ADM restarts 2 idle ethanol plants, reports improved Q1 results

April 27, 2021

BY Erin Krueger

Archer Daniels Midland Co. released first quarter financial results on April 27, reporting significantly higher results for its carbohydrate solutions business segment, which includes its ethanol production business, and the restart of two idle ethanol plants.

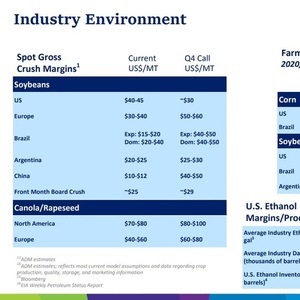

ADM said starches and sweeteners, including ethanol production from wet mills, achieved significantly higher results during the period. The company the segment managed risk exceptionally well, capitalizing on rising prices in the ethanol complex and favorable coproduct values in an industry environment of improving margins and falling inventories. Corn oil results were also significantly higher than the previous year, which had been impacted by substantial mark-to-market effects.

Advertisement

In addition, the Vantage Corn Processors business, also contained under the carbohydrate solutions business segment, achieved significantly improved results, which ADM said was driven by improved margins on the distribution of fuel ethanol and strong performance in USP-grade industrial alcohol.

During ADM’s first quarter earnings call, Juan Luciano, chairman, president and CEO of ADM, said the company is currently seeing positive demand indications in the U.S. ethanol market and is restarting two plants idled during the pandemic.

“About a year ago, we made the difficult decision to idle ethanol production at our dry mills in Cedar Rapids, Iowa, and Columbus, Nebraska,” Luciano said. “We committed that we will not restart those facilities until we saw economic and market factors that would point to a sustainable recovery.” The driving miles have now increased as COVID-19-related restrictions have eased, he added, noting that recent gasoline consumption is getting closer to pre-pandemic levels. Luciano also cited support from the U.S. EPA for the Renewable Fuel Standard and China’s purchases of U.S. ethanol as factors supporting demand growth and improving industry margins.

Advertisement

Luciano also stressed that ADM is continuing to work with interested parties to complete the monetization of its dry mill ethanol assets. “From a portfolio management perspective, we are still committed to reducing our exposure to vehicle fuel ethanol,” he said.

Overall, ADM reported first quarter net earnings of $689 million, up from $391 million reported for the same period of last year. Adjusted net earnings reached $783 million, or $1.39 per share, compared to $361 million, or 64 cents per share, for the first quarter of 2020.

Related Stories

CountryMark on July 22 celebrated the completion of more than $100 million in upgrades at its refinery in Indiana, including those related to soybean oil storage. The facility produces renewable diesel via coprocessing technology.

ATOBA Energy and Air Moana are partnering to implement scalable solutions for the supply of SAF. The collaboration aims to ensure long-term SAF availability while supporting local initiatives to develop sustainable fuel production in Tahiti.

Neste Corp. on July 24 released second quarter results, reporting record quarterly renewable product sales volumes despite weaker margins. SAF sales were up nearly 80% when compared to the first quarter of 2025.

Valero Energy Corp. on July 24 released second quarter results, reporting a profitable three-month period for its ethanol segment. The renewable diesel segment posted a loss, but the company’s new sustainable aviation fuel (SAF) unit operated well.

The IRS on July 21 published a notice announcing the 2025 calendar-year inflation adjustment factor for the Section 45Z clen fuel production credit. The resulting adjustment boosts maximum the value of the credit by approximately 6%.

Upcoming Events