Brazilian biodiesel production expected to grow by 18% in 2024

SOURCE: USDA FAS GAIN

September 17, 2024

BY Erin Krueger

Brazilian biodiesel production is expected to increase 18% this year, according to a report filed with the USDA Foreign Agricultural Service’s Global Agricultural Information Network on Aug. 31. Consumption is also forecast to be up 18%.

The increase is attributed to both a growing diesel pool and rising blend mandate. The government of Brazil increased the biodiesel blend mandate from 12% to 14%, effective March 1, 2024. B15 blending is currently scheduled to begin in 2025.

Advertisement

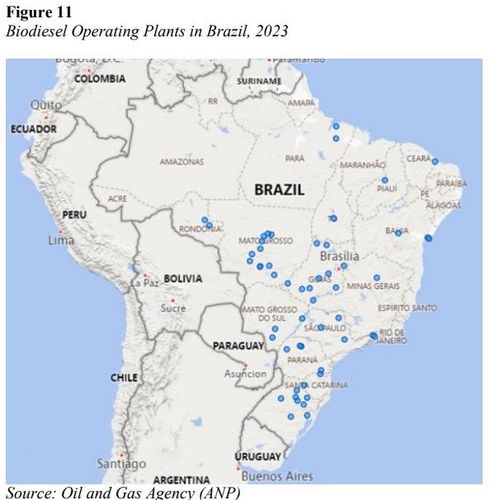

According to the report, Brazil currently has 62 biodiesel plants, up from 61 in 2023 and 57 in 2022. Total capacity for 2024 is estimated at 14.89 billion gallons (3.93 billion gallons) per year, up from 14.378 billion gallons last year and 13.66 billion gallons in 2022. Capacity use is expected to reach 55% in 2024, compared to 52% in 2023 and 50% in 2022.

Brazil is expected to produce 8.9 billion liters of biodiesel this year, up from 7.53 billion liters in 2023 and 6.77 billion liters in 2022.

The country imports and exports very little biodiesel. Tota imports are expected to reach 2 million liters this year, unchanged from the previous three year. Exports are expected to reach 4 million liters, unchanged from 2023, but down when compared to the 5 million liters exported in 2022.

Advertisement

Soybean oil is the primary biodiesel feedstock in Brazil, followed by animal fat, palm oil and used cooking oil.

The total biodiesel blend rate in Brazil is expected reach 13.2% in 2024, up from 11.4% last year and 10.7% in 2022.

A full copy of the report is available on the USDA FAS GAIN website.

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

Upcoming Events