Commodities: Corn prices tumble, ethanol margins improve

July 31, 2014

BY Jason Sagebiel, FCStone

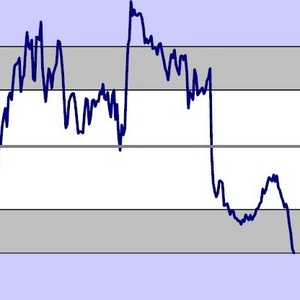

July was not a pretty month for the corn producer but end-users of corn benefited with tumbling prices. Nearby corn futures declined nearly 60 cents since July 1 to July 28 and continued to drop low through the end of the month, with the lowest point on July 24. Prospects of a bigger yield continue to weigh on prices and the cash markets. However, ethanol plants and livestock feeding operations have benefited from the price decline. Ethanol margins continue to improve and higher meat prices are encouraging for the livestock producers.

In the July USDA report old crop corn carryout increased from 1.246 billion bushels which was somewhat expected after the June 30 stocks report. Old crop demand by the livestock feed sector saw a decrease by 125 million bushels and exports an increase by 25 million bushels. Corn for feed demand was recently projected at 5.175 billion bushels, down from 5.300 billion bushels in June and 4.333 billion bushels a year ago. New crop feed demand is projected at 5.200 billion bushels, down 50 million bushels from the previous estimate. Ultimately the USDA was too aggressive with the feed number and this was not reflected until the June 30 stocks report. This is why the USDA lowered new crop feed demand. Ethanol demand garnered some attention due to its increase despite logistic problems encountered this winter. The forward projection is for 5.50 billion bushels and that will assume no logistical issues.

Now that the horse is before the cart, new crop yield was estimated at 165.3 bushels per acre. However, traders have set their sights higher with a lot of talk of a 170 bushel national yield at this point in time. With the current yield estimate of 165.3 bushel, production would be pegged at 13.860 billion bushels. Ultimately carryout for new crop is projected at 1.801 billion bushels. Any increases in yield increases potential carryout without any demand changes. A 5 bushel yield increase would increase production by 419 million bushels; carry-out jumping to 2.220 billion bushels. With the crop production winding down and new demand waning a scenario like the above will put much more pressure on new crop corn prices. Demand increases will be expected to come from exports if prices move lower. Another concerning topic is the funds positions. Managed money was running a net short at this time last year. They are still holding onto a net long position in late July. This too will not bode well for corn if yields and, or production grow.

Advertisement

Advertisement

September corn futures

| Date | High | Low | Close |

| July 25, 2014 | 3.63 1/2 | 3.57 | 3.63 |

| June 25, 2014 | 4.36 3/4 | 4.33 3/4 | 4.35 3/4 |

| July 25, 2013 | 5.10 3/4 | 4.92 1/4 | 4.96 |

Advertisement

Advertisement

Related Stories

The U.S Department of Energy Bioenergy Technologies Office, in partnership with the Algae Foundation and NREL, on July 21 announced the grand champion and top four winning teams of the 2023 - 2025 U.S. DOE AlgaePrize Competition.

The European Commission on July 18 announced its investigation into biodiesel imports from China is now complete and did not confirm the existence of fraud. The commission will take action, however, to address some systemic weaknesses it identified.

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

Upcoming Events