Ample corn supplies expected, modestly higher prices forecast

monthly Ag Marketing Resource Center

April 30, 2015

BY Susanne Retka Schill

As corn planting gets in full swing across the Corn Belt, ag economists are looking at projections and implications. Planted corn acres are projected lower and yields are expected to be slightly below the trend-line, writes retired University of Iowa biofuels economist, Robert Wisner, in an analysis for the monthly Ag Marketing Resource Center renewable energy report.

“The intended corn planted area and this yield (165 bushels per acre) would produce a crop approximately 5 percent smaller than last year but only 1.1 percent less than projected corn use for the current marketing year,” Wisner suggests. Historically, farmers plant slightly more corn that indicated in the Prospective Plantings report, he adds. Yield projections, of course, are tentative. Wisner explains his yield projections are based on favorable, but not perfect conditions, and factor in an expected reduction in fertilizer rates and lower-cost seed use by farmers as a response to new-crop corn prices being lower than full cost of production.

Advertisement

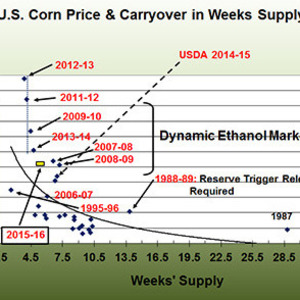

“With a small increase in corn use in the 2015-16 marketing year, this combination of production and use would leave ending U.S. corn carryover stocks on Aug. 31, 2016, at approximately a 5.8 weeks supply,” Wisner writes. “While that would be down from an anticipated 7 week supply this year, it would be considerably larger than 2010-11 through 2013-14 carryover stocks.” The minimum Aug. 31 corn stocks needed by the grain industry are approximately 3.8 to 4.0 weeks supply. Lower than that, prices tend to increase. The historical relationship between ending corn carryover stocks and the U.S. season average corn price is shown in the accompanying chart.

“Our medium projections show a U.S. season average corn price of $4.20 per bushel and an Iowa average price of about $4.15 per bushel, with Iowa harvest-time average prices of approximately $3.70 per bushel,” Wisner writes. “The harvest-time prices could offer ethanol processors opportunity to profitably cover supplies needed later in the year, depending on basis prospects, the carry in the futures market this fall, and forward pricing opportunities for ethanol and DDGS. The projected season average corn price, with ethanol prices continuing at the current level would weaken ethanol profit margins from recently depressed levels.”

Advertisement

Wisner goes on to discuss the gasoline marketing, concluding that there is significant upward price risk. “But without changes in the dollar’s value or increased political disruption in the Middle East, a large increase in gasoline and ethanol prices may not occur in the next crop season. Higher oil and gasoline prices would allow the ethanol industry to more easily adjust to modestly higher corn prices and maintain corn demand for ethanol production.”

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

Upcoming Events