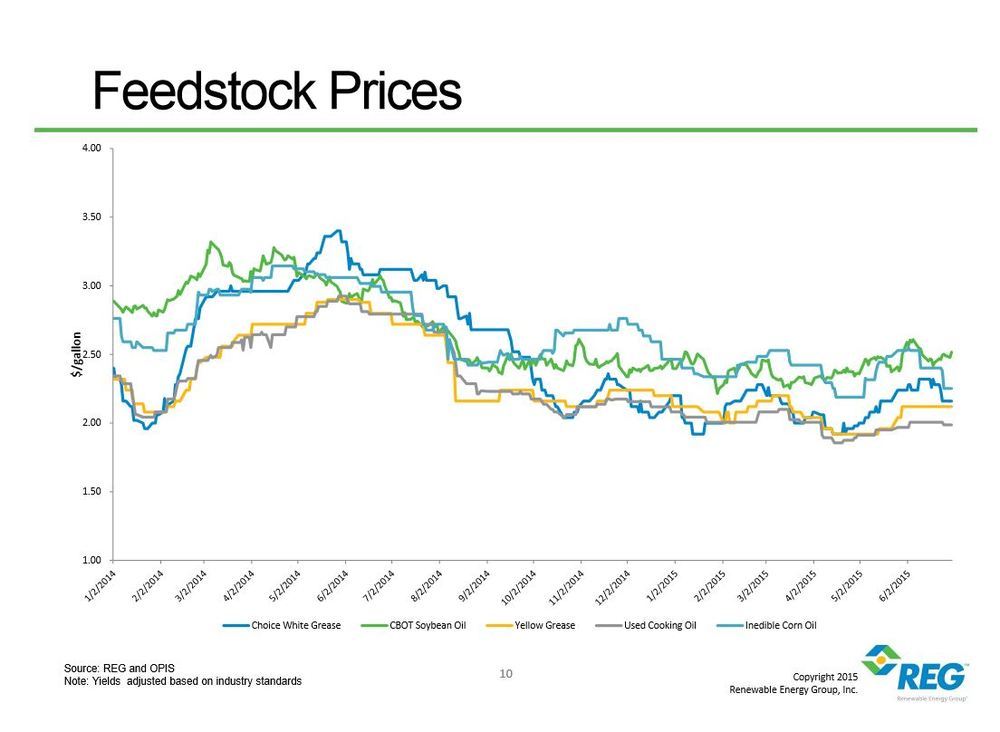

REG produced 73.2 million gallons of biomass-based diesel during the quarter, up 30.1 percent from quarter two in the prior year. The company estimates, based on the forward curve between feedstock prices and biodiesel prices, it will sell 100 to 110 million gallons in quarter three of 2015. Other assumptions in the company’s outlook include no change to the proposed renewable volume obligation (RVO) volumes and market participants will continue to trade as if the federal biodiesel tax credit (BTC) will be retroactively reinstated for 2015. The outlook provides that if BTC is reinstated estimated adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) will be approximately $30 to $40 million, and without BTC adjusted EBITDA would be less than $10 million.

Advertisement

Advertisement

Revenues for the quarter were $373.8 million, an increase of 12.3 percent from the same period in the prior year. Adjusted EBITDA for the second quarter was $3.3 million, compared to $5.7 million in the prior year period, without any adjustments for the 2014 BTC. REG estimates that the adjusted EBITDA impact during the second quarter associated with its Geismar, Louisiana, facility fire was approximately negative $7 million.

One of the highlights of the quarter included significant progress at the facility. “We have also completed much of the rebuilding and other upgrades at Geismar, and expect to resume renewable hydrocarbon diesel production in the third quarter,” said Daniel J. Oh, president and CEO of REG.

Advertisement

Advertisement

Gross profit was $15.9 million, or 4.3 percent of revenues, compared to gross profit of $15.2 million, or 4.6 percent of revenues, for quarter two of 2014. This slight increase is attributed to volume, offset by compressed spreads as energy and biomass-based diesel prices declined more rapidly than feedstock prices.

A net loss attributable to common stockholders of 5 cents per share on a fully diluted basis, or $2 million, was reported for quarter two. This compares to a net income of 27 cents per share on a fully diluted basis, or $10.8 million, in the second quarter of 2014. REG repurchased 668,376 shares during the second quarter under its share repurchase program at an average price of $9.75 per share.

“Our second quarter results reflect improved market conditions relative to the first quarter,” Oh said. “During the quarter, energy prices began to stabilize and we saw increased demand. The EPA's proposed volumes for biomass-based diesel through 2017 have reduced market uncertainty and are a significant improvement over the originally proposed levels.”

The quarterly financial results presentation also included details on the $15 million in cash acquisition of the nameplate 100 MMgy biorefinery in Grays Harbor, Washington, which creates its fuel primarily from canola and soybean oil. REG broke ground on a $31 million upgrade to its Danville facility; adding distillation capabilities, pretreatment capacity improvements and storage optimization and enhanced logistics and administrative space. Fifth Third Bank will reinvest in the facility by financing up to $12 million of the cost of the project. “With upgrades underway at Danville and the agreement to acquire the biorefinery and terminal assets at Grays Harbor, Washington, we are further positioning ourselves to benefit from growing volumes under RFS2 (renewable fuel standard) and West Coast low-carbon fuel markets,” Oh said.

Related Stories

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

Upcoming Events