ADM targets Dec. 1 for launch of ethanol subsidiary

October 31, 2019

BY Erin Krueger

Archer Daniels Midland Co. has announced plans to launch Vantage Corn Processors, its stand-alone ethanol subsidiary, by Dec. 1. Ray Young, chief financial officer at ADM, also said the company is working with interested parties on strategic alternatives for the business.

Young made his comments during an Oct. 31 earnings call held by the company to discuss third quarter financial results.

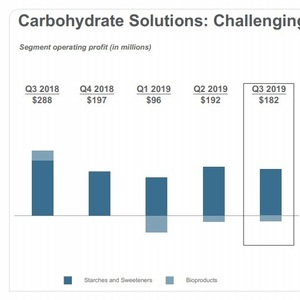

The company reported that third quarter results for its carbohydrate solutions business were substantially lower than last year. The division includes bioproducts, which reported significantly lower earnings due primarily to the unfavorable margin environment for the ethanol industry.

During the call, Young said bioproducts results were significantly lower when compared to the third quarter of last year hear, driven by high industry inventories and higher net corn costs in North America. Those factors led to a challenged industry market environment, he said. Young also noted that ethanol margins remain negatively impacted by the lack of Chinese purchases from the U.S. and by small refinery exemptions (SREs).

Advertisement

Regarding the launch of Vantage Corn Processors, Juan Luciano, chairman and CEO of ADM, said the company is currently targeting Dec. 1. According to Luciano, the launch of the subsidiary is an important step as the company continues to evaluate strategic alternatives for its dry mill facilities.

Young said that ADM is currently working with “quite a few interested parties” and is at the initial stage of some form of sale, joint venture or other type of structured transaction. “We’re…well along our way there in terms of our strategic alternatives,” he said.

Young also briefly discussed the current state of the ethanol industry. He said the ethanol margin environment this year has been extremely challenging and many facilities have idled production. That idling of production capacity, however, has helped drive improved ethanol margins, he said, particularly after Labor Day. “There has been some rebalancing of supply and demand,” Young added, noting that increases in incremental demand are also needed to drive ethanol margins higher.

Advertisement

Moving forward, Young said it’s difficult to see a scenario by which ethanol industry margins in 2020 are worse than in 2019. He said he is somewhat encouraged by the idling of facilities, which shows there seems to be a bit more discipline in the industry right now in terms of trying to better match supply and demand.

“I do believe that it is important that the U.S. ethanol industry is strong, because that results in basically the U.S. agriculture industry being strong,” he said. “Therefore, we remain optimistic that we’ll get toward some solution that will drive incremental demand and hence stronger ethanol margins in the future.”

The bioproducts segment, which includes ethanol, reported an operating loss of $25 million for the third quarter, compared to $43 million in operating profit for the same period of last year. Overall, ADM reported $764 million in adjusted segment operating profit, down from $861 million during the third quarter of 2018. Earnings per share were 72 cents, down from 94 cents, while adjusted earnings per share fell to 77 cents, down from 92 cents.

Related Stories

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

International Air Transport Association has announced the release of the Sustainable Aviation Fuel (SAF) Matchmaker platform, to facilitate SAF procurement between airlines and SAF producers by matching requests for SAF supply with offers.

Alfanar on June 20 officially opened its new office in London, further reaffirming its continued investment in the U.K. The company is developing Lighthouse Green Fuels, a U.K.-based SAF project that is expected to be complete in 2029.

Upcoming Events