ADM: third quarter earnings fall, ethanol margins lower

November 3, 2015

BY Ann Bailey

Archer Daniels Midland’s third quarter adjusted earnings per share fell by 30 percent and adjusted segment operating profit declined by 27 percent from the same period last year, ADM said Tuesday during a conference call to its investors.

The company’s adjusted earnings per share for the third quarter that ended Sept. 30, was 60 cents, compared with 86 cents in the third quarter last year, while its adjusted segment operating profit was $684 million, down from $941 million during the same period a year ago. Third quarter net earnings, meanwhile, were $252 million or 41 cents per share. Segment operating profit was $709 million, ADM said.

“It was a tough quarter,” said Juan Luciano, ADM president and CEO.

Advertisement

Factors that contributed to the decline in the company’s profits include weak ethanol industry margins and a large South American crop that combined with a strong U.S. dollar to reduce North American exports, ADM said.

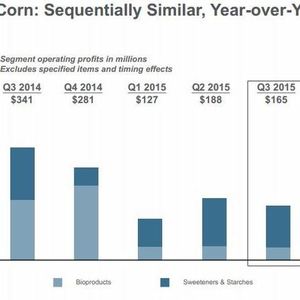

The company’s corn processing operating profit fell from $341 million to $165 million, a decline of slightly more than 50 percent. Corn byproducts’ operating profit during the third quarter declined nearly 80 percent, falling from $183 million to $40 million as a result of low ethanol margins that sharply contrast with last year’s record margin.

Advertisement

While domestic and overseas ethanol demand remain solid, U.S. ethanol industry production levels also are strong and that means ethanol inventory levels are high, ADM said. The total capacity of the U.S. ethanol industry is 14.8 billion gallons.

A strong U.S. dollar, plentiful South American crop and lower margins limited earnings in ADM’s corn processing division, he said. Ethanol industry margins continue “very weak,” Luciano said. The margins will continue to move based on supply and demand, he said.

“The main thing we can do to help our sales is continually work on the cost of our plants,” Luciano said.

The company has continued to execute its strategic plans, including working to improve its operational efficiencies, selling its global cocoa business and acquiring Eatem Foods, ADM said. Specifically for corn, ADM plans to launch commercial production at its Tianjin fructose plant and diversify its global footprint.

Related Stories

General Index and ATOBA Energy are partnering to bring a brand-new vision of how SAF benchmarks are built. SAF indexes need to be tailored to the unique cost profiles of diverse production technologies, the companies said.

The Singapore Airlines Group has signed agreements with Neste and World Energy to acquire sustainable aviation fuel (SAF) and SAF certificates, respectively. The purchases include 1,000 metric tons of neat SAF from Neste.

Biomass Magazine has announced the dates for the 19th annual International Biomass Conference & Expo. The event is scheduled to be held March 31-April 2, 2026, in Nashville, Tennessee, at the Gaylord Opryland Resort & Convention Center.

Keolis Commuter Services, the Massachusetts Bay Transportation Authority’s operations and maintenance partner for the Commuter Rail, has launched an alternative fuel pilot utilizing renewable diesel for some locomotives.

Virgin Australia and Boeing on May 22 released a report by Pollination on the challenges and opportunities of an International Book and Claim system for sustainable aviation fuel (SAF) accounting.

Upcoming Events