ADM to receive bids on dry mill assets; reports Q2 results

Archer Daniels Midland Co.

August 2, 2016

BY Susanne Retka Schill

Seven parties have expressed interest in Archer Daniels Midland Co.’s dry mill ethanol assets, and bids are expected by the end of August, Chairman and CEO Juan Luciano said in the company’s second quarter investor call. The company announced earlier this year that it was undergoing a strategic review of its dry mills. Ray Young, chief financial officer, responded to a question, adding, “We did management presentations to interested parties. We’ve been open minded about alternatives to sales, including joint ventures or other structures.”

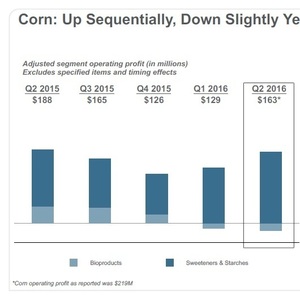

ADM’s bioproducts segment reported a $19 million operating loss in Q2, compared to $43 million in profits in the same quarter last year. Improved profits in sweeteners and starches in corn processing offset the operating loss in bioproducts, where ethanol results are reported.

Sweeteners and starches results increased as the business continued to perform well with higher volumes and pricing, and improved margins from optimizing product grind in the company’s corn wet mills. With ethanol margins continuing to be weak coming into the quarter due to high industry inventory levels, the company decreased production in Q2.

Corn processing saw a segment adjusted operating profit of $163 million in Q2 2016 compared to $188 million in the same period last year. Operating profits for the sweeteners and starchs were $182 million for Q2, compared to $145 million in Q2 2015. The integration of the recent Eaststarch and Morocco wet mill acquisitions has gone better than planned, the company said, contributing to the company’s global sweeteners and starches portfolio and results.

Overall, the publicly traded company reported adjusted earnings of 41 center per share, or net earnings of $284 million for the quarter ended June 30.

Advertisement

“After a challenging start to the year, general market conditions began to turn at the end of the second quarter, providing us with improved opportunities for the second half of the year,” Luciano said. “Weak grain handling margins and merchandising results continued for ag services. Results for corn included strong performance in sweeteners and starches offset by lower ethanol results. Our oilseeds operations leveraged their flex capacity to crush record volumes of soybeans in the second quarter as global protein demand continues to grow. WFSI saw strong growth in flavors and systems, with operating profit in line with the year-ago quarter.”

In talking about driving value creation, Luciano pointed to the expansion of its sweetener and starches footprint globally with the acquisition of a Moroccan wet mill. Process improvements in lysine, another product in the bioproducts segment along with ethanol, should improve margins there, he said. And, the company has completed the sale of its sugarcane ethanol operations in Brazil.

When asked about the ethanol run rate, Luciano pointed out April ethanol inventories were high, running 8 percent above a year ago, while by the end of July there was a more normal inventory situation with ethanol inventories at 3.4 percent above last year. The company will continue to evaluate whether to run for yield or volume, he said. “We will probably continue to run for yield and not slow down like we did in Q2, where we took a hit on reduced volumes.”

The company expects net exports of 850 million to 900 million gallons, Luciano said. While the change in corn policy in China may result in the country making ethanol from the corn, he said there are questions about the quality of corn in storage. “We continue to see other markets coming on strongly, like India. We believe China will be there in the market, and Mexico will join.”

Advertisement

Related Stories

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

Upcoming Events