BIO report demonstrates economic power of US bioeconomy

SOURCE: Biotechnology Innovation Organization

March 25, 2025

BY Erin Voegele

The Biotechnology Innovation Organization, in partnership with Kearney, a global management consulting firm, on March 24 released a report showing the U.S. bioeconomy currently contributes $210 billion in direct economic impact to the U.S. economy, excluding healthcare. Indirect benefits push the total impact beyond $830 billion.

The sector currently supports 430,000 jobs across various industries, including biobased materials and polymers, biobased industrial chemicals, biofuels, and biobased food ingredients and additives.

By 2030, the report predicts the full economic potential of the bioeconomy could reach $400 billion, nearly doubling its current impact. According to BIO, the report’s findings reinforce the bioeconomy’s status as an essential economic driver.

Advertisement

"The power of biotechnology in food, agriculture, and manufacturing plays a pivotal role in fostering long-term economic growth and enhancing our national security," said John Crowley, president and CEO of BIO. "The U.S. must now take a series of bold measures to modernize the regulatory frameworks that govern the review and approval process of new biotechnologies to ensure that our nation continues to lead the world in agricultural innovation.”

“For the first time, we have a comprehensive, data-driven analysis that quantifies the economic impact of this critical segment of the bioeconomy,” said Sylvia Wulf, interim head of BIO’s Agriculture and Environment Center of Excellence. “This report highlights the immense economic contributions of plant, animal, and biobased product innovations. These insights underline the urgency of public policies and investments that will unlock the bioeconomy’s full potential.”

The U.S. industrial biobased products industry had an estimated economic impact of $172 billion in 2023. The report predicts the economic impact of the industry could expand to $247 billion to $345 billion by 2030, depending on the impact of key market drivers and barriers to growth. The industry is defined to include biofuels, industrial chemicals, biotech-based materials and polymers, and biotech-based food ingredients and additives.

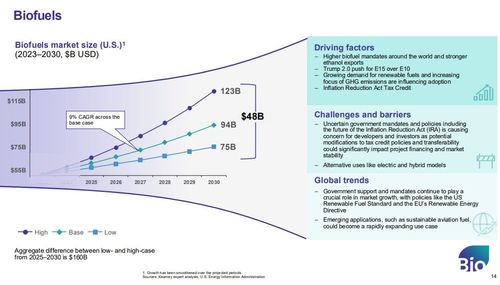

According to the report, the economic impact of the U.S. biofuels sector could grow to as high as $123 billion by 2030, up from approximately $55 billion in 2024. Factors driving expected growth in biofuels include higher mandates around the world, strong ethanol exports, a potential move to E15, increasing focus on greenhouse gas (GHG) emissions reductions, and Inflation Reduction Act tax credits.

Advertisement

The biofuels sector, however, is also experiencing uncertainty around government mandates and policies, including IRA tax credits. The report notes that developers and investors are concerned about potential modification to tax credit policies, which could significantly impact project financing and market stability.

The economic impact of the biobased material and polymers sector could reach as high as $38 billion by 2030, according to the report. The economic impact of the sector was less than $25 billion in 2024. According to the report, government policy and consumer awareness, emerging bioidentical polymers, and emerging technologies are driving growth in the sector. Price competitiveness, the lack of a universal carbon tax credit and a lack of logistical advantage in the U.S. are some factors that could limit growth in the sector.

The report also indicates that the biobased industrial chemicals sector could create an economic impact of up to $50 billion in 2030, up from approximately $22 billion in 2023, driven by environmental factors. The lack of a carbon tax, however, could impede potential growth in the sector.

A full copy of the report is available on the BIO website.

Related Stories

BWC Terminals on April 22 celebrated the official completion of its expanded renewable fuels terminal at the Port of Stockton. The facility is designed to safely and efficiently transfer renewable diesel and biodiesel from marine vessels.

Repsol and Bunge on April 25 announced plans to incorporate the use of camelina and safflower feedstocks in the production of renewable fuels, including renewable diesel and sustainable aviation fuel (SAF).

Renewable Fuels Month highlights the importance of renewable biofuels, such as ethanol and biodiesel. The month of May marks the beginning of the summer driving season, making it an ideal time to fuel up on clean and cost-saving biofuels.

PBF Energy on May 1 announced that its St. Bernard Renewables facility produced approximately 10,000 barrels per day of renewable diesel during Q1, down from 17,000 barrels per day during the Q4 2024.

Germany-based Mabanaft on April 17 announced it started to supply SAF to airlines at Frankfurt Airport in January. The company said it will deliver more than 1,000 metric tons of SAF to the airport this year under the European SAF mandate.

Upcoming Events