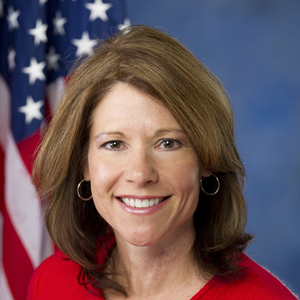

Bustos introduces Next Generation Fuels Act

September 24, 2020

BY Erin Krueger

Rep. Cheri Bustos, D-Ill., on Sept. 24 introduced the Next Generation Fuels Act, a bill that establishes a minimum octane standard for gasoline and requires sources of added octane value to reduce carbon emissions by at least 30 percent when compared to baseline gasoline. The bill would also limit the use of harmful aromatics in meeting the new high-octane standard, as well as in current-market gasoline.

To accomplish its goals, the legislation would require the U.S. EPA to create a new 98 research octane number (RON) standard, limit reliance on toxic aromatic hydrocarbons, and update fuel and infrastructure regulations to expand the availability of mid-level ethanol blends. It would ensure parity in the regulation of gasoline volatility, correct the R-factor used in fuel economy testing, provide for an E30 fuel waiver, replace the EPA’s flawed MOVES model, and restore meaningful credit toward compliance with fuel economy and emissions standards for the production of flex fuel vehicles.

“For the last three and a half years, we have been forced to fight battle after battle and face this Administration’s broken promise after broken promise to ensure our country is meeting the full potential of biofuels,” Bustos said. “The Next Generation Fuels Act looks toward the future to make sure we bring an environmental lens to biofuels production, in order to increase demand while reducing carbon emissions.”

Advertisement

Advertisement

Representatives of the biofuels industry have spoken out in support of the bill.

Growth Energy is applauding Bustos for her push for high-octane, low carbon fuels. “There has never been a more urgent need to adopt higher octane, low-carbon ethanol blends in America’s fuel supply, as they are key to achieving clean, healthy air,” said Emily Skor, CEO of Growth Energy. “We applaud Congresswoman Bustos for charting a path forward that will unleash clean, affordable ethanol to drive decarbonization in our nation’s transportation fleet and save consumers money at the fuel pump.”

The Renewable Fuels Association called the bill the beginning of an exciting new era in transportation fuels policy. ““The Next Generation Fuels Act of 2020 provides a bold and innovative approach to reducing carbon emissions, improving engine efficiency and performance, protecting human health, and removing the arcane regulatory roadblocks that have hindered the expansion of cleaner, greener liquid fuels,” said Geoff Cooper, president and CEO of the RFA. “By establishing the roadmap for an orderly transition to high-octane, low-carbon fuels, this landmark legislation begins an exciting new era in transportation fuels policy. As the world’s top supplier of clean, affordable, low-carbon octane, the U.S. ethanol industry proudly and enthusiastically supports this legislation. We thank Rep. Bustos for her thoughtful leadership and determined efforts to craft and introduce this bill, and we look forward to working together to make this bold vision a reality.”

The American Coalition for Ethanol said the bill contains key priorities, but features a carbon accounting approach that undermines many of the group’s members. “We appreciate Congresswoman Bustos has introduced legislation designed to remove barriers to higher blends of ethanol and which acknowledges future policy needs to be considered in the framework of GHG emissions,” said Brian Jennings, CEO of Ace. “While this legislation contains many of our top priorities, its approach to carbon accounting is flawed and undermines the investment many ACE members have made to reduce their carbon intensity.”

Advertisement

Advertisement

According to Ace, the bill’s definition of “average” to determine the lifecycle greenhouse gas (GHG) emissions of ethanol, also known as carbon intensity (CI), shortchanges many producers.

“Under this legislation, ethanol from a coal-fired ADM facility, whose fuel is similar to the CI of gasoline, would get the same access to the new octane market as the most efficient farmer-owned ethanol facility, whose carbon footprint is at least 50 percent cleaner than gasoline,” Jennings said. “In other words, the bill as currently drafted would perversely reward ADM for doing nothing to reduce the CI of the fuel produced in its coal-fired facilities and penalize many ACE-member companies that have invested millions of dollars to install technology to reduce the CI of their fuel. We do not believe there is a good rationale for a carbon policy which treats ethanol with a CI that is hardly indistinguishable from gasoline the same as ethanol from a facility that is 50 percent cleaner than gasoline.

“ACE prefers a low carbon fuel policy which assigns each fuel producer an individual carbon intensity score and measures lifecycle GHG emissions to provide credit for farming practices that reduce emissions from fertilizer use and sequester carbon in the soil,” he continued. “Policy with these two components would reward farmers for climate-smart practices and ethanol facilities for making investments to reduce GHG emissions.”

Related Stories

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Upcoming Events