Bill aims to reform EPA's SRE process, increase transparency

June 14, 2019

BY Erin Krueger

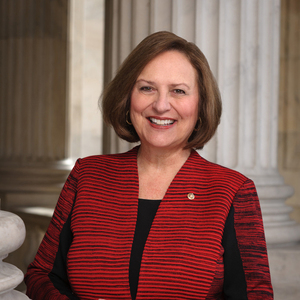

Sens. Deb Fischer, R-Neb., and Tammy Duckworth, D-Ill., introduced the RFS Integrity Act of 2019 on June 13. The bill aims to bring transparency and predictability to the U.S. EPA’s small refinery exemption (SRE) process.

The legislation would require small refineries to petition for Renewable Fuel Standard hardship exemptions by June 1 of each year. The deadline would ensure that EPA can properly account for exempted gallons in the annual renewable volume obligations (RVOs) it sets each November.

The bill also aims to increase transparency by ensuring that key information surrounding SREs is made publicly available. In addition, the EPA would be required to report to Congress on the methodology it uses when grading SREs, a process that is currently carried out behind closed doors with little to no congressional oversight.

“The bipartisan solution we are putting forth today builds off of the recent victory on year-round E-15 sales,” Fischer said. “In the past, EPA has issued small refinery exemptions after the Renewable Volume Obligations have already been determined. That’s unfair, and it hurts our farmers and ethanol producers. This bill would shine a light on what’s been an obscure exemption process and help promote economic growth in rural America.”

Advertisement

“Farmers across Illinois and throughout the Midwest are hurting and ethanol plants are idling while this administration is abusing the small refinery exemption program to undermine the bipartisan Renewable Fuel Standard,” Duckworth added. “I am proud to work with Senator Fischer to introduce this bipartisan legislation to bring much-needed transparency to the waiver process and prevent it from being misused to benefit billion dollar oil companies at the expense of hardworking Americans.”

To date, Sens. John Thune, R-S.D.; Joni Ernst, R-Iowa; and Chuck Grassley, R-Iowa, have signed on to cosponsor the bill.

Several biofuel trade groups have spoken out in support of the bill.

The Renewable Fuels Association applauded the introduction of the legislation. “We are grateful for the leadership of Senators Fischer and Duckworth on this issue,” said Geoff Cooper, president and CEO of the RFA. “Refiner exemptions have had a devastating impact on the ethanol industry, erasing 2.6 billion gallons of RFS demand over the past two years. This week, President Trump came to Iowa to celebrate the promise of homegrown renewable fuels, only days after EPA’s final rule allowing year-round sales of E15. Any additional small refiner exemptions granted by EPA would totally undermine the demand gains we expect to see from year-round E15, hitting the rural economy hard. The legislation introduced today provides important reforms that would prevent further abuse of the small refiner exemption provision, providing a boost to ethanol producers, farmers and American families each time they fill up at the pump.”

Advertisement

The American Coalition for Ethanol has also announced its support of the bill. “ACE thanks Senators Fischer and Duckworth for bipartisan legislation to correct EPA’s brazen mismanagement of the RFS small refinery exemption provision,” said Brian Jennings, CEO of ACE. “Under President Trump, EPA has retroactively granted more than 50 so-called hardship waivers for small refineries, erasing 2.61 billion gallons worth of the RFS blending obligations for 2016 and 2017 compliance years, and has 39 more requests pending for 2018. As we celebrated year-round access for E15 this week in Iowa with President Trump, industry stakeholders pointed out that without reallocation of the demand destruction through these refinery waivers the net effect of EPA’s actions still puts us in a hole.

“The uptick of waivers without reallocation as required by law also means the Congressional intent of the RFS is undermined,” Jennings continued. “This legislation would help ensure EPA’s abuse of small refinery exemptions is put to a stop by requiring timely reallocation of any granted waiver and ensuring the statutory RFS volumes are enforced. ACE is grateful for the leadership of Senators Fischer and Duckworth to help get the RFS back on track by following the rule of law.”

Growth Energy said the bill will provide transparency and accountability over the SRE process. “EPA’s track-record on handouts to big oil through small refinery exemptions has eliminated markets at a time when growers and producers face true economic hardship,” said Emily Skor, CEO of Growth Energy. “U.S. ethanol consumption recently fell for the first time in 20 years. Across the heartland, many biofuel plants have shut their doors or idled production. Farm income plummeted $11.8 billion over just the last three months, the steepest drop since 2016. It’s clear that the ‘economic hardship’ is happening in America’s farm belt—not in oil company boardrooms.

“This bipartisan legislation from Senators Fischer and Duckworth can help restore transparency and integrity to the abusive exemption process,” Skor continued. “By providing the public with more information, accounting for exemptions and ensuring biofuel targets are met in full, farmers and producers across the nation can count on stable biofuels

Related Stories

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

EcoCeres Inc. has signed a multi-year agreement to supply British Airways with sustainable aviation fuel (SAF). The fuel will be produced from 100% waste-based biomass feedstock, such as used cooking oil (UCO).

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Upcoming Events