Advanced biofuel producers ask Congress to extend tax credits

February 12, 2019

BY Erin Krueger

A group of advanced biofuel producers are urging leaders of the U.S. House Committee on Ways and Means to extend two tax credits that are critical to the development and deployment of advanced biofuels.

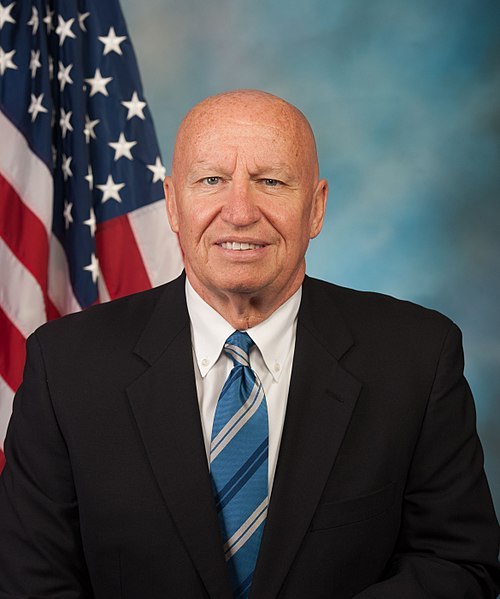

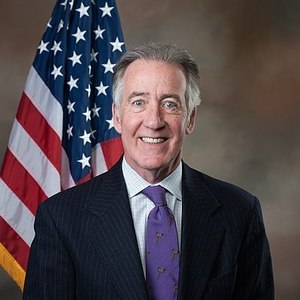

On Feb. 7, Aemetis, Enerkem, Fiberight, Fulcrum Bioenergy, LanzaTech, Novozymes and Velocys sent a letter to Committee Chairman Richard Neal, D-Mass., and Ranking Member Kevin Brady, R-Texas, asking the committee to extend the second generation biofuel producer tax credit (PTC) and the special depreciation allowance for second generation biofuel plant property.

Advertisement

Advertisement

“These incentives expired at the end of 2017 after retroactive extension in the Bipartisan Budget Act of 2018,” the groups wrote in the letter. “Against the backdrop of permanent federal tax incentives for our competitors in the oil and gas industries, lapsing advanced biofuel incentives create inequity and uncertainty for advanced biofuel investors and jeopardize project development in the United States.”

Within the letter, the companies note they are at the forefront of the development of low-carbon, innovative fuels. “We are commercializing technologies to convert municipal solid waste (MSW) into low carbon motor fuels, biochemicals and other products,” they wrote. “The second generation biofuel PTC and depreciation allowance level the playing field and enable our companies to create new jobs, lower carbon emissions and diversify our nation’s energy supply. However, ongoing delay in the effort to extend these credits puts these investments and benefits at risk.”

Advertisement

Advertisement

In the interest of job creation, infrastructure development, innovation, energy security and energy tax parity, the letter asks Congress to immediately pass a seamless, multi-year extension of both credits to insure the advanced biofuel industry will be able to account for those credits in this year’s tax filings.

A full copy of the letter can be downloaded from the Advanced Biofuels Business Council website. https://advancedbiofuels.org/

Related Stories

The U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy is soliciting public comments on a preliminary plan for determining provisional emissions rates (PER) for the purposes of the 45Z clean fuel production credit.

On July 17, Iowa’s cost-share Renewable Fuels Infrastructure Program awarded $1.12 million in grants for 20 applicants to add B11 and 4 applicants to add E15 to retail sites. This was the first meeting following the start of RFIP’s fiscal year.

Par Pacific Holdings Inc., Mitsubishi Corp. and ENEOS Corp. on July 21 announced the signing of definitive agreements to establish Hawaii Renewables LLC, a joint venture to produce renewable fuels at Par Pacific’s refinery in Kapolei Hawaii.

A new study published by the ABFA finds that the U.S. EPA’s proposal to cut the RIN by 50% for fuels made from foreign feedstocks, as part of its 2026 and 2027 RVOs, could stall the growth of the biomass-based diesel (BBD) industry.

Reps. Mike Flood, R-Neb., and Troy A. Carter, Sr., D-La., on July 21 reintroduced the SAF Information Act. The bill directs the U.S. EIA to more explicitly include SAF data in its weekly and monthly reports.

Upcoming Events