CoBank report discusses the impact of expanding soybean crush capacity

SOURCE: CoBank

March 27, 2024

BY Erin Voegele

CoBank is predicting U.S. soybean crush capacity will expand 23% over the next three years. In a report released March 21, the company discusses the risk that this rapidly expanding capacity could exceed renewable diesel growth.

In the report, CoBank discusses how the recent renewable diesel production boom has created enormous demand for soybean oil, citing University of Illinois economists who found almost no soybean oil was used to produce renewable diesel before 2018. By 2022, however, its share had risen to 26.9%.

Advertisement

Soybean crush capacity in the U.S. grew 7% over the past three years and is poised to expand by 23% over the next three years. According to the report, this growth is expected to result in 11 new greenfield plants being developed, along with four plants that are expanding capacity or being retrofitted to process oilseeds. The impact of these projects is regional, with more than half the expected expansion to occur in North Dakota, Nebraska, Wisconsin and Missouri.

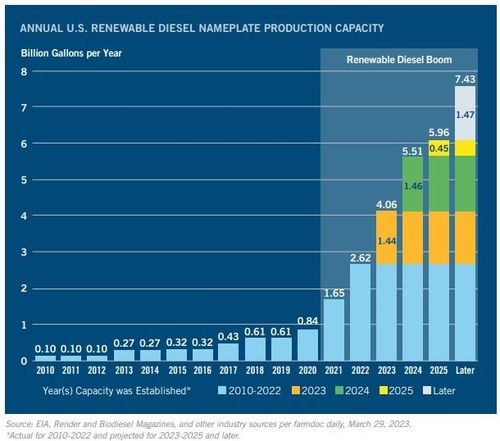

The federal Renewable Fuel Standard and state-level low carbon fuel standards (LCFS) in California, Oregon and Washington have helped boost renewable diesel demand in recent years. While recent lower prices for renewable identification number (RINs) may cause the development of planned renewable diesel project to slow or be shelved, CoBank’s report predicts demand for low carbon fuels will continue to grow. If all renewable diesel projects currently under development begin operations as scheduled, CoBank predicts U.S. renewable diesel capacity could reach 5.96 billion gallons per year by the end of 2025.

Soybean oil remains the primary feedstock for U.S. renewable diesel production, at roughly 35% of monthly feedstock consumption, CoBank said. This is down from a share of 50% a year ago as the share of competing fats, greases and oils has increased. While processing margins on soybean oil for renewable diesel are the lowest of all feedstocks, CoBank said that soybean oil still has the greatest capacity for growth due to its ample domestic availability.

Advertisement

According to the report, expansion in soybean processing will cause a growing surplus of soybean meal. While domestic demand is expected to increase, it will not increase at the same pace as supply, requiring the U.S. to increase exports. Global opportunities are murky, however, among rising export competition, according to the report.

CoBank also said the record crush margins of the past several years are likely in the rearview mirror, with low to moderate margins expected for the near-term. This raises the margin risk on newly built plants with higher breakeven costs of production or destination plants with higher costs of acquiring and transporting soybeans. In the long-term, the risk of overbuilding U.S. soybean crush capacity by undisciplined capital could result in declining margins and the eventual consolidation of weaker players, according to CoBank.

A full copy of the report is available on CoBank’s website.

Related Stories

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Scientists at ORNL have developed a first-ever method of detecting ribonucleic acid, or RNA, inside plant cells using a technique that results in a visible fluorescent signal. The technology could help develop hardier bioenergy and food crops.

The 2025 International Fuel Ethanol Workshop & Expo, held in Omaha, Nebraska, concluded with record-breaking participation and industry engagement, reinforcing its role as the largest and most influential gathering in the global ethanol sector.

TotalEnergies and Quatra, the European market leader in the collection and recycling of used cooking oil, have signed a 15-year agreement beginning in 2026, for the supply of 60,000 tons a year of European used cooking oil.

Upcoming Events