Calumet reports improved Q4 EBITDA for Montana Renewables

SOURCE: Calumet Inc.

March 4, 2025

BY Erin Krueger

Calumet Inc. released fourth quarter financial results on Feb. 28. During an earnings call, company officials discussed operations at its Montana Renewables facility, changing market dynamics for biobased-based diesel, and the company’s MaxSAF initiative.

Montana Renewables, an unrestricted subsidiary of Calumet, on Feb. 18 received its first drawdown of approximately $782 million from its $1.44 billion guaranteed loan facility with the DOE Loan Programs Office. The loan funds expansion of sustainable aviation fuel (SAF) capacity at Montana Renewables’ biorefinery, an initiative the company refers to as MaxSAF.

Advertisement

Advertisement

The project aims to increase annual production capacity at Montana Renewables to 330 MMgy, including 300 MMgy of SAF and 30 MMgy of renewable diesel. According to Calumet, the planned expansion includes several key modular components, which will provide the ability to increase capacity and reduce costs. The company important component is a second renewable fuels reactor, which the company said will allow approximately half of the 300 MMgy SAF capacity to be online by 2026.

The second tranche of the DOE loan guarantee is expected to be dispersed during construction beginning in 2025 through the anticipated completion of the MaxSAF project in 2028.

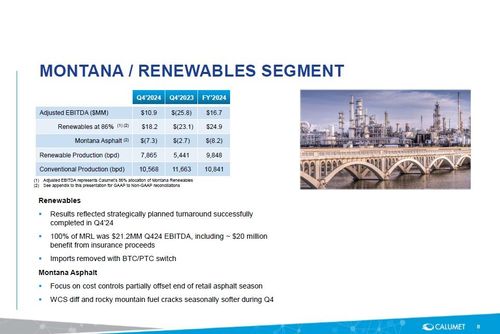

The Montana Renewables subsidiary reported $10.9 million in adjusted EBITDA during the fourth quarter of 2024, compared to an adjusted EBITDA loss of $25.8 million during same period of 2023. Calumet said the results reflect continued operating momentum in its renewables business and the receipt of an insurance claim, partially offset by the impact of a planned turnaround in the fourth quarter of 2024. The turnaround was successfully completed during the quarter, and the biorefinery resumed normal operations in December, according to Calumet.

Advertisement

Advertisement

David Lunin, executive vice president and chief financial officer at Calumet, said the company intentionally did not sell any SAF in December because SAF shipped in December but not received until January would not be eligible for the environmental credit under the changing tax incentives. With the change over from the biodiesel tax credit to the 45Z clean fuel production credit, Lunin said normal SAF shipments resumed in January.

Lunin also discussed some of the impacts of the changing tax credit structure, including an expected drop in biobased diesel imports. In addition, he said the 45Z credit is expected to reward feedstock flexibility, end-market diversity and end-product flexibility.

Todd Borgmann, CEO of Calumet, discussed changing market dynamics for biobased diesel products, noting that the January renewable identification number (RIN) data showed a 34% decline in biomass-based diesel production. Biodiesel production alone was down 63% and imports were non-existent, he added. If that production decline persisted for the full year 2025, Borgmann said biodiesel diesel volumes would fall nearly 1 billion gallons short of Renewable Fuel Standard blending targets. Reduced production is expected to support stronger RIN prices, boosting margins. Borgmann also briefly discussed SAF mandates in the European Union and U.K. and how they will increase global demand for the fuel.

Related Stories

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

International Air Transport Association has announced the release of the Sustainable Aviation Fuel (SAF) Matchmaker platform, to facilitate SAF procurement between airlines and SAF producers by matching requests for SAF supply with offers.

Upcoming Events