ADM reports Q2 operating profits of $724M, down 13% from 2014

Archer Daniels Midland Co.

August 4, 2015

BY Susanne Retka Schill

Archer Daniels Midland Inc. reported adjusted earnings per share of 60 cents for the quarter ended June 30, down from 79 cents in the same period last year. Adjusted segment operating profit was $724 million, down 13 percent from $835 million in the previous year, with net earnings for the quarter of $386 million, or 62 cents per share

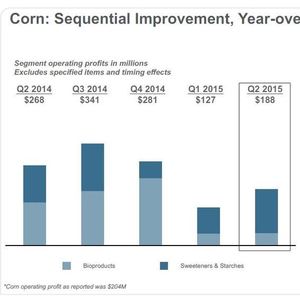

“Our second-quarter results demonstrate the strength and value of our geographic and business-portfolio diversity,” said ADM CEO Juan Luciano. “In corn, domestic and export demand for ethanol was robust, but record industry production limited margins. This was partially offset by strong results from our corn sweeteners and starches business.” Corn processing decreased $80 million on the lower bioproducts results, where the company’s ethanol business is reported. Luciano reported an 18-cent-per-gallon EBITA margin on ethanol for the quarter. Cost reduction improvements have been completed in the company’s wet mills that comprise 1.1 billion gallons of ethanol capacity. “We focused on the wet mills first because they are our oldest and largest,” he added. “We think there are opportunities to improve cost positions in our dry mill, which represent 600 million gallons of nameplate capacity.”

ADM’s oilseed segment reported strong performance, while the company’s new Wild Flavors and Specialty Ingredients segment is making “great progress toward achieving their targeted cost and revenue synergies,” Luciano said. The ag services segment earnings were impacted by lower margins and lower volumes of North American exports due to their weak global competitiveness. The milling business within ag services, however, had record second-quarter results.

Advertisement

During the first half of 2015, the company returned $1.5 billion to shareholders through dividends and the repurchase of 24 million shares. The trailing four-quarter-average adjusted return on invested capital was 9 percent, up 120 basis points year over year and 240 basis points above annual weighted average cost of capital of 6.6 percent.

Several investors posed questions about the ethanol business in the question period following the financial presentation, particularly the impact of sharply petroleum prices. Luciano expressed confidence in ethanol in the medium- and long-term. The continued low price of gas has boosted driving miles 3 percent, he pointed out, while exports are moving at an annualized rate of 800 million gallons. “It’s difficult to call in the short term, and there are risks such as Brazilian ethanol could be coming into the U.S. market,” he said. “But we continue to see international markets develop. There’s 6 billion gallons of MTBE capacity we’re working very hard to replace and ethanol is the most sustainable and lower cost alternative.”

When asked about E15 and higher blends, Luciano said, “When we started with E15, we expected implementation to take five years. We would like to thank Secretary Tom Vilsack for funds to invest in infrastructure.” The USDA investment, along with ethanol industry efforts, is moving the tipping point forward, he said. “We think by 2017 or 2018 this will become a more meaningful part of the supply helping the ethanol supply and demand balance.”

Advertisement

Related Stories

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

Scientists at ORNL have developed a first-ever method of detecting ribonucleic acid, or RNA, inside plant cells using a technique that results in a visible fluorescent signal. The technology could help develop hardier bioenergy and food crops.

Upcoming Events