Biodiesel prices up 30 percent in Germany over past month

September 19, 2019

BY UFOP

Buoyant demand for biodiesel in Germany, especially rapeseed methyl ester, hasn’t just driven biodiesel prices up, but also rapeseed oil prices.

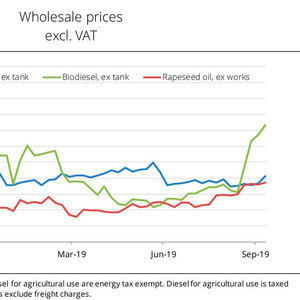

Wholesale prices for biodiesel have seen a sharp rise since Aug. 14, from 70.5 euro cents per liter ($2.95 per gallon) in mid-August to recently 91.6 euro cents per liter ($3.82 per gallon). This translates to an approximately 30 percent increase. The current price exceeds the level a year ago by 27 percent. The mark of 90 euro cents per liter was not cracked until November 2018.

According to Agrarmarkt Informations-Gesellschaft (mbH), the price increase is due to growing demand for biodiesel. From October onwards, rapeseed methyl ester (RME), without any additives, is the primary material blended into diesel fuel in Germany and northern EU nations to ensure winter diesel quality. The fatty acid composition of rapeseed oil accounts for the edge rapeseed oil-based biodiesel has over biodiesel based on soybean oil and, above all, palm oil.

Advertisement

As a result, demand for RME rises every year in September, driving up prices. The requirements for winter diesel apply to diesel fuel all over the northern part of the EU. The above-mentioned property of rapeseed oil is unique. For this reason, national commitment targets indicate a minimum need for rapeseed methyl ester. Moreover, petroleum companies, which are subject to the obligation to meet the GHG reduction quota, are required to meet such quota by the end of the calendar year. This is why they are stocking up on RME for the fourth quarter. In 2019, the companies started to order RME as early as mid-August, a month earlier than the previous year.

Higher demand for RME has also pulled up wholesale prices for rapeseed oil, which recently reached 73.5 euro cents per liter. Only prices for agricultural diesel have remained at a relatively constant level of around 76 euro cents per liter since July 2019.

Advertisement

Related Stories

The USDA maintained its outlook for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released Aug. 12. The forecast for soybean oil prices was also unchanged.

U.S. soybean production for 2025 is forecast at 4.29 billion bushels, down 2% when compared to last year, according to the USDA National Agricultural Statistics Service’s latest monthly Crop Production report, released Aug. 12.

Marathon Petroleum Corp. on Aug. 5 released second quarter financial results, reporting improved EBITDA for its renewable diesel segment. The company primarily attributed the improvement to increased utilization and higher margins.

Chevron Corp. on Aug. 1 confirmed the company started production at the Geismar renewable diesel plant in Louisiana during the second quarter after completing work to expand plant capacity from 7,000 to 22,000 barrels per day.

California’s new specified source feedstock attestation requirement: A critical new compliance step for renewable fuel producers

As of July 2025, California’s SCFS requires renewable fuel producers using specified source feedstocks to secure attestation letters reaching back to the point of origin. This marks a significant shift in compliance expectations.

Upcoming Events