ADM corn processing performs well in Q4; annual earnings down

Archer Daniels Midland Co.

February 7, 2017

BY Susanne Retka Schill

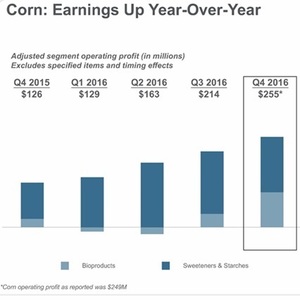

Archer Daniels Midland Co. reported a strong fourth quarter, making up for what was described as difficult marketing conditions for much of 2016. ADM reported Q4 net earnings of $424 million with adjusted segment operating profit up 30 percent from the same quarter a year ago. For the year, earnings before taxes were down $462 million in 2016 at $1.822 billion.

“We capitalized on an improved environment, delivering stronger fourth quarter performance after working through difficult market conditions earlier in the year,” said ADM Chairman and CEO Juan Luciano. “Ag services saw strong results in North America and weak results from the global trade desk. The corn business delivered a good quarter, led by sweeteners and starches, and saw solid results from bioproducts. Oilseeds results were comparable to last year despite lower global crush margins. In WFSI, WILD Flavors continued to deliver earnings growth, while some of our specialty ingredients businesses faced challenges, which we are addressing.”

Luciano reported progress is being made in advancing the company’s strategic plan, “by completing additional acquisitions, organic growth projects and portfolio management actions; exceeding our 2016 target for run-rate cost savings; and progressing in our efforts to reduce capital intensity. In line with our balanced capital allocation framework, we returned $1.7 billion to shareholders in dividends and share buybacks during the year.”

ADM’s corn processing segment posted significantly improved results in 2016, leading the company’s segments for the year. Good performance in sweeteners and starches was driven by solid demand in North America and improved contributions from international operations. Higher results in bioproducts were driven by improved ethanol margins and volumes as a result of robust domestic and export demand. Animal nutrition posted improved results, in part due to operational improvements in the company’s lysine production processes.

Advertisement

Advertisement

Bioproducts $99 million Q4 operating profit compared to $24 million in 2015. That offset less robust earnings earlier in the year for a year-end operating profit of $106 million in bioproducts, down from $149 million for the year ending Dec. 31, 2015. Bioproducts’ Q4 saw operating profits of $249 million compared to $102 million for Q4 2015. The full year saw operating profit in corn processing at $811 million, up from $648 million for the 2015 fiscal year. The company’s focus on cost and efficiency improvements was apparent in the much smaller increases seen in corn processing revenues. Q4 corn processing revenues were $2.5 billion, compared to 2.4 billion in Q4 2015. Year-end corn processing revenues totaled $9.5 billion, compared to $10 billion for the previous year.

In ag services, operating profits for 2016 were down $112 million to $602 million and oilseeds processing down $703 million to $871. The newest segment, Wild Flavors and specialty ingredients, was up $6 million to $286 million. After adjustments for financial gains, corporate results and other segment adjustments, earnings before taxes overall were down $462 million in 2016 at $1.822 billion, compared to 2015 year-end earnings of $2.284 billion.

Corn processing volumes in 2016 were down for the year at 22.3 million metric tons, compared to 2015’s 23.1 million metric tons. The overall decrease in corn processing relates to the disposal of the Brazilian sugar ethanol operations in May, offset partially by the acquisition of the European corn processor Eaststarch CV in November 2015.

In fielding questions following the investor presentation, Luciano said many of the concerns voiced regarding the new Trump administration are based on speculation. Possible tax reforms and sensible regulations could benefit the company. Administration statements on trade are being watched closely. “Trade in our agricultural commodities have tremendous benefits for our farmers and Midwestern states,” Luciano said. In another question he addressed possible changes to the North American Free Trade Agreement, saying. “NAFTA has served agriculture well for the past 20 years,” he said in referring to possible trade changes, “but after 20 years, there is room for improving that. Closing the borders, we think, is a big leap.” ADM’s emphasis on geographical diversification should offer the company options, if trade patterns change.

ADM expects ethanol demand to remain strong in 2017, Luciano said. Gasoline demand is projected to be up 1 to 1.5 percent which should support 14.5 billion gallons of domestic demand. In exports, the company sees no competition in the coming year from Brazil cane ethanol, and, with ethanol currently about 15 cents per gallon cheaper than MTBE, export demand should remain strong at a projected 1 billion to 1.2 billion gallons for 2017, Luciano said.

Advertisement

Advertisement

When asked about the potential sale of its dry mill ethanol assets, Luciano reported talks with different parties are onging. With the talk of federal tax reform, new mechanisms or structures may become available to monetize the assets, he said.

Related Stories

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Upcoming Events