AgMRC looks at drivers behind high ethanol blending

Iowa Agricultural Marketing Resource Center

November 9, 2016

BY Susanne Retka Schill

The economic drivers behind recent higher ethanol blending rates were examined by Iowa economic researcher Sampath Jayasinghe in the Renewable Energy Report from the Iowa Agricultural Marketing Resource Center.

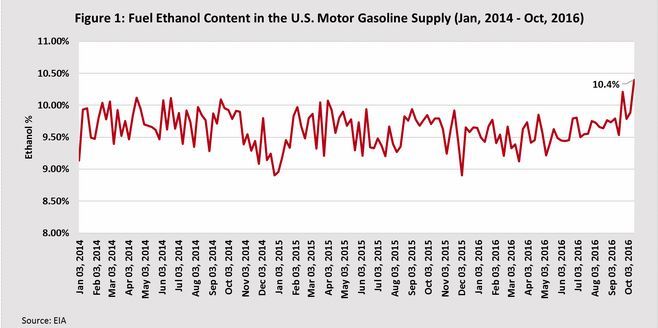

In the week ending Sept. 23, the percentage of ethanol in the U.S. gasoline market averaged 10.21, topping 10 percent for the first time. A few weeks later, Oct. 14, the percentage went slightly higher to 10.4, as reported by the U.S. Energy Information Administration.

There are several economic drivers beyond the simple one, that the value of blending ethanol is determined by the value of petroleum-crude oil and gasoline, Jayasinghe writes.

Advertisement

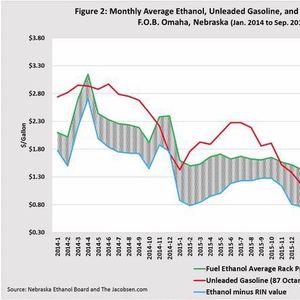

“Ethanol blending is economically attractive when the gasoline-ethanol price spread is larger,” he wrote. And, when the economics of ethanol blending with gasoline is unfavorable based on current wholesale prices, a higher renewable identification number (RIN) price can reduce the cost of ethanol blending. He cited a 2015 analysis by S. Hill at the EIA that described this as the “net of RIN”—ethanol minus RIN value—which makes it harder to choose the option of purchasing RINs rather than blending ethanol. An earlier analysis by AgMRC found the value of RINs increases as the blending economics become unfavorable, and as the supply of RINs becomes tighter.

“The major assumption in the above descriptions is that the blender is the obligated party and has compliance options that must be met by either buying ethanol or buying RINs, and there is no other reason to buy ethanol,” Jayasinghe writes, adding there are other factors that limit that reasoning, such as not all blenders are obligated parties and ethanol also is needed as an octane booster, particularly to meet reformulated gasoline specifications.

Advertisement

To read the complete analysis, click here.

The Renewable Fuels Monthly Report is produced as a partnership between the AgMRC operated by the Value Added Agriculture Program at Iowa State Extension and Outreach and the Iowa Grain Quality Initiative and is authored by Decision Innovation Solutions LLC, an economic research and analysis firm located in Urbandale, Iowa.

Related Stories

CountryMark on July 22 celebrated the completion of more than $100 million in upgrades at its refinery in Indiana, including those related to soybean oil storage. The facility produces renewable diesel via coprocessing technology.

ATOBA Energy and Air Moana are partnering to implement scalable solutions for the supply of SAF. The collaboration aims to ensure long-term SAF availability while supporting local initiatives to develop sustainable fuel production in Tahiti.

While final IRS guidance is still pending, the foundation of the 45Z program is well defined. Clean fuel producers should no longer be waiting; they can now move forward with critical planning and preparation, according to EcoEngineers.

Neste Corp. on July 24 released second quarter results, reporting record quarterly renewable product sales volumes despite weaker margins. SAF sales were up nearly 80% when compared to the first quarter of 2025.

Valero Energy Corp. on July 24 released second quarter results, reporting a profitable three-month period for its ethanol segment. The renewable diesel segment posted a loss, but the company’s new sustainable aviation fuel (SAF) unit operated well.

Upcoming Events