'Back to the Future' With N-butanol

PHOTO: KIMM ANDERSON

May 20, 2015

BY Holly Jessen

Running a 21 MMgy ethanol plant in an industry led by 100 MMgy-plus facilities isn’t easy. Smaller plants are at a major disadvantage, says Dana Persson, who served as CEO of Central Minnesota Ethanol Co-op for four years. “Being a small plant, you question what your future might be, and what that means to the plant, the corn farmers and shareholders.”

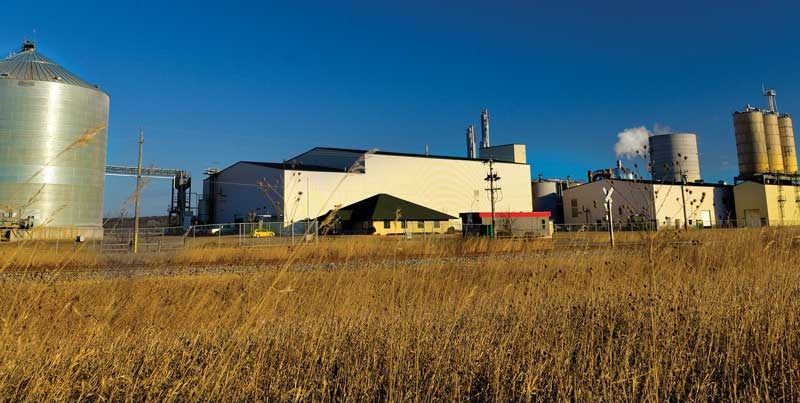

Then, along came Green Biologics Inc., a wholly owned subsidiary of a United Kingdom industrial biotechnology and renewable chemicals company, Green Biologics Ltd. The company’s business model is to own and operate or become a majority shareholder in ethanol plants for normal butanol (n-butanol) and acetone production, says Joel Stone, president of Green Biologics. The plan is to add bolt-on production capacity at ethanol plants or retrofit them, like at newly renamed Central Minnesota Renewables in Little Falls, where Persson now serves as interim general manager of the plant and vice president for Green Biologics. Pulp and paper mills are another potential target, Stone says.

Acquisition of the Little Falls facility, which closed in December, was the first step. Detailed engineering to retrofit it for n-butanol and acetone production was ongoing in April, with construction expected to begin in early summer, he says.

The plant will continue to produce ethanol with minimal disruption during the transition to renewable chemical production, which is expected to be complete in mid-2016.

Ethanol, a two-carbon alcohol, and n-butanol, a four-carbon alcohol, can both be produced through fermentation of corn, other crops or biomass. Although new distillation equipment will be installed, most equipment will be repurposed, including fermenters, where Clostridia, small rod bacteria, will replace the use of yeast.

Going from ethanol to chemical production is a steep learning curve for the employees, Persson says. The fermentation process is more detailed, for one thing. The facility will also produce another coproduct, high-protein fermentation broth concentrate, in addition to distillers grains. “There are going to be some things that are pretty different but there are some things that will be the same,” he says.

Still, the transition into renewable chemicals has been welcomed with open arms, Stone says. In fact, some ethanol plant shareholders rolled over their investments to become minority shareholders in the new company. That enthusiasm also includes everyone from the former ethanol plant employees, who now work for the new company, to the local community, and all the way up to Minnesota government officials. In late April, Green Biologics collected the Standout Fundraising Achievement of the Year award from Cleantech Group for raising more than $100 million since December 2013, using a creative combination of of venture debt and equity.

The retrofit model is one that Green Biologics thinks could work at additional ethanol plants, Stone says. The bolt-on approach, on the other hand, could be pursued by ethanol producers who want to continue producing fuel while diversifying risk. For example, a 100 MMgy nameplate facility operating close to 120 MMgy could add on n-butanol and acetone production, allowing the company to operate more efficiently at 90 MMgy and produce renewable chemicals with some of its feedstock. “Our most logical-sized facility would be producing somewhere between 40,000 and 50,000 metric tons of total solvent, which would be the butanol, acetone and ethanol,” he says.

Old Made New

Although, currently, nearly 100 percent of the global market for n-butnaol and acetone is petroleum derived, producing it from renewable sources isn’t a new concept. “We say it’s back to the future,” Stone says. The fermentation process to produce acetone, butanol and ethanol (ABE) from corn mash or molasses was commercialized in 1915 in England. It wasn’t until 1938 that a process was developed for petrochemical-derived n-butanol and acetone and, by the late-1940s, the last plant producing the chemicals from renewable sources had closed.

In the 1990s David Ramey began to champion butanol as a drop-in replacement for gasoline. In 2005, he drove 10,000 miles in an unmodified 1992 Buick Park Avenue powered by 100 percent butanol. He also founded ButyFuel LLC, which merged with Green Biologics in 2012. While Ramey focused on butanol or isobutanol, primarily a fuel blendstock, Green Biologics has its sights set on n-butanol. Both are types of butanol with similar characteristics but dramatically different uses.

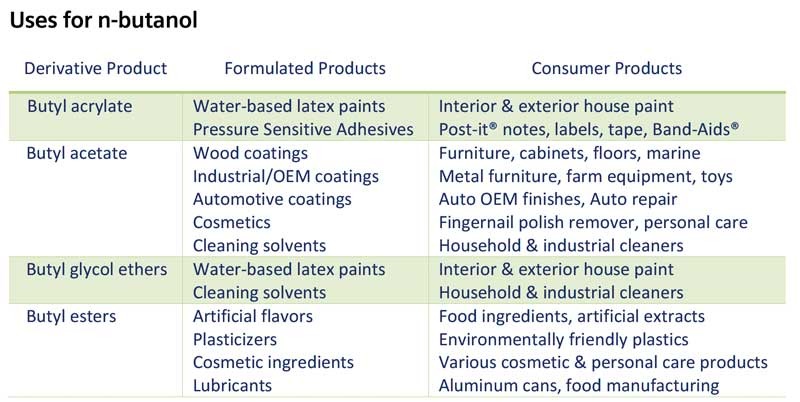

N-butanol is an ingredient in products like moisturizers, fragrances and other personal care products and n-butanol derivatives are used in paints, inks and more. Acetone is a chemical found in nail polish remover and can also be transformed into rubbing alcohol, which can be an ingredient in flavor and fragrance compounds. “We’re not locked into a single end use for these products,” Stone says. “There are a myriad of uses of normal butanol and acetone through different consumer products.”

The global annual demand for n-butanol is more than 8 billion pounds with 4.4 percent yearly growth, Stone says. It has an intermediate market valued at more than $6 billion as well as downstream chemical intermediate markets valued at more than $40 billion. And, there’s a significant demand to replace petroleum-based products with biobased alternatives. “The mix of the normal butanol and acetone that we are producing will be marketed for a value that is probably double what fuel ethanol would market for,” Stone says, adding that chemical markets are not as volatile as fuel markets. “That’s a good rule of thumb. It could be significantly higher, depending on market conditions.”

Just as the ethanol industry has optimized operations over time, Green Biologics has improved on the ABE process, and plans to continue to do so. R&D work on ABE fermentation has been done at a pilot plant in Columbus, Ohio, and a demo-scale facility in Emmetsburg, Iowa, which has been operating continuously since 2014, Stone says.

At the Little Falls facility, the plant will continue to produce a small amount of ethanol after the conversion to n-butanol and acetone production. However, it’s expected to be only about 2 percent of total production and as the company optimizes its production process, the amount of ethanol produced may go to zero, he adds.

In addition, Green Biologics believes the process is superior to petrochemical processes. It’s at least 45 percent more carbon efficient, produces higher purity materials and results in n-butanol with lower water content and no hydrocarbon impurities, which are intrinsic to the oil refinery produced n-butanol. The acetone produced will also be free of toxic impurities.

Author: Holly Jessen

Managing Editor, Ethanol Producer Magazine

701-738-4946

hjessen@bbiinternational.com

Advertisement

Advertisement

Advertisement

Advertisement

Related Stories

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

EcoCeres Inc. has signed a multi-year agreement to supply British Airways with sustainable aviation fuel (SAF). The fuel will be produced from 100% waste-based biomass feedstock, such as used cooking oil (UCO).

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Upcoming Events