Alto reports challenging Q4, continues to diversify operations

March 13, 2023

BY Erin Krueger

Alto Ingredients Inc. on March 9 released fourth quarter results, reporting that the company was negatively impacted last year by commodity price swings, which CEO Mike Kandris said underscore the need to reduce reliance on fuel ethanol margins. During an earnings call, Kandris discussed ongoing work to implement projects to add high protein and corn oil extraction capabilities at Alto’s biorefineries. He also highlighted progress with carbon capture and storage (CCS) and renewable natural gas (RNG) projects.

According to Kandris, Alto was impacted in the fourth quarter by extreme commodity volatility in the form of regional natural gas price spikes, high corn basis, and a dramatic decline in ethanol prices. “These factors outweighed our performance in what was already a challenging year,” he said, noting the company’s 2022 results clearly underscore the need to further mitigate the impact of renewable fuel and commodity price swings.

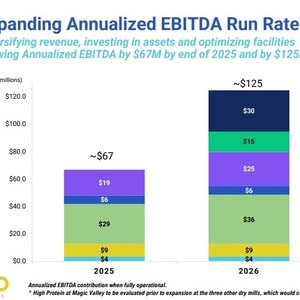

Kandris said Alto’s near-term and long-term goals continue to focus on diversified margin expansion. He said the company is increasing production of several products, including grain neutral spirits, corn oil, high protein products and primary yeast. He also noted Alto is in the advanced stages to launch its CCS project and is working to execute strategies to increase plant efficiency and reliability, including through additional corn storage, the installation of a natural gas pipeline, converting biogas into RNG, building energy cogeneration capabilities at the Pekin, Illinois, campus, and upgrading other types of equipment.

Advertisement

Improvements made at the Pekin campus have enabled Alto to introduce a new high-quality 190 proof and low-moisture 200 proof grain neutral spirits to customers in the beverage, food, flavor, personal care and pharmaceutical industries, Kandris said.

Alto is also diversifying products at its dry mill facilities. In October, the commissioned a corn oil technology installed at its Magic Valley facility in Idaho. Kandris said the facility experienced increased yields of approximately 40 percent. When combined with high protein technology, the company expected to reach 50 percent or better increased yield.

In December, natural gas prices in the West spiked, increasing more than 400 percent when compared to natural gas prices during the third quarter. As a result, Kandris said Alto moderated production at its Columbia plant in Oregon and temporarily hot idled the Magic Valley facility. Taking advantage of the situation, Kandris said the company focused its attention on installing a high-protein CoPromax system, which is currently in the final stages of construction. He said the high-protein and corn oil systems are expected to be operating at full capacity by the third quarter of this year.

Due to the success experienced at Magic Valley, Alto plans to install corn oil technology at its other three dry mill facilities. Kandris said that once the high protein system is fully operational at Magic Valley, the company will evaluate and anticipate rolling that technology at its dry mills as well.

Advertisement

Regarding CCS, Kandris said Alto is in advanced negotiations for turnkey transportation, sequestration and monitoring services. He said the company is also finalizing the selection of engineering services for the design and installation of the capture, compression and energy requirements at the Pekin campus. Kandris indicted the project could be operational by 2026.

Other improvements at the Pekin campus included additional corn storage, which is expected to be fully operational during the second quarter, and the installation of a new natural gas pipeline that would reduce energy costs and allow Alto to inject RNG. Alto currently flares most of the biogas it produces. The new natural gas pipeline would allow the company to upgrade its biogas into RNG and inject it into the pipeline for distribution. Kandris said the pipeline could be fully operational in 2024. Alto is also finishing a third-party study focused on the potential to add cogeneration capabilities at Pekin.

Alto reported a gross loss of $21.6 million for the fourth quarter, compared to a pross profit of $42.1 million reported for the same period of 2021. Operating loss was $31.3 million, compared to an operating profit of $37.3 million. Net loss available to common stockholders was $33.4 million, or 46 cents per share, compared to net income of $35.4 million, or 49 cents per diluted share, during the fourth quarter of 2021.

Related Stories

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

International Air Transport Association has announced the release of the Sustainable Aviation Fuel (SAF) Matchmaker platform, to facilitate SAF procurement between airlines and SAF producers by matching requests for SAF supply with offers.

Alfanar on June 20 officially opened its new office in London, further reaffirming its continued investment in the U.K. The company is developing Lighthouse Green Fuels, a U.K.-based SAF project that is expected to be complete in 2029.

ATR and French SAF aggregator ATOBA Energy on June 19 signed a memorandum of understanding (MOU) to explore ways to facilitate and accelerate sustainable aviation fuel (SAF) adoption for ATR operators.

Upcoming Events