Big corn crop expected, the question being how big?

July 11, 2014

BY Susanne Retka Schill

Great growing conditions have the industry speculating on just how big the corn crop will be. USDA’s July 11 supply/demand report pegs the 2014 corn crop at 13.86 billion bushels, 65 million bushels below last year’s record and 75 million bushels below last month’s report, based on a record yield of 165.3 bushels per acre and the agency’s projected harvested acres of 83.8 million acres. “Favorable early July crop conditions and weather support an outlook for record yields across most of the Corn Belt, however, for much of the crop, the critical pollination period will be during middle and late July,” the report said.

Adjustments to carryin stocks and lowered feed use, however, mean the overall corn supply is projected 75 million bushels higher than the previous month’s report, resulting in projected ending stocks of 1.8 billion bushels, well above the 1.246 billion bushel estimated 2013 ending stocks.

The strong corn report reflects good growing conditions. USDA’s July 7 crop progress report pegged 21 percent of the crop in excellent condition across 18 corn producing states, and another 54 percent in good, with 20 percent in fair condition and only 5 percent in poor or very poor condition.

Taking an independent view, the Genscape LandViewer weekly report for July 4 showed great corn growing conditions across the Corn Belt, with excellent crop condition reported in Illinois and Indiana and very good crop condition indicated in Ohio and Iowa. The LandViewer analysis of growing degree days indicated the crop should be tasseling in the area from Kansas and across Missouri and all but the northern third of Illinois and Indiana. LandViewer combines ground observations from 12 independent crop consultants with geospatial data such as growing degree days, nighttime temperatures and multiple other variables to offer early yield projections.

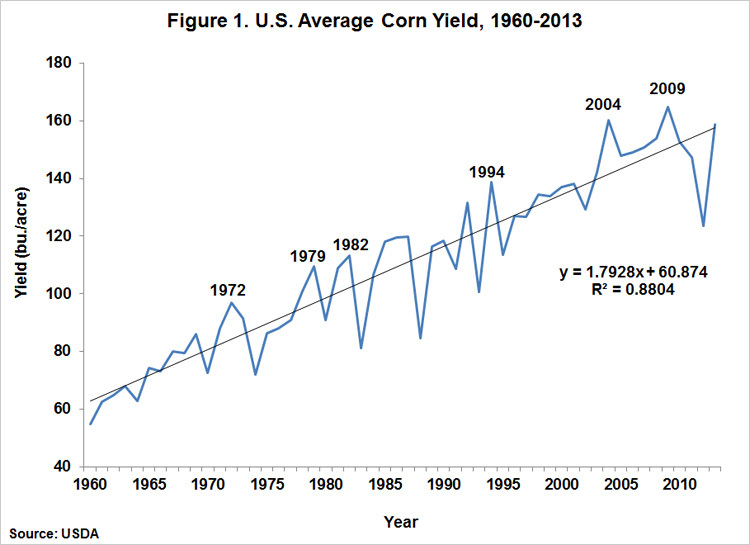

The favorable growing conditions and high percentage of crop in good or excellent condition set University of Illinois economists Darrel Good and Scott Irwin to considering whether the 2014 crop will set new records, particularly for average yield, “perhaps exceeding the previous record yield of 164.7 bushels in 2009 by a considerable margin.” The economists recently posted their analysis, “The 2014 U.S. Average Corn Yield: Big or Really Big?” on FarmDocDaily.

Advertisement

Advertisement

The yield could be as high as 173.6 bushels, they said, if follows the average above-trend yield in the previous six highest yielding years. That record yield times USDA’s projected harvested acres of 83.8 million acres would bring in a bin-busting 14.5 billion bushels.

The 173.6 bushel projection is based on an analysis of six previous high-yielding years, that showed an average yield 14.1 bushels higher than the yield trend at the time. June weather conditions, however, were not consistent with those experienced in the previous six highest yielding years in the heart of the Corn Belt, they said. The weather in the first week of July, was very favorable, though. “Temperatures in major corn producing states averaged two to seven degrees below normal and precipitation was near average over a widespread area. Near average precipitation and below average temperatures are expected over the next two weeks. Such weather would keep expectations of a very high average corn yield alive. History suggests that cool, moist conditions need to persist through August for the U.S. average yield to be equivalent to that of the other high yielding years examined in this article.”

The USDA July 11 supply/demand report is also watched closely for its adjustments to projected use and ending stocks. Corn ending stocks were projected up 75 million bushels with a higher carryin and lower feed and residual use more than offsetting the small acreage-driven decline in production. The projected range for the season-average corn price was lowered 20 cents on each end to $3.65 to $4.35 per bushel. Projected corn feed and residual use was lowered 125 million bushels based on lower-than-expected March-May disappearance as indicated by the June 1 stocks.

Corn used to produce ethanol was projected 25 million bushels higher based on the pace of ethanol production to date and lower projected sorghum food, seed, and industrial use, most of which is for ethanol. Projected 2013/14 farm prices for corn and sorghum were lowered this month as favorable weather for developing 2014 crops reduce summer price prospects.

Advertisement

Advertisement

Global coarse grain supplies for 2014/15 are projected 7.0 million tons higher with larger beginning stocks for the United States, Brazil, and China and larger production for China, the EU, Ukraine, Russia, and Serbia. Lower corn production for the United States and lower corn, barley, and oats production for Canada partly offset this month’s increases in world coarse grain output.

Foreign corn production for 2014/15 is raised 1.7 million tons. China corn production is up 2.0 million tons on higher expected area. China 2013/14 corn production is also raised, up 0.8 million tons based on the latest government estimates that include higher area. EU 2014/15 corn production is raised 0.4 million with larger crops expected in Germany and France. Serbia corn production is also raised 0.3 million tons. Partly offsetting is a 0.9-million-ton reduction in Canada corn reflecting the lower planted area recently reported by Statistics Canada. Brazil corn production is unchanged for 2014/15, but raised 2.0 million tons for 2013/14 based on higher area indications for second crop corn.

Global 2014/15 corn trade is nearly unchanged with a reduction for Canada exports partly offset by an increase for Serbia. For 2013/14, world corn trade is raised with higher imports for the EU and South Korea more than offsetting a reduction for China. Corn exports for 2013/14 are raised for Canada, the EU, and Russia. Global corn consumption is lowered slightly for both 2013/14 and 2014/15 mostly reflecting the lower U.S. feed and residual use projections. Global 2014/15 corn ending stocks are projected 5.4 million tons higher with increases for China, Brazil, and the United States more than offsetting the Canada reduction.

Related Stories

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Scientists at ORNL have developed a first-ever method of detecting ribonucleic acid, or RNA, inside plant cells using a technique that results in a visible fluorescent signal. The technology could help develop hardier bioenergy and food crops.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

Upcoming Events