BPC report highlights 40 RFS policy options

Bipartisan Policy Center

December 18, 2014

BY Erin Krueger

Growth Energy has responded to a report released by the Bipartisan Policy Center that describes several options for reforming the renewable fuel standard (RFS), noting it pushes some of same tired talking points Big Oil has relied on for years. While some of the policy options would clearly be detrimental to the RFS, others, including one that calls for the 1.0 Reid vapor pressure exception already in place for E10 to be extended to higher-level ethanol blends and other biofuels, and another that calls for all vehicles to be flex-fuel, could be beneficial.

According to the report, the BPC convened an advisory group of stakeholders that met three times over the course of 2014 to discuss ways to improve the RFS. The report also stresses that the 40 policy options outlined in the report do not represent the consensus of the advisory group, which included representatives of Phillips 66, Iowa State University, BP America, Neste Oil, The Boeing Co., ACARYIS—Energy Solutions, National Farmers Union, Walmart, KiOR Inc., the University of Illinois at Urbana-Champaign, American Fuel & Petrochemical Manufacturers, ExxonMobil Corp., Union of Concerned Scientists, Toyota Motor North America, Shell Oil, FBR Capital Markets, National Resources Defense Council, Green Earth Fuels of Houston LLC, Amyris, and Bracewell Giuliani.

The policy options included in the report vary widely, including options to:

Advertisement

Advertisement

- Create equivalence values based on factors beyond energy density, such as rural development and greenhouse gas performance

- Create additional renewable identification (RIN) number subcategories that divide existing categories

- Use a neutral third-party reviewer for technology pathway approvals.

- Allow companies to conduct a self-assessment of their technology pathway against a set of predefined criteria and then submit the pathway and supporting information to EPA for final approval

- Conduct only a small-scale review for each new technology pathway until that industry reaches a certain scale, at which time a full review with more complete data would be performed

- Standardize the technology pathway approval process to better align with the current processes in other locations, such as Canada and the European Union.

- Expand the definition of cellulosic biofuel, such as by including wastes and residues.

- Specify a volume of E0 to be available for legacy equipment.

- Create a longer-term period and increased amount of RINs for banking and borrowing

- Allow exports of biofuels to meaningfully contribute to the RFS program.

Advertisement

Advertisement

- Modify the land accounting and documentation approach for domestic and/or foreign feedstock producers

- Recalculate the lifecycle greenhouse gas emissions assessments, possibly using a modified assessment methodology

- Modify the cellulosic waiver credit mechanism

- Start with mandate levels that more gradually slope to 20-21 billion gallons by 2022, and then consider additional volumes after that

- Create slight “stretch” goal of mandate levels

- Flatten all mandate volumes at their current levels for some period of time and then bump the mandates up to a higher set of levels at another point in time

- Flatten the total renewable fuel mandate at its current level going forward, but continue to increase the three advanced categories

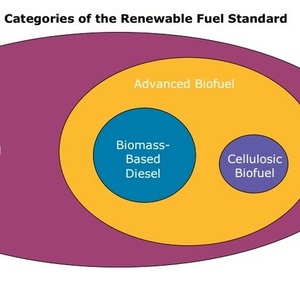

- Remove the total renewable fuel mandate and only maintain the three advanced biofuel categories

- Convert all mandated volumes to percentage mandates

- Create a mandate for ethanol based on percentage of consumption, in addition to the volumetric RFS mandate categories

- Implement automatic consequences if EPA fails to meet statutory deadlines, especially for setting the annual volumes

- Increase funding for EPA to enhance regulatory capacity

- Change the definition of obligated parties

- Establish explicit methodologies for setting the annual volumes

- Create an explicit methodology for discretionary use of waiver authority, possibly including quantitative definitions of severe economic harm

- Create a clear methodology and criteria for linking waivers across RFS mandate categories

- Separate the Renewable Volume Obligation calculations for gasoline and diesel

- Create a mechanism to ensure that obligated parties are not purchasing invalid RINs

- Limit the participants in the RIN market

- Increase data availability, such as that related to volumes, prices, trades, and fuel blends

- Give the Department of Defense longer-term procurement ability

- Create an education campaign to inform consumers about new fuels, flex-fuel stations, and which engines can handle which blends

- Create/expand incentive programs—such as government R&D, grants, loan guarantees, or tax incentives—for the production of advanced biofuels, with long-term stability that phases out slowly

- Create/expand incentive programs—such as government R&D, grants, loan guarantees, or tax incentives—for biofuels consumption infrastructure, with long-term stability that phases out slowly

- Provide a 1.0 Reid Vapor Pressure exception for ethanol blends above 10 percent and for other biofuels, as is in place for blends of up to 10 percent ethanol

- Remove the Federal Trade Commission labeling requirement for infrastructure-compatible drop-in fuels if they meet the petroleum specification

- Mandate that all vehicles are created as flex-fuel vehicles

- Evaluate the costs of, benefits of, and obstacles to introducing into commerce higher-octane gasoline blends

- Address warranty issues related to misfueling in older vehicles and equipment

- Fully fund and enforce agricultural conservation programs

“The RFS has and continues to be one of the most successful energy programs of the last 40 years. It has reduced our dangerous dependence on foreign oil, improved our nation's air quality, and created hundreds of thousands of American jobs,” said Growth Energy CEO Tom Buis in a statement. “The RFS has a great deal of flexibility built into the program based on the ability of biofuel producers to supply the market. Critics in the oil industry have done everything to tear this program down and continue to push their agenda at every turn. They do not want American-made biofuels to succeed because they are afraid to lose their iron grip on the American fuel market. Unfortunately, this report continues to push some of the same, tired talking points that the oil industry has espoused since the program began.”

A full copy of the report can be downloaded from the BPC website here.

Related Stories

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

EcoCeres Inc. has signed a multi-year agreement to supply British Airways with sustainable aviation fuel (SAF). The fuel will be produced from 100% waste-based biomass feedstock, such as used cooking oil (UCO).

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

Upcoming Events