Alto announces plans to further diversify operations

November 8, 2022

BY Erin Voegele

Alto Ingredients Inc. on Nov. 7 released third quarter financial results and announced it has entered into a $125 million senior secured term loan facility that will support efforts to complete strategic upgrades, including those related to corn oil, protein and yeast production, renewable natural gas (RNG) and carbon capture and storage (CCS) opportunities

Alto Ingredients CEO Mike Kandris discussed the loan during the company’s third quarter earnings call, noting it will help accelerate Alto’s diversification growth strategies, contribute significantly to the company’s top and bottom lines, and further insulate it from commodity and margin swings. He said the financing circumvents the need to rely solely on organic cash flow, facilitating the timely completion of capital projects that are lager in magnitude, scope and cost benefit to all stakeholders by building a more stable business. With the bolstered capital resources, Kandris said the company plans to undertake these key projects simultaneously.

According to Kandris, Alto plans to add new natural gas and RNG pipelines to connect directly to nearby major hubs. He said the project will increase the company’s access to more competitive natural gas, better address future energy needs, including supporting carbon capture, and improve Alto’s ability to monetize the RNG the company currently produces and flares. Kandris said the natural gas/RNG project is in the design and permitting phase and is expected to be completed in 2024.

Advertisement

Citing the company’s 24 years as a reliable supplier to the pet food industry, Kandris also announced plans to expand its operations into the commercial production of yeast through an aerobic fermentation process at its wet mill. “Although primary yeast production has a different process and different market, many existing as well as prospective customers have expressed interest in this product for years,” he said.

The $125 million in financing will also support efforts to implement CCS. Kandris said the Alto is currently working with “various parties to finalize the best option for Alto’s carbon sequestration future,” adding that the company is finalizing the selection of both its front-end engineering and design partner and its carbon transportation pipeline and sequestration developer.

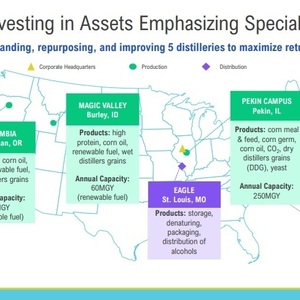

Regarding third quarter operations, Kandris called the three-month period “challenging” and said Alto’s results were negatively impacted by low margins, high corn prices, logistical constraints and the maintenance shutdown of its ICP facility. He also discussed progress with ongoing improvement projects. He said the first phase of the CoPromax system installation at the company’s Idaho plant is complete, with corn oil production meeting expectations. Given the positive results at the Idaho facility, Kandris said Alto plans to proceed with similar installation at its other dry mills. The second phase of the CoPromax installation at the Idaho plant will enable enhanced protein production. That installation is expected to be complete during the first quarter of 2023.

Kandris also reported that construction is underway on the corn storage expansion project in Illinois, with that project expected to be complete before the end of the year. The project will double corn storage capacity at the site, helping reduce the volatility of production input costs. In addition, Alto is upgrading equipment related to its specialty alcohol production and has replaced two boilers at its Pekin campus.

Advertisement

Alto produced 74.7 million gallons of ethanol during the third quarter, up from 60.6 million gallons produced during the same period of last year. Capacity utilization was at 85 percent, up from 59 percent.

Fuel ethanol gallons sold reached 53 million during the third quarter, compared to 38.3 million gallons reported for the same quarter of 2021. Specialty alcohol gallons sold reached 23.3 million, up from 19.87 million, with third party renewable fuel gallons sold at 27.6 million, down from 67.2 million.

Net sales for the third quarter were $336.9 million, compared to $305.6 million during the third quarter of last year. Gross loss was $356.7 million, compared to $3.4 million. Net loss available to common stockholders was $28.4 million, or 39 cents per share, compared to $3.5 million, or 5 cents per share.

Related Stories

The U.S. EPA on May 14 delivered two RFS rulemakings to the White House OMB, beginning the interagency review process. One rule focuses on RFS RVOs and the other focuses on a partial waiver of the 2024 cellulosic RVO.

The U.S. EPA on May 15 released data showing nearly 1.79 billion RINs were generated under the RFS in April, down from 2.09 million generated during the same month of last year. Total RIN generation for the first four months of 2025 was 7.12 billion.

Calumet Inc. on May 9 announced sustainable aviation fuel (SAF) capacity at its Montana Renewables biorefinery is expected to reach 120 MMgy to 150 MMgy sooner than previously reported for a fraction of the originally expected cost.

Tidewater Renewables on May 8 announced that its 3,000-barrel-per-day renewable diesel plant in Prince George, British Columbia, operated at 75% capacity during the first quarter, up from 71% during the same period of last year.

Aemetis Inc. released Q1 results on May 8, reporting increased biogas production, progress with efficiency improvements at the Keyes ethanol plant, and resumed biodiesel deliveries. Financing activities are also underway for a proposed SAF project.

Upcoming Events