China considering 2nd DDGS anti-dumping investigation

SOURCE: RFA

October 29, 2015

BY Holly Jessen

News that two Chinese companies have petitioned the Chinese government to launch an anti-dumping investigation over imports of U.S. distillers grains is one factor in lowered distillers grains prices and slowed exports to China, but it’s not the only factor, according to Sean Broderick, CHS Inc. senior merchandiser.

The U.S. Grains Council confirmed Oct. 28 that the organization is aware of the China situation, as it pertains to distillers grains.”[We] are monitoring the situation in D.C. and Beijing along with the team we worked with on the last anti-dumping case,” a spokesperson told Ethanol Producer Magazine.

Rumors about China have been floating around for a while now, Broderick said. The word is that one of the companies that has petitioned the government is a Chinese government-owned company, but it’s not known exactly what that will mean, if anything. “They usually give themselves a month to respond, so we will see what happens,” Broderick said.

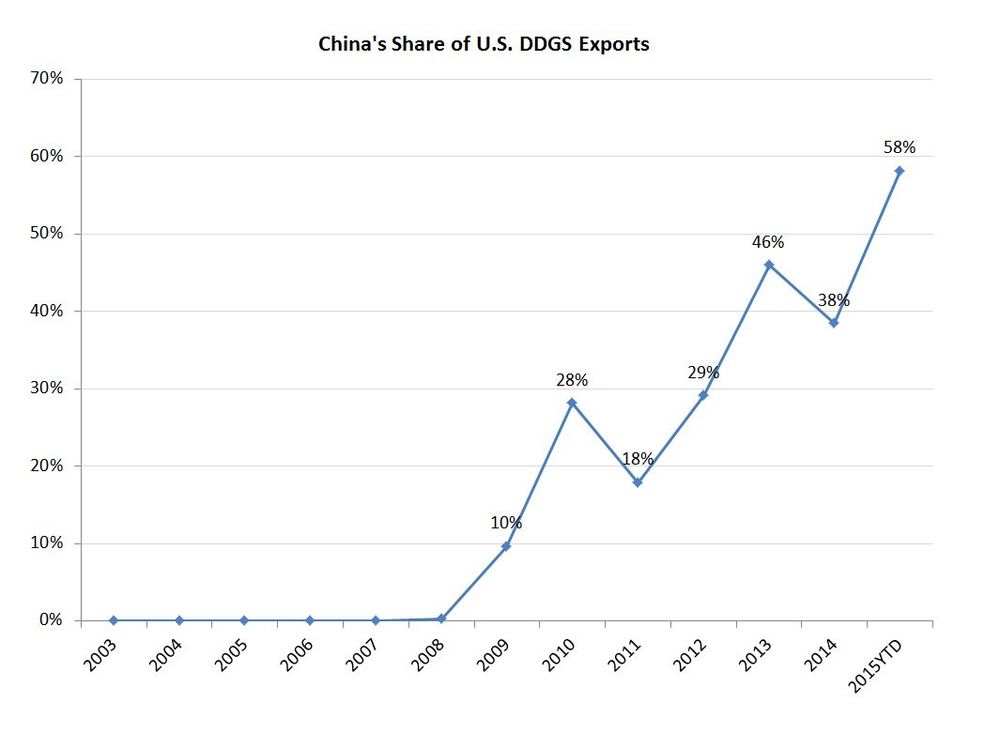

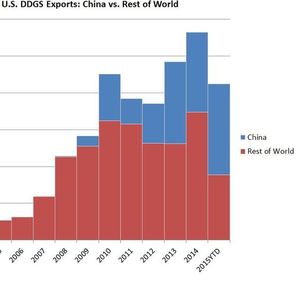

If an anti-dumping investigation of U.S. DDGS does become a reality, it will be the second time. At the end of 2010, China launched an anti-dumping investigation that was dropped in mid-2012. Exports to China were curtailed before surging again in 2013, with China importing 46 percent of all the exported U.S. DDGS, the largest market share of all importing countries, according to information from the Renewable Fuels Association.

Advertisement

So far this year, the market share figure has been even higher, with China taking in 58 percent of all exported U.S. DDGS through August, the most recent government data available. That data showed that China had imported 4.93 million metric tons (mmt). “That is more than the 4.33 million mmt they imported during the entire 2014 calendar year, and more than the 2013 calendar year record of 4.44 mmt to China,” said Geoff Cooper, senior vice president of RFA. He added that although it’s difficult to know for sure how the year will end up, the final tally for worldwide DDGS exports could still mean another record year of DDGS exports. “Even if China shuts down we’d expect to see at least the second-largest annual export total on record.”

Cooper described China’s DDGS market as a rollercoaster ride. “When the door is open, China is a fantastic market for U.S. DDGS exports,” he said. “But that door can slam as quickly as it opened—often for inexplicable reasons—and that can devastating impacts on the ethanol industry’s profitability. We continue to work with partners like the U.S. Grains Council to pursue a more certain and stable market environment in China.”

Chinese buyers are continuing to buy U.S. DDGS, Broderick confirmed, although those numbers have been slowing down since July. Once the export data comes in for September and October, he expects to see some “pretty big drop offs.” One factor includes discussion in China about a permit system for imports. “I’m not so sure that also didn’t make traders pause a little bit,” he said.

Advertisement

Then there’s the price factor. DDGS prices went up to $235 a short ton in the Gulf in early summer and are now in the $165 range. “The hard thing for China is, when they start buying en mass, they kind of create a higher market in and of themselves,” he said. “So if they are in the market, it tends to move higher and if they aren’t in the market, it tends to move lower.” In other words, Chinese buying of DDGS runs prices up and when Chinese buyers buy less, prices go down. “Sustaining DDGS prices at 135 percent the value of corn, that’s not really that likely of a sustainable long term position,” he added.

Chinese buying isn’t the only factor, however. Demand for U.S. DDGS worldwide is heavily influenced by the strength of the U.S. dollar.

Talk of a possible anti-dumping investigation is having an effect too. “I think people don’t want to fool with that,” he said.

As far as DDGS prices go, Broderick pointed to a common saying: “Nothing solves low prices like low prices.” In the early summer through July, U.S. buyers have been priced out of the DDGS market. Now, with lower prices, domestic buyers are jumping back in. “Which, to me is something you really need to have a healthy market,” he says.

Related Stories

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

The U.S. EIA reduced its 2025 and 2026 production forecasts for a category of biofuels that includes SAF in its latest Short-Term Energy Outlook, released June 10. The forecast for 2025 renewable diesel production was also revised down.

Upcoming Events