ADM expects improved outlook for ethanol in late 2023

April 25, 2023

BY Erin Krueger

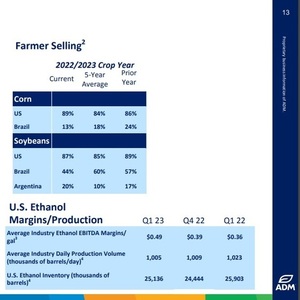

Archer Daniels Midlands Co. released first quarter financial results on April 25, reporting its ethanol operations were impacted by low margins during the three-month period. Despite continued volatility, the outlook for ethanol may be improved later in the year.

ADM’s Carbohydrate Solutions business segment reported $273 million in operating profit for the first quarter, down from $317 million during the same period of last year. The Starches and Sweeteners subsegment reported $307 million in operating profit, down slightly from $316 million during the first quarter of last year. Vantage Corn Processors reported a $34 million loss, compared to a $1 million in operating profit during the first quarter of 2022.

According the company, ethanol margins for the first quarter, pressured by high industry stock levels, were down relative to the first quarter of 2022. The impact of those low margins primarily impacted the Vantage Corn Processors subsegment, which includes ADM’s dry mill facilities.

Advertisement

Advertisement

Vikram Luthar, chief financial officer of ADM, said the company expects ethanol margins to improve during the second quarter, but continue to remain below last year’s margin levels.

Luthar also noted that ethanol remains the most volatile part of ADM’s portfolio. Despite continued low margins during the first half of 2023, Luthar said the company is more constructive about the outlook for ethanol during the remainder of the year. He cited falling ethanol stock levels, high export demand for ethanol, higher blending rates, and strong gasoline demand as some factors contributing to this outlook.

Advertisement

Advertisement

Overall, ADM reported $1.72 billion in segment operating profit for the first quarter, up from $1.54 billion during the same period of 2022. Net earnings attributable to ADM reached $1.17 billion, up from $1.05 billion. Earnings per share reached $2.12, up from $1.86, with adjusted earnings per share at $2.09, up from $1.90.

Related Stories

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

International Air Transport Association has announced the release of the Sustainable Aviation Fuel (SAF) Matchmaker platform, to facilitate SAF procurement between airlines and SAF producers by matching requests for SAF supply with offers.

Alfanar on June 20 officially opened its new office in London, further reaffirming its continued investment in the U.K. The company is developing Lighthouse Green Fuels, a U.K.-based SAF project that is expected to be complete in 2029.

Upcoming Events